Introduction

Kenya’s real estate market has been a topic of interest for both local and international investors over the past decade. With rapid urbanization, population growth, and increasing foreign investment, the country’s property landscape is evolving at an impressive pace.

But how much real estate is actually in Kenya? While there isn’t a single number that captures the total land area or property count, understanding the scale and scope of Kenya’s real estate market involves examining various factors including land use, urban development, and investment trends.

In this blog post, we’ll explore the current state of real estate in Kenya, the types of properties available, major markets, and what drives growth in this dynamic industry.

Understanding Kenya’s Land Area

Kenya covers approximately 580,367 square kilometers , making it one of the larger countries in Africa. However, not all of this land is suitable for real estate development. Large portions are covered by forests, national parks, rivers, and arid regions unsuitable for habitation or farming.

Only about 10 to 12 percent of Kenya’s total land area is considered habitable or suitable for agriculture and real estate development. Within that space, urban centers like Nairobi, Mombasa, Kisumu, Nakuru, and Eldoret have become focal points for residential and commercial growth.

Major Real Estate Markets in Kenya

1. Nairobi

As the capital city and economic hub of East Africa, Nairobi dominates Kenya’s real estate market. The city is home to numerous residential estates, commercial buildings, shopping malls, and industrial zones.

Popular areas include Karen, Lavington, Westlands, Kilimani, Upper Hill, and Runda. The demand for housing and office spaces continues to rise, with developers focusing on mixed-use projects and high-rise apartments.

2. Mombasa

The coastal city of Mombasa is another hotspot for real estate, particularly for tourism-related investments such as hotels, beachfront properties, and holiday homes.

Areas like Nyali, Bamburi, Mtwapa, and Diani Beach attract both local and foreign buyers. Seasonal demand and rising tourism make this region ideal for rental income and vacation property investments.

3. Kisumu & Western Kenya

Kisumu is emerging as a strong contender in the real estate market, driven by its strategic location on Lake Victoria and improved infrastructure.

The city offers opportunities in affordable housing, small-scale commercial units, and residential plots. Government initiatives and private sector involvement are boosting development in surrounding neighborhoods.

4. Eldoret & Rift Valley Region

Eldoret has seen significant growth due to its educational institutions, agricultural potential, and proximity to Uganda and South Sudan.

The city attracts investors interested in student housing, farmland, and residential developments. Its role as a regional transport hub also supports the growth of logistics and industrial real estate.

Types of Real Estate in Kenya

Kenya’s real estate market can be broadly categorized into five main types:

1. Residential Real Estate

This includes apartments, bungalows, townhouses, gated communities, and informal settlements. There’s a wide range of options from low-cost housing to luxury villas.

2. Commercial Real Estate

Office buildings, shopping malls, service stations, and retail outlets dominate this segment. Nairobi and Mombasa host the majority of commercial developments.

3. Industrial Real Estate

Factories, warehouses, logistics hubs, and manufacturing plants are primarily found in industrial zones around Nairobi, Mombasa, and Eldoret.

4. Agricultural Land

Vast tracts of land used for farming, ranching, and horticulture—especially in Rift Valley and Central Kenya—are part of the real estate market. These lands are often purchased for long-term investment or agri-business ventures.

5. Vacant Land

Land parcels awaiting development are common across the country. Investors buy them for future resale or planned construction projects.

Real Estate Development Statistics in Kenya

While exact numbers on total property stock are hard to come by, here are some key statistics that highlight the scale of Kenya’s real estate market:

- Kenya faces a housing deficit of around 2 million units , according to the Ministry of Housing.

- Over 20,000 property transactions are recorded annually in major cities.

- The government’s Affordable Housing Program aims to deliver 500,000 affordable houses by 2027.

- The construction sector grew at a rate of 6–8% per year before the pandemic and is now recovering steadily.

Factors Driving Real Estate Growth in Kenya

1. Urbanization

Kenya’s urban population is growing rapidly. Nairobi alone absorbs more than 100,000 new residents each year, driving demand for housing and infrastructure.

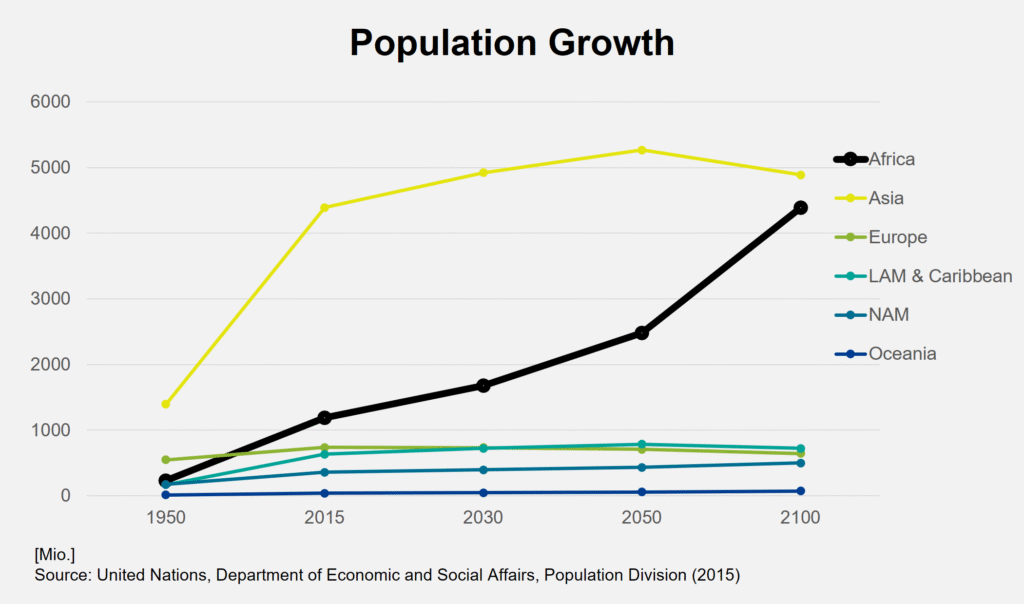

2. Population Growth

With a population of over 55 million and a growth rate of nearly 2.5%, the need for housing and land continues to rise.

3. Foreign Investment

Kenya is a preferred destination for real estate investment in East Africa. Investors from the UK, UAE, India, and neighboring African countries are buying property for personal use, rentals, and development.

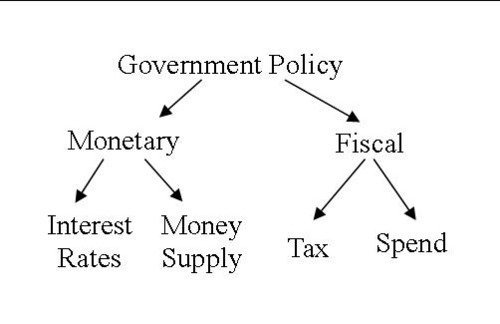

4. Government Policies

Initiatives like the Affordable Housing Program, digitization of land records, and infrastructure development are improving the environment for real estate growth.

5. Technology and Innovation

Online property platforms, digital financing options, and smart city concepts are transforming how Kenyans buy, sell, and invest in real estate.

Challenges Facing Kenya’s Real Estate Sector

Despite its growth, the sector faces several challenges:

- High cost of financing: Mortgages are still limited and expensive for many Kenyans.

- Land ownership disputes: Issues with title deeds and unclear land ownership remain a barrier.

- Infrastructure gaps: Poor roads and utilities in some areas affect property values.

- Informal settlements: A large portion of the population lives in slums, highlighting the housing deficit.

Conclusion

So, how much real estate is in Kenya?

There’s no single figure, but with over 580,000 square kilometers of land and a booming urban property market, Kenya offers vast opportunities for real estate investment. From Nairobi’s skyline to Mombasa’s beaches and the emerging towns in Western and Rift Valley regions, the real estate scene is diverse and expanding.

Whether you’re looking to invest, build, or relocate, Kenya’s real estate market presents exciting possibilities backed by demographic and economic growth.

Frequently Asked Questions (FAQs)

Q: Is real estate in Kenya a good investment?

Yes, especially in urban centers and emerging towns. With rising urbanization and government support, the market offers solid returns for both residential and commercial properties.

Q: Can foreigners own land in Kenya?

Foreigners cannot own land outright but can lease land for up to 99 years. They can also invest in property through companies registered in Kenya.

Q: What is the average price of land in Nairobi?

Land prices vary widely depending on location. In prime areas like Lavington or Karen, prices can exceed KES 1 million per square meter, while peri-urban areas may start from KES 50,000 per square meter.

Q: How big is Kenya’s housing deficit?

It is estimated at 2 million housing units , with the gap widening each year due to population growth and urban migration.

Join The Discussion