Real estate joint ventures are becoming a popular investment strategy in Kenya, especially among small and medium-scale investors looking to pool resources and share risks. Whether you’re teaming up with friends, family, or professional partners, a real estate joint venture in Kenya can help you access larger property deals, reduce financial pressure, and increase your chances of success.

In this guide, we’ll walk you through everything you need to know about real estate joint ventures in Kenya, including how they work, legal requirements, benefits, common structures, and tips for starting or joining one.

What Is a Real Estate Joint Venture?

A real estate joint venture (JV) is a partnership between two or more parties who combine capital, skills, and resources to invest in property projects. These partnerships are usually formed for a specific project — such as buying land, developing apartments, or renovating commercial buildings — and may be temporary or long-term depending on the goals of the participants.

Joint ventures are ideal for:

- First-time investors with limited funds

- Professionals seeking collaboration (e.g., agents, developers, valuers)

- Individuals wanting to diversify their real estate portfolio

Why Real Estate Joint Ventures Are Gaining Popularity in Kenya

Kenya’s booming property market, rising demand for affordable housing, and increased access to financing have made joint ventures an attractive option for many.

Key Drivers:

- Rising property prices making solo investments difficult

- Growth of Nairobi, Mombasa, and satellite towns like Ruiru and Thika

- Government-backed housing programs encouraging group investments

- Increased awareness of collaborative investment opportunities

- Digital platforms connecting investors and facilitating partnerships

Benefits of Real Estate Joint Ventures in Kenya

Joining or forming a real estate joint venture offers several advantages:

1. Shared Investment Costs

Pooling money allows you to afford properties that would otherwise be out of reach.

2. Risk Diversification

Financial and legal risks are spread across multiple parties.

3. Access to Expertise

Each partner brings different skills — from marketing and finance to construction and legal knowledge.

4. Faster Deal Execution

More capital means quicker purchases and better negotiation power.

5. Scalability

Joint ventures allow for reinvestment and expansion into bigger projects.

Types of Real Estate Joint Ventures in Kenya

There are various ways to structure a real estate joint venture depending on your goals and partnership style.

1. Informal Investor Groups

Small groups formed by friends or family pooling money for property purchases.

2. Developer-Investor Partnerships

Developers provide land and expertise while investors contribute capital.

3. Land Banking JVs

Multiple investors buy large plots together and develop them over time.

4. REIT-Based Joint Investments

Using Real Estate Investment Trusts (REITs) to co-invest in income-generating properties.

5. Affordable Housing Cooperatives

Community-based groups targeting government-supported housing schemes.

How to Start a Real Estate Joint Venture in Kenya

Starting a successful real estate joint venture requires careful planning and legal structuring.

Step-by-Step Guide:

1. Define Your Investment Goal

Are you investing for rental income, flipping, or long-term appreciation? Clarify your objective before bringing in partners.

2. Find the Right Partners

Look for individuals or companies whose skills and values align with yours. Use:

- Real estate forums

- LinkedIn groups

- Local investor clubs

- Property expos

3. Set Clear Roles and Contributions

Decide who will manage finances, handle property management, or oversee development.

4. Create a Legal Agreement

Draft a formal JV agreement outlining:

- Profit-sharing ratios

- Responsibilities

- Exit strategies

- Dispute resolution methods

Always consult a licensed real estate lawyer to ensure compliance.

5. Register the Venture (Optional but Recommended)

Depending on the scale, consider registering as a Limited Liability Partnership (LLP) or company with the Registrar of Companies.

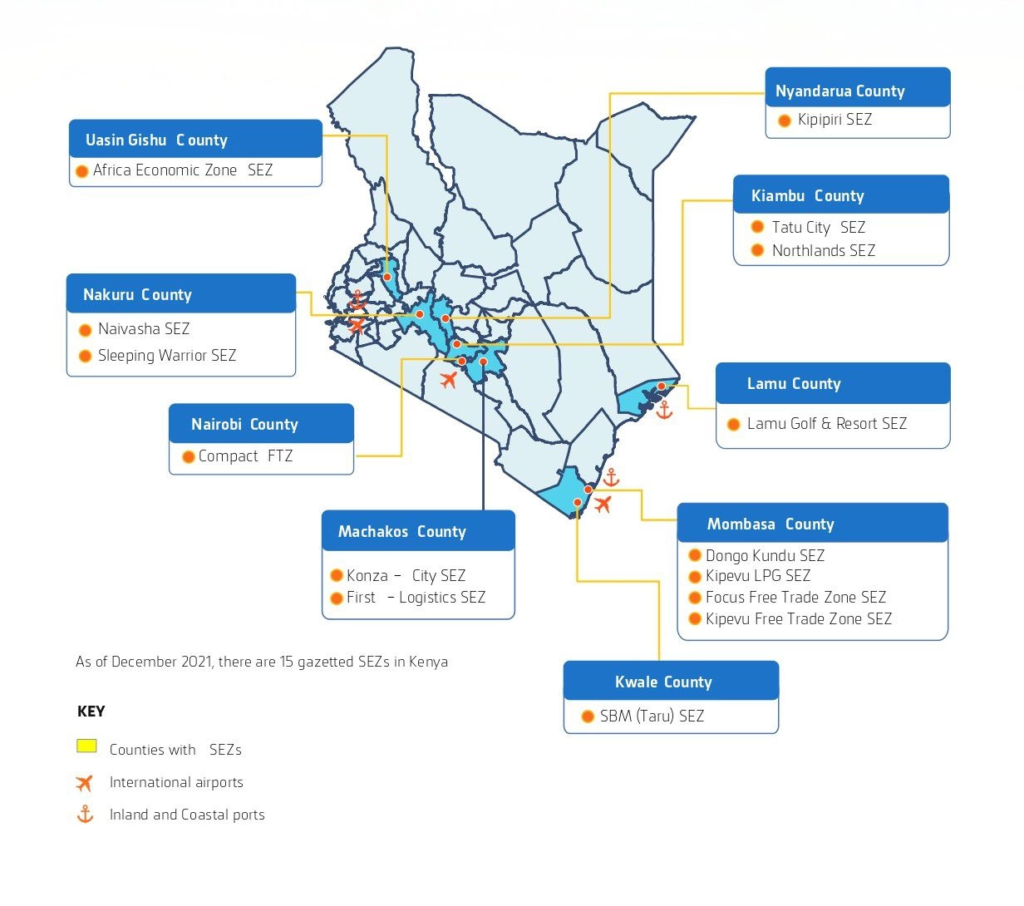

Top Cities for Real Estate Joint Ventures in Kenya

Certain regions offer high growth potential and are ideal for joint property investments.

Best Locations:

- Nairobi Satellite Towns – Machakos

- Coastal Regions – Mombasa

- Secondary Cities – Kisumu

- Gated Communities – Karen

These areas offer good infrastructure, rising demand, and favorable investment returns.

Real-Life Examples of Real Estate Joint Ventures in Kenya

Here are some practical examples of how joint ventures are being used:

Example 1: Land Banking Group

Five investors pool KES 500,000 each to buy a plot worth KES 2.5 million in Ruiru. The land appreciates over 3 years and is sold for KES 4 million — netting each investor KES 800,000 profit.

Example 2: Developer-Investor Partnership

An investor contributes 60% of the funding while a developer handles construction, permits, and sales. Profits are split 60/40.

Example 3: Affordable Housing Cooperative

A group of 20 professionals joins a government-backed affordable housing scheme to qualify for bulk discounts and financing options.

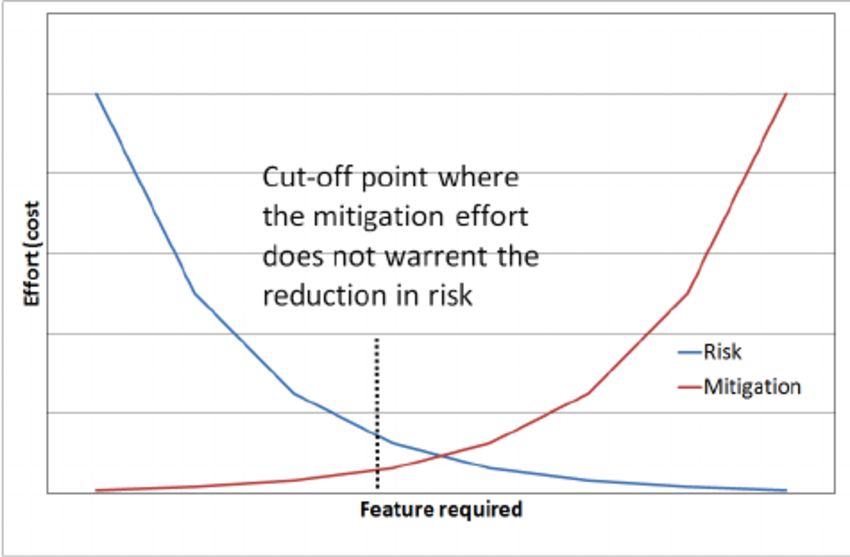

Risks and Challenges to Watch For

While real estate joint ventures offer many benefits, there are risks to be aware of:

- Conflicting interests or misaligned goals

- Unequal contribution or effort

- Lack of transparency in finances

- Legal disputes due to poor documentation

- Difficulty exiting the venture

To minimize these risks, always:

- Draft a clear partnership agreement

- Maintain open communication

- Use a joint bank account for contributions

- Involve a lawyer from the start

Tips for a Successful Real Estate Joint Venture

Maximize your chances of success with these expert-backed strategies:

✅ Choose partners carefully and vet their background

✅ Define roles and responsibilities clearly

✅ Set realistic timelines and exit strategies

✅ Keep finances transparent and auditable

✅ Regularly review performance and adjust strategies

Frequently Asked Questions

Can foreigners join real estate joint ventures in Kenya?

Yes, provided they comply with leasehold ownership laws and use local partners.

Are real estate joint ventures legally recognized in Kenya?

Yes. They should be formalized through a legal contract and, where applicable, registered with the Registrar of Companies.

What is the minimum investment amount for a JV?

It varies by project, but many ventures allow entry from as low as KES 100,000 per person.

Conclusion

Real estate joint ventures in Kenya offer a powerful way to enter the property market with less financial burden and greater support. Whether you’re buying land, developing residential units, or investing in commercial property, working with others can unlock bigger opportunities and higher returns.

By understanding how to structure your venture, choosing the right partners, and setting clear expectations, you can build wealth through real estate — together.