The future of real estate in Kenya looks promising, with rapid urbanization, government-backed housing initiatives, and technological advancements shaping the industry. As demand for affordable homes rises and commercial development expands, Kenya’s property market is undergoing a transformation that presents exciting opportunities for investors, developers, and homebuyers.

In this guide, we’ll explore:

- Emerging trends driving the real estate sector

- Impact of technology and digital platforms

- Government policies and affordable housing programs

- Growth projections for Nairobi, Mombasa, and satellite towns

- How to prepare for future real estate opportunities

Urbanization and Population Growth – Key Drivers of Real Estate Demand

Kenya’s population is projected to reach over 60 million by 2030, fueling demand for housing across cities and rural areas. With more people moving into urban centers like Nairobi, Mombasa, and Kisumu, pressure on residential and commercial property supply continues to rise.

What This Means for the Future:

- More demand for apartments, townhouses, and rental units

- Expansion of infrastructure and transport networks

- Increased interest in satellite towns such as Ruiru, Thika, and Machakos

These shifts are pushing developers and policymakers to innovate and meet the growing needs of Kenyan home seekers.

Government Housing Initiatives and Affordable Housing Scheme

One of the most significant developments influencing the future of real estate in Kenya is the Affordable Housing Program (AHS), part of the Big Four Agenda.

This initiative aims to build 500,000 affordable homes by 2027, targeting middle and low-income earners. It includes:

- Subsidized mortgages from banks like Jamii Housing and Co-operative Bank

- Bulk land acquisition and standardized housing plans

- Public-private partnerships with major developers

- Lower interest rates and flexible payment plans

As the program gains momentum, it will reshape how Kenyans access homeownership — making real estate more inclusive and sustainable.

Rise of Digital Real Estate Platforms

Technology is transforming how real estate is bought, sold, and managed in Kenya. Online platforms like buykenya.com, Jengo Homes, and Zameen Africa are streamlining property transactions and improving transparency.

Future Impact of Real Estate Tech:

- Virtual property tours and online valuations

- AI-driven pricing tools and buyer recommendations

- Smart contracts and blockchain-based property transfers

- Greater access to international buyers through global listings

- Improved lead generation and CRM systems for agents

Digital innovation is making real estate more accessible and efficient — setting the stage for a modernized industry.

Smart Cities and Planned Developments

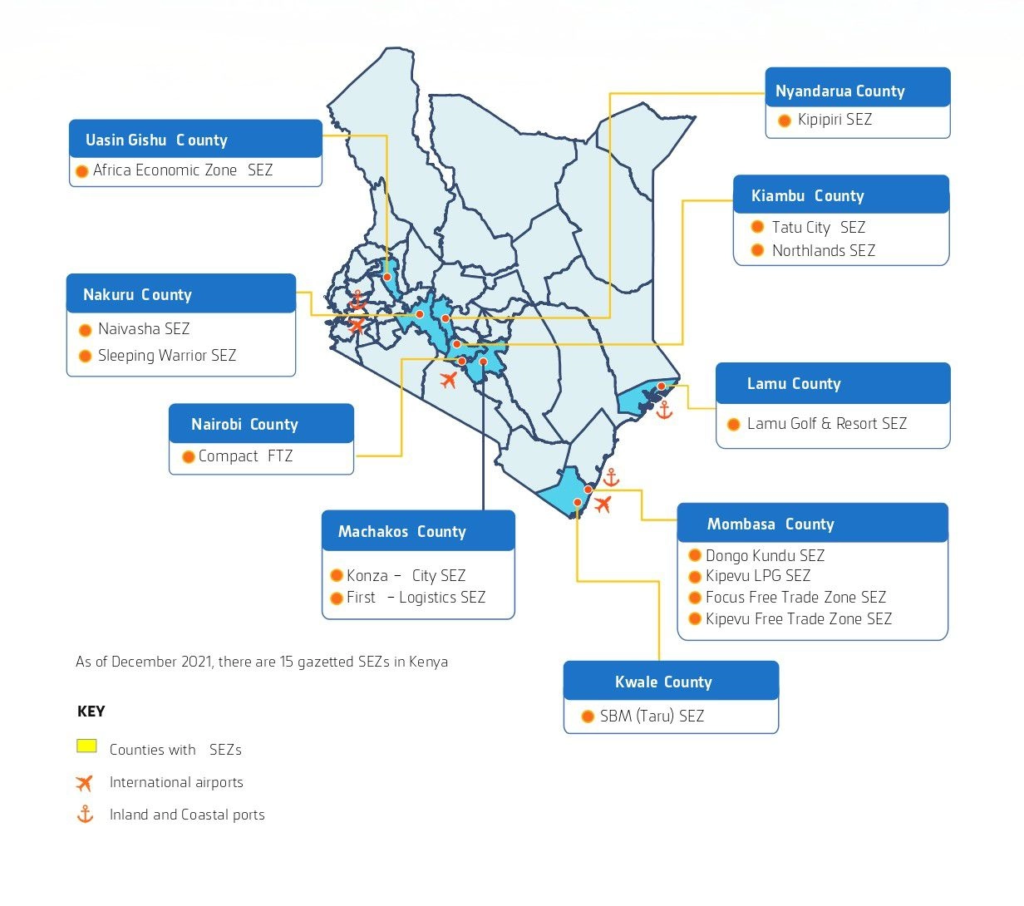

Kenya is embracing the concept of smart city planning, with projects like Konza Technopolis, Centum City, and Manga Smart City leading the way.

These developments integrate technology, sustainability, and modern infrastructure to create live-work-play environments that attract both local and foreign investment.

Features of Future Real Estate Development:

- Green building materials and energy-efficient designs

- Integrated transport and utility systems

- Mixed-use spaces combining residential, retail, and office buildings

- High-speed internet and tech-enabled living

- Security-focused gated communities

Such projects are expected to redefine urban living and set new standards for future property investments.

Sustainable and Eco-Friendly Housing

Environmental concerns are influencing architectural and construction practices globally — and Kenya is no exception. Developers are increasingly adopting green building techniques, solar-powered utilities, and water conservation systems.

Benefits of Eco-Friendly Housing:

- Lower long-term maintenance costs

- Reduced utility bills for residents

- Compliance with global sustainability standards

- Higher resale and rental value

- Appeal to environmentally conscious buyers

Expect to see more eco-homes, green estates, and energy-efficient apartments entering the market in the coming years.

Growth of Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are gaining popularity in Kenya, offering investors an opportunity to earn returns without direct property ownership.

Currently, REITs like Stanlib Fahari I-REIT and Britam REIT Opportunities Fund allow individuals to invest in income-generating properties such as office blocks, shopping malls, and industrial parks.

Why REITs Are the Future:

- Low entry barriers (as little as KES 10,000)

- Regular dividend payouts from rental income

- Professional management of assets

- Diversification of investment portfolios

- Liquidity through listing on the Nairobi Securities Exchange

REITs provide a scalable and accessible option for small and large investors alike.

Land Use Reforms and Policy Changes

The government is working on land use reforms aimed at optimizing space and reducing speculation. These changes include:

- Digitization of land records to improve transparency

- Streamlined approval processes for subdivisions and developments

- Encouraging vertical development to conserve land

- Promoting transit-oriented development near rail and road corridors

These policy shifts are expected to reduce fraud, speed up transactions, and enhance overall efficiency in the real estate sector.

The Role of Foreign Investment in Kenya’s Property Market

Foreign interest in Kenyan real estate remains strong, particularly in coastal and retirement zones. While non-citizens cannot own land on a freehold basis, they can lease property for up to 99 years, making Kenya an attractive destination for international investors.

Areas Attracting Foreign Buyers:

- Malindi and Watamu for beachfront properties

- Karen and Lavington for upscale living

- Nakuru and Naivasha for serene retirement options

With improved legal frameworks and digital marketing, more foreigners are expected to enter the Kenyan market in the next decade.

Real Estate in Satellite Towns – The Next Frontier

Cities like Ruiru, Thika, Mlolongo, and Kiserian are becoming hotspots for property investment due to their proximity to Nairobi and lower entry costs.

Why Satellite Towns Are Rising:

- Better roads and public transport links

- Government infrastructure investments

- Affordable land and housing

- Growing schools, hospitals, and shopping centers

- Lower cost of living compared to Nairobi

These towns are expected to experience rapid appreciation as urban expansion continues.

Increasing Demand for Serviced Apartments and Gated Communities

Modern lifestyles and security concerns are shifting buyer preferences toward serviced apartments and gated communities.

Developers are responding with:

- Fully furnished and ready-to-move-in units

- Smart home automation features

- Community amenities like gyms, pools, and co-working spaces

- Enhanced security and controlled access

This trend is especially popular among young professionals, expatriates, and retirees looking for convenience and comfort.

Challenges and Risks in the Real Estate Sector

Despite its bright outlook, Kenya’s real estate sector faces several challenges that could impact future growth:

- Lengthy property registration processes

- Inconsistent enforcement of zoning and building laws

- Unregulated informal settlements and speculative land deals

- Limited mortgage access for low-income earners

- Legal disputes over unclear land titles

However, increased digitization and regulatory oversight are helping to mitigate these issues.

Frequently Asked Questions

Will property prices increase in Kenya?

Yes, especially in well-connected areas where demand outpaces supply.

Can foreigners invest in real estate in Kenya?

Yes, through leasehold agreements (up to 99 years) or via local entities.

Is now a good time to invest in Kenyan real estate?

Yes, especially in emerging markets and government-supported housing schemes.

Conclusion

The future of real estate in Kenya is being shaped by technology, policy reforms, and changing lifestyle preferences. From smart cities and REITs to affordable housing and sustainable development, the sector offers diverse opportunities for investors, developers, and homebuyers.

By staying informed about upcoming trends and leveraging digital tools, you can position yourself to benefit from Kenya’s evolving property landscape and secure valuable assets for the long term.