Real Estate Investment Trusts (REITs) are gaining popularity in Kenya as a modern way to invest in property without owning land or buildings directly. These trusts allow small investors to earn dividends from commercial properties like malls, office towers, and residential complexes.

In this guide, we’ll explore the top 10 real estate investment trusts in Kenya , their focus areas, and how they offer passive income and portfolio diversification for both local and international investors.

Let’s dive in!

📌 What Are REITs?

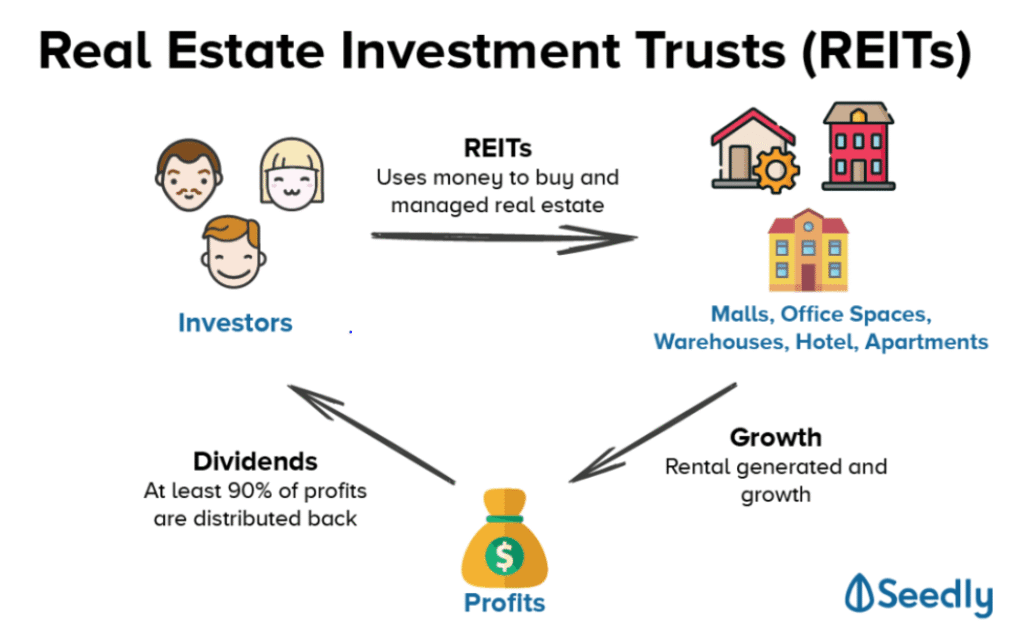

A Real Estate Investment Trust (REIT) is a company that owns or finances income-generating real estate such as malls, hotels, offices, or apartments.

Instead of buying property outright, you purchase shares in the trust—and receive regular dividends from rental yields .

Key Features of REITs:

- Minimum investment required

- Passive income through dividends

- Regulated by the Capital Markets Authority (CMA)

- Transparent and liquid compared to traditional real estate

📌 REITs are ideal for retirement planning, portfolio diversification, and steady income generation.

🔝 Top 10 Real Estate Investment Trusts (REITs) in Kenya (2025 Picks)

Here are the most promising REITs currently available or under development:

| REIT Name | Operator | Focus Property |

|---|---|---|

| Centum REIT | Centum Investment Co. | Garden City Mall, Two Rivers Mall, and Nairobi-based residential towers |

| Britam REIT | Britam Holdings | Commercial buildings and asset management |

| Nairobi REIT Fund | Local fund managers | Office and retail space in Nairobi CBD |

| Industrial REIT | Private Equity Firms | Warehouses and logistics-linked developments |

| Coastal Tourism REIT | Mombasa-based investors | Hotels and resorts along the Kenyan coast |

| Affordable Housing REIT | Government-backed funds | Low-cost housing projects under Big Four Agenda |

| Garden City REIT | Garden City Group | Income from mall and residential leases |

| Home Afrika REIT (Planned) | Home Afrika Limited | Future residential income-generating assets |

| Sameer Africa REIT (Exploratory) | Sameer Group | Potential luxury residential and commercial trust |

| Tatu City REIT (Future Launch) | Tatu City Development Co. | Smart city commercial and industrial zones |

📌 Kenya launched its first REIT in 2020—more are expected to follow as demand grows.

🧾 Expected Returns from Kenyan REITs

Investing in REITs can provide regular income and long-term appreciation:

| REIT Type | Average Annual Dividend Yield | Capital Appreciation Potential |

|---|---|---|

| Retail Mall REITs | 6% – 10% | Moderate |

| Office Space REITs | 7% – 12% | Strong |

| Industrial REITs | 8% – 14% | High |

| Affordable Housing REIT | 6% – 9% | Stable growth |

| Coastal Tourism REITs | 6% – 10% | Seasonal variation |

📈 Compared to traditional savings accounts or bonds, REITs offer superior returns and stability.

🧭 How to Invest in REITs in Kenya

Here’s how you can start investing:

Step 1: Open a CDS Account

To trade REITs listed on the Nairobi Securities Exchange (NSE), you need a Central Depository & Settlement (CDS) account .

Step 2: Choose a REIT

Research available REITs and select one based on your goals and risk appetite.

Step 3: Buy Units or Shares

You can invest in REITs through:

- The NSE (for publicly traded REITs)

- Private funds (offered by developers or banks)

📌 Minimum investment varies—from KES 100,000 upwards depending on the fund.

📊 Benefits of Investing in REITs in Kenya

| Benefit | Explanation |

|---|---|

| Low Entry Barrier | Start with as little as KES 100,000 |

| Passive Income | Earn regular dividends from rental income |

| Diversification | Spread risk across multiple properties |

| Professional Management | No need to manage tenants or maintenance |

| Transparency | Publicly listed REITs publish quarterly reports |

📌 REITs are ideal for investors seeking stable returns without direct property ownership.

🚨 Risks and Challenges of REITs

Like any investment, REITs come with risks:

| Risk | Explanation |

|---|---|

| Market Volatility | REIT values can fluctuate with economic conditions |

| Tenant Vacancies | Low occupancy affects dividend payouts |

| Regulatory Gaps | Kenya’s REIT framework is still evolving |

| Limited Options | Only a few REITs are active today |

| Developer Reliance | Returns depend on the success of underlying projects |

📌 Always review the REIT’s prospectus and consult a licensed financial advisor before investing.

📈 Emerging Trends in Kenyan REITs

Several trends are making REITs more attractive:

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract institutional REIT investment |

| Digital Platforms | Easier access via mobile apps and online brokers |

| Government Housing Programs | Encouraging alternative financing models |

| Foreign Investor Interest | Expatriates and diaspora investors now use REITs |

| Green Building Initiatives | Eco-friendly commercial properties gain traction |

📈 As the sector matures, more REIT options will become available to local investors.

Frequently Asked Questions (FAQs)

Q1: Are there REITs in Kenya?

A1: Yes, Kenya launched its first REIT in 2020—offering small investors access to income-generating commercial properties.

Q2: Can I invest in REITs with KES 100,000 or less?

A2: Some REITs allow small investments through digital platforms and NSE-listed funds.

Q3: Is investing in REITs safe in Kenya?

A3: Yes—if you choose CMA-regulated REITs and conduct proper research.

Q4: Do REITs pay dividends?

A4: Yes—REITs distribute at least 80% of annual profits to investors as dividends.

Q5: Can foreigners invest in Kenyan REITs?

A5: Yes—through local brokerage platforms or digital investment apps linked to the Nairobi Securities Exchange.