Real estate investment is no longer limited to high-net-worth individuals. In Kenya, real estate investment groups are becoming increasingly popular as a way for small and mid-level investors to pool resources and access high-value property deals.

Whether you’re looking to buy land, rent out apartments, or invest in commercial developments, joining an investment group can help you diversify your portfolio, reduce risk, and increase returns.

📌 What Are Real Estate Investment Groups?

Real estate investment groups bring together individuals who want to invest in property collectively. Members contribute money toward purchasing or developing properties and share in the profits based on their contributions.

These groups come in many forms:

- Property syndicates

- Land banking clubs

- Crowdfunding platforms

- SACCO-linked housing schemes

📌 Ideal for people with limited capital but big ambitions in the property market.

🔝 Types of Real Estate Investment Groups in Kenya

Here are the most common types of investment groups operating in Kenya:

1. Property Syndicates

Overview:

Small groups formed by friends, colleagues, or community members who jointly invest in property.

Benefits:

- Shared costs and risks

- Collective decision-making

- Flexible investment sizes

📌 Example: A group of 5 people each investing KES 200,000 to buy a KES 1M plot in Ruiru.

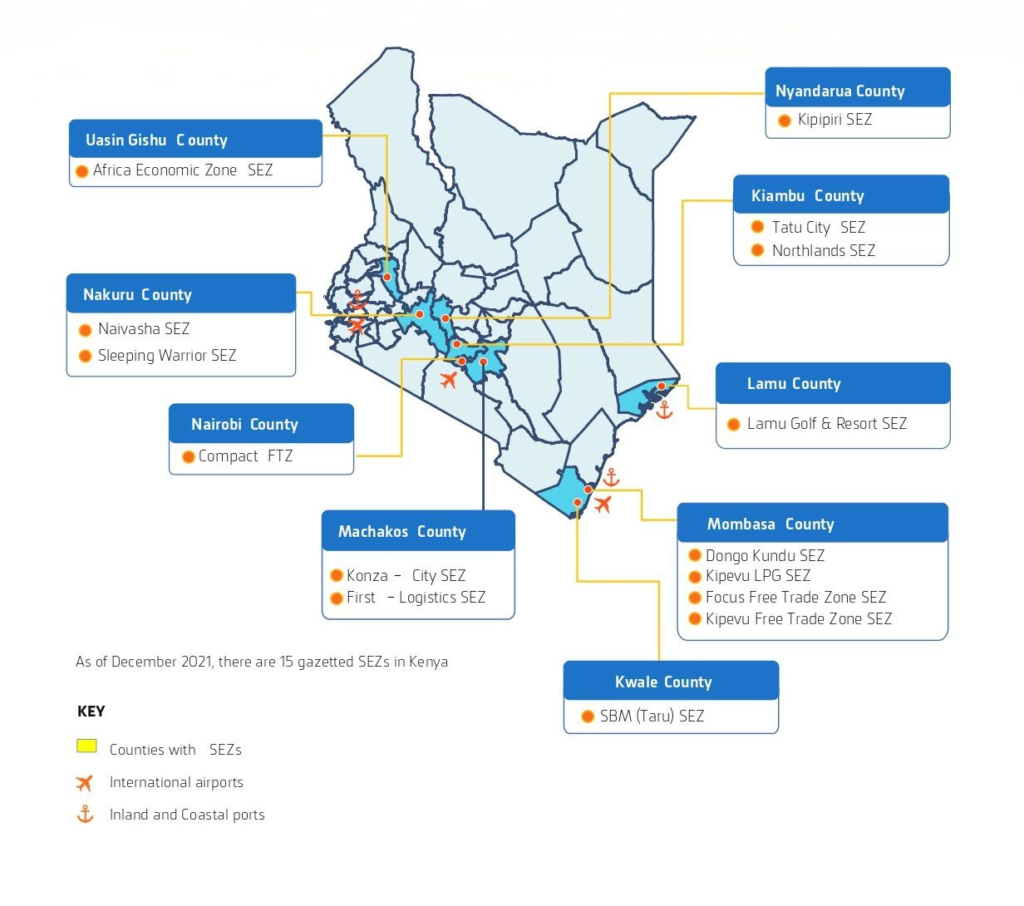

2. Land Banking Clubs

Overview:

Groups focused on buying undeveloped land for future appreciation.

Popular Locations:

- Naivasha

- Athi River

- Konza-linked zones

📌 Expected ROI: 10%–20% annually , depending on infrastructure growth.

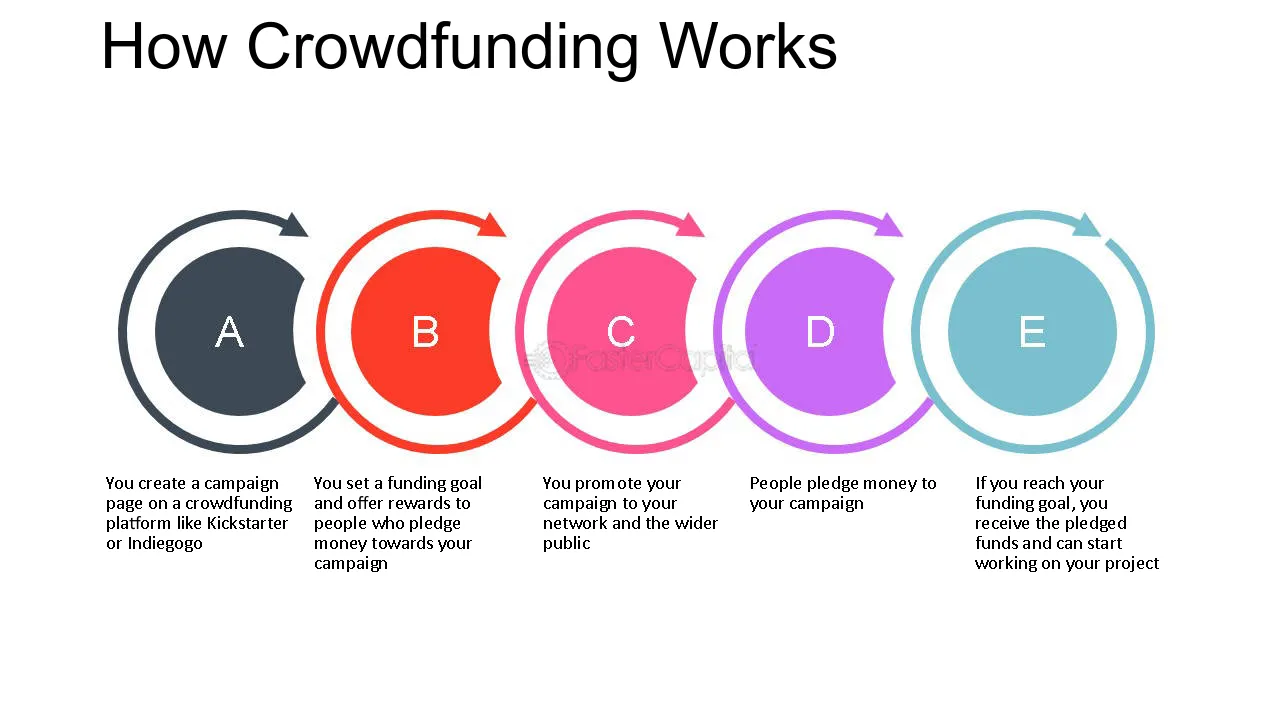

3. Crowdfunding Platforms

Overview:

Digital platforms that allow multiple investors to fund real estate projects remotely.

How It Works:

- Choose a project (e.g., apartment block, land development)

- Contribute as little as KES 50,000

- Earn profits when the property is sold or rented out

Popular Platforms:

- Zamara Africa

- Eneza Investments

- Jengo Invest

📌 Expected Return: 8%–14% return on investment , depending on the project.

4. SACCO-Based Housing Schemes

Overview:

Many SACCOs (Savings and Credit Cooperatives) have introduced housing schemes where members contribute regularly toward affordable homes.

How It Works:

- Members save monthly

- Loans are issued at favorable rates for home purchase

- Some SACCOs partner with developers for bulk buying power

📌 Great for middle-income earners looking to own property over time.

5. Private Equity & Developer Partnerships

Overview:

Firms like Centum Investment Company and Actis (Tatu City) offer structured investment opportunities through syndicated deals and private equity funds.

How It Works:

- Minimum investments start at KES 5M+

- Targeted at high-net-worth individuals and institutions

- Focuses on commercial and mixed-use developments

📌 These groups often deliver high returns , especially in Nairobi and coastal areas.

🧭 How to Join a Real Estate Investment Group in Kenya

Here’s a simple step-by-step process to get started:

Step 1: Choose Your Investment Type

Decide whether you want:

- Syndicate with friends/family

- Join a SACCO scheme

- Use a crowdfunding platform

- Invest in developer-led groups

Step 2: Research Groups & Platforms

Look into:

- Past performance

- Reviews and user feedback

- Legal compliance and licensing

Step 3: Register and Open an Account

Most platforms require:

- National ID

- Bank details

- Email verification

Step 4: Select a Project or Fund

Choose a specific property or opt for a general real estate fund

Step 5: Make Your Investment

Transfer funds via M-Pesa, bank transfer, or online payment

Step 6: Monitor & Reinvest

Track your returns and decide whether to reinvest or withdraw earnings

📌 Tip: Always read the terms and conditions before investing.

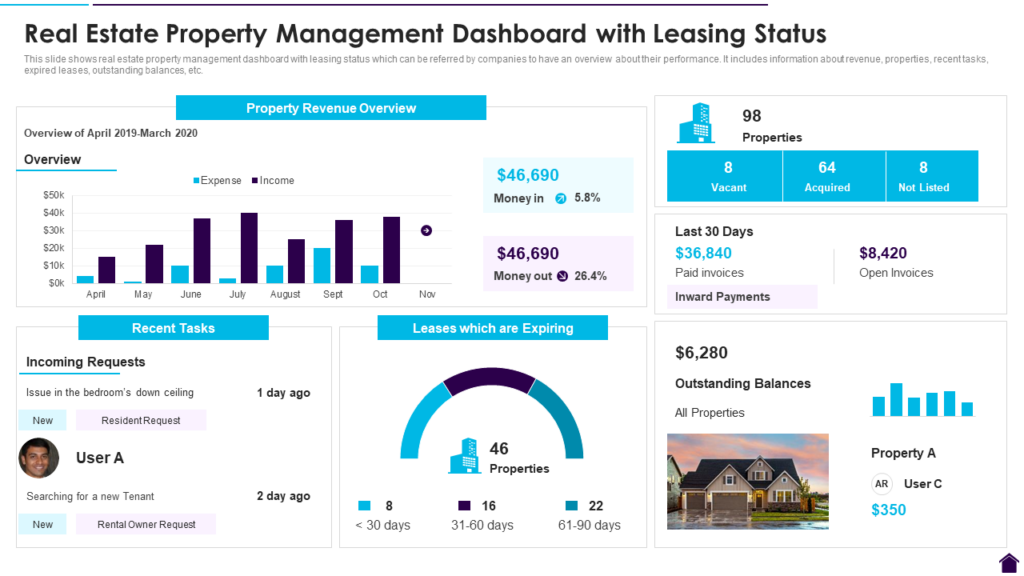

🏢 Top Real Estate Investment Groups & Platforms in Kenya

| Group / Platform | Type | Minimum Investment |

|---|---|---|

| Zamara Africa | Crowdfunding | KES 50,000 |

| Eneza Investments | Crowdfunding | KES 50,000 |

| Jengo Invest | Digital Real Estate Fund | KES 50,000 |

| Stima Housing Limited | SACCO-Based | Varies by member contribution |

| Jamii Bora Housing Ltd | Affordable Housing Group | SACCO membership required |

| CIC Asset Management | Mutual Fund | KES 10,000 |

| Sanlam Kenya | Property Unit Trusts | KES 10,000 |

| Genghis Capital | Property Investment Fund | KES 50,000 |

📊 Expected Returns by Group Type

| Investment Type | Average Annual Return |

|---|---|

| Property Syndicates | 8% – 15% |

| Land Banking Clubs | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% |

| SACCO Housing Schemes | 5% – 9% (equity build-up) |

| Private Equity Funds | 10% – 20% |

📈 These returns make investment groups one of the most attractive alternatives to traditional property investment.

📍 Top Locations for Group-Based Real Estate Investment

Some areas are more popular among investment groups due to strong demand and infrastructure growth:

| Location | Why It’s Popular |

|---|---|

| Nairobi (Karen, Lavington) | High rental demand and value appreciation |

| Mombasa | Logistics and commercial activity |

| Ruiru | Tech city development driving future growth |

| Naivasha | Strategic transport links and land banking |

| Coastal Regions (Kilifi County) | Tourism-driven short-term rental yields |

🚨 Risks and Challenges of Real Estate Investment Groups

While real estate investment groups offer many benefits, they also come with risks:

| Risk | Explanation |

|---|---|

| Lack of Regulation | Many crowdfunding platforms are not yet fully regulated |

| Developer Default | If a project fails, returns may be delayed or lost |

| Market Fluctuations | Property values can drop during economic downturns |

| Illiquidity | Some funds lock in capital for months or years |

| Platform Fraud | Unregulated sites may mismanage funds |

📌 Pro tip: Only invest through licensed or well-reviewed platforms.

📈 Emerging Trends in Real Estate Investment Groups (2025)

The sector is evolving fast. Here’s what’s shaping the future of real estate investment in Kenya:

| Trend | Impact |

|---|---|

| Blockchain Integration | Secure, transparent transactions and fractional ownership |

| Green Building Funds | Eco-friendly developments attract ESG-focused investors |

| Mobile-Based Investment Apps | More Kenyans investing via mobile apps and USSD codes |

| Partnerships with Banks | Easier access to mortgage-linked real estate funds |

| Government Support | Encouraging alternative financing under the Big Four Agenda |

🎓 Who Can Join Real Estate Investment Groups?

These groups are open to:

- Individual retail investors

- SACCO members

- Institutional investors

- Expatriates (through leasehold arrangements)

No prior experience is needed—just the willingness to learn and invest wisely.

📈 Benefits of Joining a Real Estate Investment Group

| Benefit | Description |

|---|---|

| Low Entry Barrier | Start with as little as KES 50,000 |

| Passive Income | Earn regular returns without managing property |

| Diversification | Spread risk across multiple properties |

| Professional Management | Leave the work to experts |

| Transparency | Most platforms provide regular updates |

⚖️ Legal Framework for Investment Groups in Kenya

Currently, the regulatory environment is still developing:

| Group Type | Regulated By |

|---|---|

| REITs | Capital Markets Authority (CMA) |

| Crowdfunding | No formal regulation yet |

| SACCO Housing Schemes | SACCO Societies Regulatory Authority (SASRA) |

| Private Equity | CMA & Companies Act |

📌 As the market matures, expect stronger oversight and investor protections.

📉 Real Estate Investment Group Performance (2025 Outlook)

Kenya’s real estate investment group market is growing steadily, driven by:

- Rising smartphone and internet penetration

- Increased interest in digital investing

- Government support for alternative finance

- Growing urbanization and housing deficit

With the right strategy, these groups will continue to gain traction among young professionals, expatriates, and retirement savers.

🧾 Conclusion

Real estate investment groups in Kenya are opening up new doors for investors who want to benefit from property markets without the hassle of owning or managing buildings directly.

From syndicates and land banking clubs to crowdfunding and SACCO schemes , there are diverse ways to participate in the booming Kenyan real estate market.

Now is the perfect time to explore your options—and start building wealth through group-based real estate investment.

❓ Frequently Asked Questions (FAQs)

Q1: Can I join a real estate investment group in Kenya with KES 100,000 or less?

A: Yes! Crowdfunding platforms like Zamara Africa and Eneza Investments accept small contributions.

Q2: Is investing in a real estate group safe in Kenya?

A: It depends on the provider—always verify the platform and developer before investing.

Q3: Do real estate investment groups pay dividends?

A: Some do—especially those linked to REITs or income-generating property portfolios.

Q4: Can foreigners join real estate investment groups in Kenya?

A: Yes—especially through REITs and crowdfunding platforms.

Q5: Are there legal protections for group investors in Kenya?

A: Yes, though regulations vary by group type—work only with trusted providers.