The real estate market trends in Kenya are evolving rapidly due to urbanization, digital transformation, and government-backed housing initiatives. Whether you’re a first-time buyer, property investor, or developer, staying updated on current trends is essential for making smart decisions.

In this guide, we’ll explore the latest developments shaping Kenya’s real estate landscape, including:

- Rising demand in Nairobi, Mombasa, and satellite towns

- Digital property platforms transforming transactions

- Affordable housing schemes and mortgage financing

- Land banking and commercial real estate growth

- Emerging investment opportunities

Rapid Urbanization Driving Property Demand

One of the most significant real estate market trends in Kenya is the rapid pace of urbanization. Over 28% of Kenya’s population now lives in urban areas — a figure expected to grow steadily over the next decade.

Key Impacts:

- Increased pressure on housing supply in Nairobi and Mombasa

- Growth of informal settlements and need for affordable housing

- Rise in rental demand from young professionals and students

This trend is pushing developers and policymakers to find sustainable solutions that meet the growing demand for quality housing across major cities.

Technology Is Reshaping Real Estate Transactions

Digital innovation is revolutionizing how buyers and sellers interact in the Kenyan property market.

Major Tech-Driven Trends:

- Online listing platforms like Realestate.co.ke and Jengo Homes

- Virtual property tours and digital valuations

- CRM tools for better lead management

- Mobile payments and e-contracts improving transparency

- AI-powered property matching and pricing tools

These advancements make it easier than ever to research, buy, and manage real estate in Kenya — even from abroad.

Affordable Housing Scheme Gaining Momentum

The Affordable Housing Program, part of Kenya’s Big Four Agenda, is one of the most impactful trends in the sector.

Key Features:

- Government-subsidized homes priced between KES 1.5 million and KES 3 million

- Partnerships with banks to offer low-interest mortgages

- Bulk land acquisition and standardized home designs

- Focus on peri-urban areas like Ruiru, Thika, and Machakos

This initiative aims to bridge the housing gap and provide more Kenyans with access to quality, affordable homes.

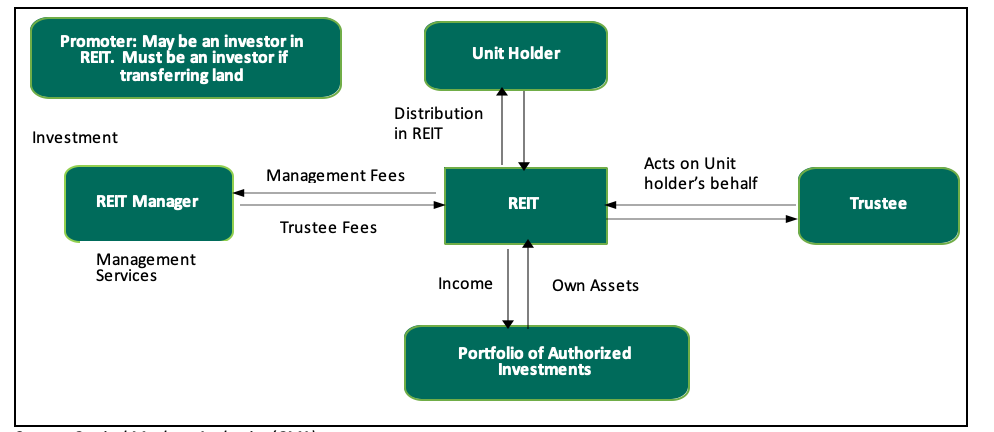

Growth of Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are gaining traction as a modern way to invest in income-generating properties without owning them directly.

Notable Developments:

- Stanlib Fahari I-REIT listed on the Nairobi Securities Exchange

- More institutional investors entering the REIT space

- Increased interest from small investors looking for passive income

REITs allow individuals to earn dividends from rental income while avoiding the responsibilities of property management.

Increasing Popularity of Serviced Apartments and Gated Communities

Modern living preferences are shifting toward serviced apartments and gated communities, especially among professionals and expatriates.

Why This Trend Is Growing:

- Enhanced security and controlled access

- Ready-to-move-in units with modern finishes

- Community amenities such as gyms, pools, and co-working spaces

- Appeal to remote workers and digital nomads

Developers are responding with new projects offering convenience, safety, and lifestyle-driven features.

Rise of Satellite Towns and Commuter Living

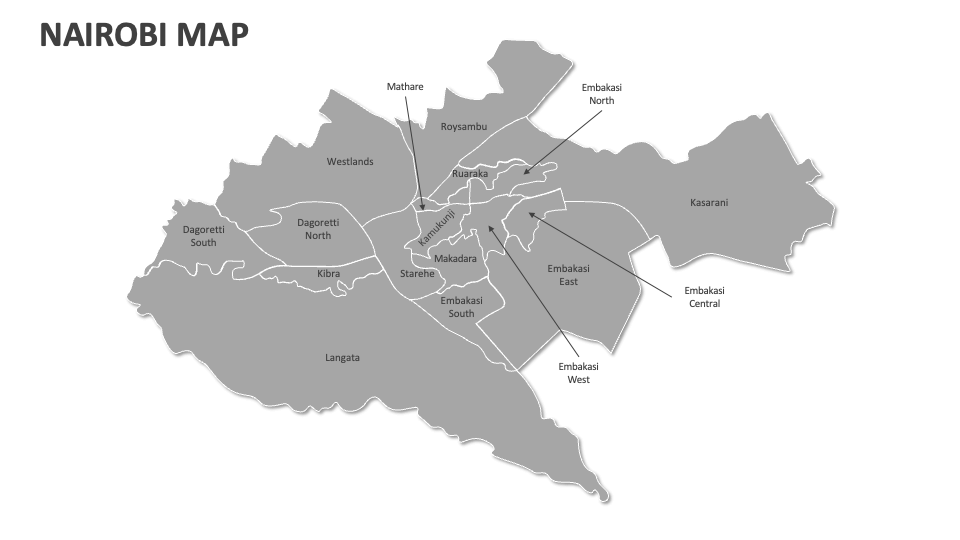

With Nairobi becoming increasingly expensive, many buyers and investors are turning to satellite towns Improved road networks and transport systems have made these areas more accessible and attractive for both residential and investment purposes.

Land Banking Remains a Strategic Investment Move

Buying undeveloped land in emerging areas continues to be a popular strategy for long-term appreciation.

Commercial Real Estate Expands in Nairobi and Mombasa

As businesses grow and foreign investment increases, commercial real estate is seeing strong momentum.

Key Developments:

- New office towers in Nairobi’s Upper Hill and Kilimani areas

- Retail centers expanding in Mombasa and Kisumu

- Mixed-use developments combining residential and business spaces

- Rise in serviced office spaces and co-working hubs

Commercial property offers higher returns but requires careful planning and legal compliance.

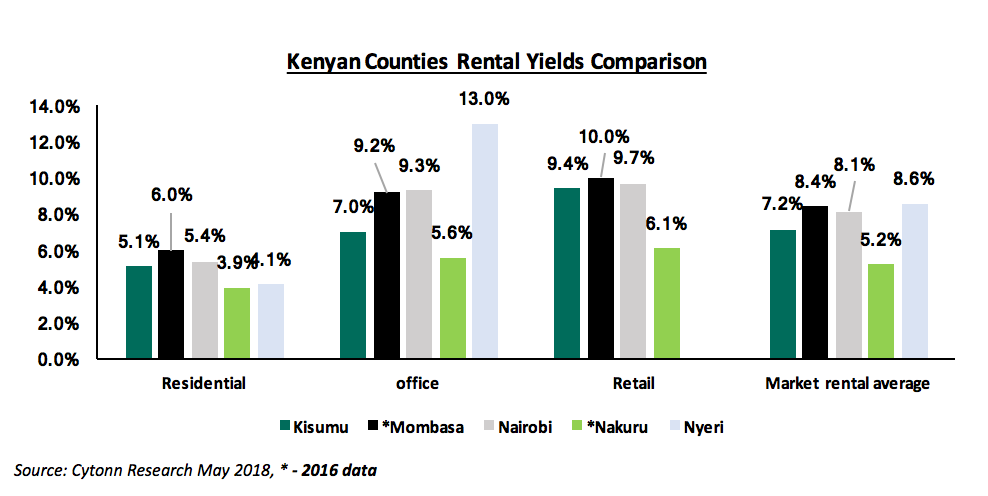

Rental Market Dynamics and Yield Performance

Rentals continue to be a key source of income for property owners, especially in university and business districts.

Average Monthly Rents (2025):

- Nairobi (Kilimani): Studio apartment – KES 15,000/month

- Mombasa (Nyali): 2-bedroom flat – KES 30,000–KES 50,000/month

- Kisumu (Nyawawa): Single room – KES 5,000–KES 8,000/month

Well-managed properties in high-demand zones deliver steady cash flow and long-term value.

Regulatory Improvements and Licensing Standards

The National Land Commission (NLC) has played a crucial role in regulating the real estate industry since the implementation of the Real Estate (Regulation and Development) Act, 2012.

Key Regulatory Advances:

- Mandatory licensing of real estate agents and brokers

- Improved title deed verification processes

- Enforcement of ethical standards in property transactions

- Digital land registries reducing fraud and speeding up transfers

These changes are increasing investor confidence and ensuring safer deals across the country.

Challenges Facing the Kenyan Real Estate Market

Despite positive trends, some challenges remain:

- Lengthy property transfer and registration process

- Unclear land titles and boundary disputes

- High upfront costs limiting buyer pool

- Limited mortgage access for low-income earners

- Inconsistent enforcement of property laws

However, increased digitization and policy reforms are helping to address these issues.

Frequently Asked Questions

What is the biggest trend in Kenya’s real estate market?

Digital transformation and online property platforms are reshaping how real estate is bought and sold.

Where should I invest in real estate in Kenya today?

Satellite towns like Ruiru, Thika, and Mlolongo offer strong appreciation potential.

Are rental yields increasing in Kenya?

Yes, especially in Nairobi and Mombasa where demand outpaces supply.

Conclusion

The market trends in real estate in Kenya show a dynamic and evolving sector influenced by technology, regulation, and shifting buyer preferences. From affordable housing and REITs to land banking and digital platforms, there are multiple ways to participate in Kenya’s growing property economy.

By understanding these trends and aligning your strategy accordingly, you can make smarter investment decisions and build lasting wealth through real estate.