Kenya’s real estate sector has evolved from being a niche market to becoming one of the key drivers of national economic growth. As urbanization accelerates and infrastructure expands, the real estate contribution to GDP in Kenya has steadily increased over the past decade.

In this article, we explore how the real estate sector impacts Kenya’s economy, its role in job creation, investment opportunities, and what the future holds for this booming industry.

How Much Does Real Estate Contribute to Kenya’s GDP?

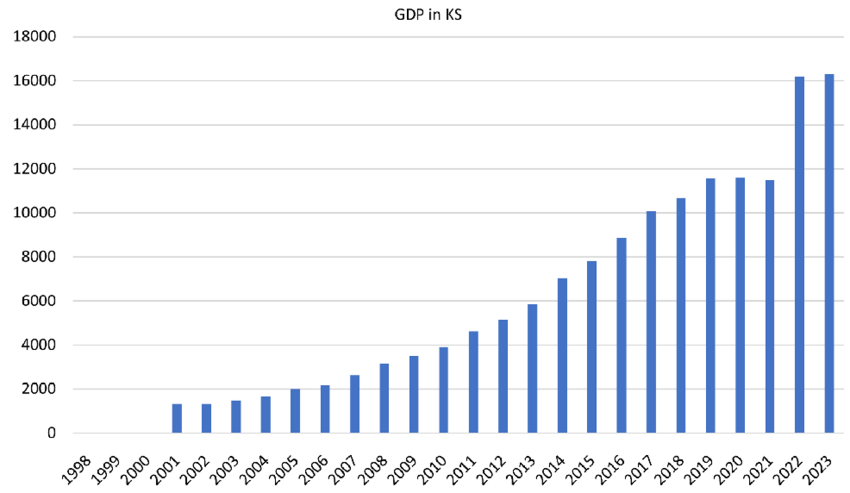

According to recent data from the Kenya National Bureau of Statistics (KNBS) , the real estate and rental services sector contributes approximately 10% to Kenya’s GDP annually .

This places it among the top sectors contributing to the country’s economic output — ahead of agriculture, construction, and tourism in some years.

📈 The sector has grown at an average rate of 5–7% per year since 2015, driven by rising demand for housing, commercial spaces, and land investments.

Key Factors Driving Real Estate Growth in Kenya

1. Urbanization and Population Growth

Kenya’s population is growing rapidly, with projections estimating over 85 million people by 2050 . This growth fuels demand for residential and commercial properties, especially in urban centers like Nairobi, Mombasa, and Kisumu.

2. Infrastructure Development

Projects such as the Nairobi Expressway , Standard Gauge Railway (SGR) , and new housing schemes have improved access to previously underdeveloped areas, boosting property values and attracting investment.

3. Government Policies Supporting Affordable Housing

Initiatives like the Affordable Housing Program under the Big Four Agenda aim to build 500,000 affordable homes by 2027. These policies are encouraging private sector participation and increasing overall real estate activity.

4. Increased Access to Mortgage Financing

Though still limited compared to global standards, banks and microfinance institutions are expanding mortgage options and innovative financing models, making homeownership more accessible to middle-income earners.

Economic Impact Beyond GDP

While the real estate contribution to GDP in Kenya is significant, the sector also has broader economic benefits:

| Benefit | Description |

|---|---|

| Job Creation | Thousands employed directly and indirectly in construction, sales, and management |

| Tax Revenue | Property taxes contribute to local government revenue |

| Ancillary Industries | Boosts related sectors like furniture, interior design, and utilities |

| Foreign Direct Investment (FDI) | Real estate attracts international investors looking for stable returns |

Top Cities Contributing to Real Estate Growth

Here are the major cities where real estate activity is most concentrated:

| City | Contribution to Real Estate Sector |

|---|---|

| Nairobi | Economic capital; highest property value and transaction volume |

| Mombasa | Coastal hub with strong tourism-driven real estate demand |

| Kisumu | Emerging lakeside market with untapped potential |

| Nakuru | Rapidly developing town with rising commercial interest |

| Ruiru | Affordable housing hotspot near Nairobi |

Challenges Facing the Kenyan Real Estate Sector

Despite its positive economic impact, the sector faces several challenges that can affect its long-term contribution to GDP:

- ⚠️ High Cost of Construction Materials

- ⚠️ Land Ownership and Title Conflicts

- ⚠️ Limited Mortgage Accessibility

- ⚠️ Slow Regulatory Approvals

💡 Pro Tip: Investors should conduct thorough due diligence and work with licensed professionals to mitigate risks.

Future Outlook: Will Real Estate Continue to Drive Kenya’s Economy?

Yes — the outlook remains positive . With continued urbanization, supportive government policies, and increasing foreign interest, real estate is expected to maintain its strong contribution to Kenya’s GDP.

Experts predict that if current trends continue, the sector could grow to contribute up to 15% of GDP by 2030 , especially with large-scale housing and commercial projects on the horizon.

Conclusion: Real Estate Is a Pillar of Kenya’s Economic Growth

The real estate contribution to GDP in Kenya highlights its critical role in shaping the country’s economic landscape. From job creation to FDI attraction, real estate is not just about bricks and mortar — it’s about building a stronger, more prosperous nation.

Whether you’re an investor, developer, or homeowner, understanding the economic significance of real estate in Kenya can help you make smarter decisions in this dynamic market.

Frequently Asked Questions (FAQs)

Q: What percentage does real estate contribute to Kenya’s GDP?

A: Approximately 10% , according to the latest KNBS reports.

Q: Which cities drive real estate growth in Kenya?

A: Nairobi, Mombasa, Kisumu, Nakuru, and Ruiru are the main contributors.

Q: Can foreigners invest in real estate in Kenya?

A: Yes, through a 99-year leasehold agreement .

Q: How does real estate support Kenya’s economy beyond GDP?

A: It creates jobs, boosts tax revenue, supports ancillary industries, and attracts foreign investment.