The year 2024 was a transformative one for Kenya’s property market. With rising demand, technological advancements, and government-backed housing programs, real estate trends in Kenya 2024 reflected a more inclusive, efficient, and investor-friendly landscape.

Whether you’re an investor, developer, or homebuyer, understanding these trends can help you make smarter decisions.

In this guide, we’ll explore:

- The most impactful real estate trends in Kenya 2024

- How they affected buyers and sellers

- And what to expect in 2025

Let’s get started!

📈 Top 10 Real Estate Trends in Kenya (2024 Recap)

Here are the key trends that shaped the Kenyan real estate sector last year:

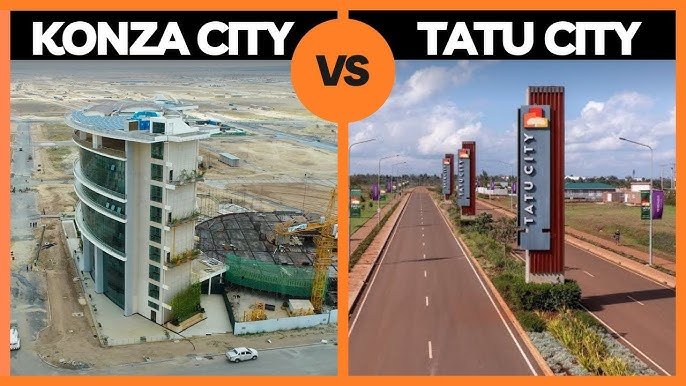

1. Smart Cities Development Gains Momentum

What Happened:

Cities like Tatu City , Konza Technopolis , and Ruiru Smart City saw major infrastructure progress.

Why It Matters:

- Attracts foreign investment and long-term residents

- Reduces pressure on Nairobi CBD

- Increases land value in surrounding areas

📌 Example: Tatu City expanded its residential and industrial zones by 30% in 2024.

2. Digital Property Platforms Rise in Popularity

What Happened:

Online listing sites like Zameen Africa , Property24 Kenya , and Jengo Real Estate gained traction.

Why It Matters:

- Increased transparency and access

- Virtual tours and mobile-based transactions became common

- Reduced fraud through verified listings

📌 WhatsApp Business and USSD-based property search also grew significantly.

3. Affordable Housing Programs Deliver Results

What Happened:

Under the Big Four Agenda , over 10,000 new homes were delivered across Nairobi, Kiambu, and Machakos.

Why It Matters:

- Makes homeownership accessible to middle-income earners

- Encourages mortgage-linked financing

- Stima Housing, Home Afrika, and Jamii Bora led the way

📌 More developers are partnering with SACCOs and banks for flexible payment plans.

4. Green Building Initiatives Go Mainstream

What Happened:

More developers adopted sustainable materials and energy-efficient designs.

Why It Matters:

- Lowers utility costs for residents

- Meets global ESG standards

- Attracts eco-conscious investors and expats

📌 Kingsight Heights and Britam Tower incorporated green features like solar panels and water recycling.

5. Land Banking in Emerging Zones Surpasses Expectations

What Happened:

Investors focused on areas near transport hubs—especially Naivasha , Athi River , and Konza-linked plots .

Why It Matters:

- Land values rose by up to 20% annually

- Strategic infrastructure projects boost future appreciation

- Lower entry point compared to built properties

📌 Many investors now prefer fractional ownership via crowdfunding platforms.

6. REITs Continue to Gain Interest

What Happened:

Kenya’s first REIT, launched in 2020, reported strong returns from Garden City Mall and Two Rivers Mall .

Why It Matters:

- Allows small investors to earn passive income from commercial property

- Offers liquidity and dividend payouts

- Institutional interest is growing

📌 More REITs are expected to launch in 2025.

7. Co-Living & Shared Housing Models Expand

What Happened:

Young professionals and students increasingly opted for co-living spaces with shared amenities.

Why It Matters:

- Affordable option for millennials and remote workers

- High occupancy and rental yields

- Combines convenience with modern design

📌 Popular in Kilimani, Westlands, and Eldoret.

8. Crowdfunding Becomes a Mainstream Investment Option

What Happened:

Platforms like Zamara Africa and Eneza Investments attracted thousands of small investors.

Why It Matters:

- Entry-level investments start at KES 50,000

- Diversifies risk among multiple buyers

- Democratizes access to prime Nairobi developments

📌 Expected ROI: 8%–14% annually depending on project type.

9. Mixed-Use Developments Rise in Nairobi

What Happened:

Developers built complexes that combine residential, retail, and office space —especially around Garden City and Upper Hill.

Why It Matters:

- Promotes walkability and convenience

- Maximizes land use in high-density areas

- Boosts foot traffic and rental income

📌 Two Rivers Mall and ABC Place followed this trend.

10. Remote Property Management Gains Ground

What Happened:

Landlords and investors increasingly used digital tools to manage rentals remotely.

Why It Matters:

- Saves time and reduces physical visits

- Appeals to overseas owners

- Enhances tenant experience through apps and chatbots

📌 Tools used include WhatsApp, Google Workspace, and SMS alerts.

🧭 How These Trends Affected Different Markets

| Trend | Residential Impact | Commercial Impact | Investment Impact |

|---|---|---|---|

| Smart Cities | New gated communities and urban planning | Industrial zones attract logistics firms | Long-term appreciation potential |

| Digital Platforms | Improved access to rentals and sales | Better visibility for mall operators | Crowdfunding and online deals grow |

| Affordable Housing | More middle-income homeowners | Developer partnerships with SACCOs | Government-backed schemes gain trust |

| Green Buildings | Energy-efficient homes rise | Eco-friendly offices attract tenants | Sustainable funds gain traction |

| Land Banking | Limited direct impact | Logistics-driven growth | High appreciation in Athi River and Naivasha |

📊 Each trend contributed to increased efficiency, transparency, and profitability.

📊 Top Performing Areas in 2024

| Area | Key Trend |

|---|---|

| Nairobi | Luxury and mixed-use developments |

| Ruiru | Affordable housing boom |

| Naivasha | Strategic land banking and transport links |

| Mombasa Road Corridor | Industrial and commercial expansion |

| Diani Coast | Tourism-driven short-term rental yields |

| Konza | Student housing and airport expansion |

📌 Nairobi outskirts and coastal regions performed best in terms of ROI.

💰 Average Returns by Trend

| Trend | Avg. Annual Return |

|---|---|

| Residential Rentals (Nairobi) | 5% – 8% |

| Commercial Properties | 7% – 12% |

| Land Banking | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 These figures show where investors earned the most in 2024.

🚨 Risks Identified in 2024

Despite positive momentum, some risks persisted:

| Risk | Explanation |

|---|---|

| Lack of Regulation in Crowdfunding | Some platforms operate without oversight |

| Developer Delays | Construction timelines extended due to inflation |

| Market Saturation in Nairobi CBD | Oversupply affects ROI |

| Title Verification Delays | Legal processes still slow in some counties |

| Platform Fraud | Fake property ads remain a concern |

📌 Pro tip: Always work with ISK-certified brokers and legal experts.

📉 Regional Breakdown of 2024 Real Estate Trends

| Region | Key Development |

|---|---|

| Nairobi | Mixed-use developments and tech-enabled property management |

| Mombasa | Coastal villa demand and port-linked investments |

| Eldoret | Student housing and airport expansion |

| Naivasha | Waterfront property and land appreciation |

| Athi River | Logistics hub development driving land prices |

| Konza Technopolis Zone | Tech city attracting global tenants and investors |

📌 Nairobi and coastal regions remained hotspots—but satellite towns showed stronger appreciation.

📈 Emerging Technologies in Real Estate (2024 Highlights)

| Innovation | Adoption in Kenya |

|---|---|

| Virtual Property Tours | Used by Zameen Africa and Property24 |

| Mobile-Based Transactions | M-Pesa payments for deposits and rent |

| AI Tenant Matching | Adopted by some crowdfunding platforms |

| Blockchain for Land Records | Pilot programs launched in Nairobi and Kiambu |

| Smart Home Integration | Prestige Group and Kingsight Heights introduced tech-integrated living |

📌 Technology improved access and transaction speed across all segments.

🧾 Conclusion

2024 was a pivotal year for real estate in Kenya. From smart cities and digital platforms to green buildings and remote property management , the sector evolved rapidly—offering better access, higher returns, and more transparency.

Whether you’re a buyer, investor, or agent, staying ahead of these trends ensures you’re prepared for the next wave of opportunities in 2025.

Start exploring today—and position yourself for success in Kenya’s booming real estate market.

❓ Frequently Asked Questions (FAQs)

Q1: What were the biggest real estate trends in Kenya in 2024?

A: Smart cities, digital platforms, green buildings, land banking, and REITs.

Q2: Are real estate prices rising in Kenya?

A: Yes, especially in Nairobi and coastal regions, though growth varies by location.

Q3: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q4: Can foreigners invest in real estate in Kenya?

A: Yes—through leasehold arrangements, crowdfunding, or REITs.

Q5: Do real estate agents in Kenya use digital tools?

A: Yes—WhatsApp, CRM systems, and virtual tours are now widely adopted.