Kenya’s real estate market continues to grow, driven by urbanization, infrastructure expansion, and increasing demand for both residential and commercial properties. Whether you’re a local investor or an expatriate looking for opportunities, knowing the best places to invest in real estate in Kenya can help you maximize returns and minimize risk.

In this guide, we’ll explore:

- The most promising locations for investment

- Property types and expected ROI

- Why these areas are growing fast

- And tips for verifying land ownership

🧭 How to Choose the Right Location for Real Estate Investment

Before exploring specific regions, here’s how to evaluate a location:

| Factor | Why It Matters |

|---|---|

| Infrastructure Development | Roads, railways, and utilities increase land value |

| Government Projects | Affordable housing and tech city plans attract buyers |

| Urbanization Rate | High population growth = higher demand |

| Market Trends | Rising property prices and rental yields indicate profitability |

| Accessibility & Amenities | Proximity to schools, hospitals, and transport boosts appeal |

📌 Always conduct title verification through a licensed lawyer before investing.

📍 Top 10 Best Places to Invest in Real Estate in Kenya (2025 Picks)

Here are the top locations where property investors are seeing strong returns:

| Location | Property Type | Annual Appreciation |

|---|---|---|

| Ruiru | Affordable Homes | 10% – 15% |

| Naivasha | Land Banking | 10% – 20% |

| Athi River | Industrial & Residential Land | 10% – 18% |

| Lavington (Nairobi) | Luxury Apartments & Villas | 6% – 9% |

| Kilimani (Nairobi) | Mid-Range Units | 7% – 10% |

| Diani Coast | Beachfront Villas | 8% – 15% |

| Konza Technopolis Zone | Smart City Plots | 12% – 20% |

| Eldoret | Student Housing | 8% – 12% |

| Mtwapa | Coastal Rentals | 7% – 13% |

| Embakasi South | Affordable Housing | 6% – 10% |

🏢 Nairobi Suburbs with Strong Returns

Nairobi remains the top destination for real estate investment—especially in its satellite towns:

1. Ruiru

- Close to Nairobi but more affordable

- Government-backed housing schemes like Umoja Village

- Growing middle-class demand

📌 Expected ROI: 10%–15% annually

2. Ruaka

- Secure gated communities

- Good road access and upcoming water projects

- Popular among families and professionals

📌 Expected ROI: 8%–12% annually

3. Lavington

- Upscale neighborhoods with high-end homes

- Stable appreciation due to limited supply

- Popular with expats and diplomats

📌 Expected ROI: 6%–9% annually

4. Kilimani

- Vibrant lifestyle, close to universities and malls

- High rental demand from young professionals

- Mixed-use developments boosting foot traffic

📌 Expected ROI: 7%–10% annually

🌆 Emerging Urban Centers Outside Nairobi

Several towns are gaining traction as smart investment options:

5. Naivasha

- Strategic location along the Mombasa Road and SGR line

- Tourism and agriculture drive demand

- Land prices still relatively low

📌 Expected ROI: 10%–20% over 5 years

6. Athi River

- Logistics and industrial hub near Jomo Kenyatta International Airport

- Government infrastructure upgrades in progress

- Affordable land plots available

📌 Expected ROI: 10%–18% over 5 years

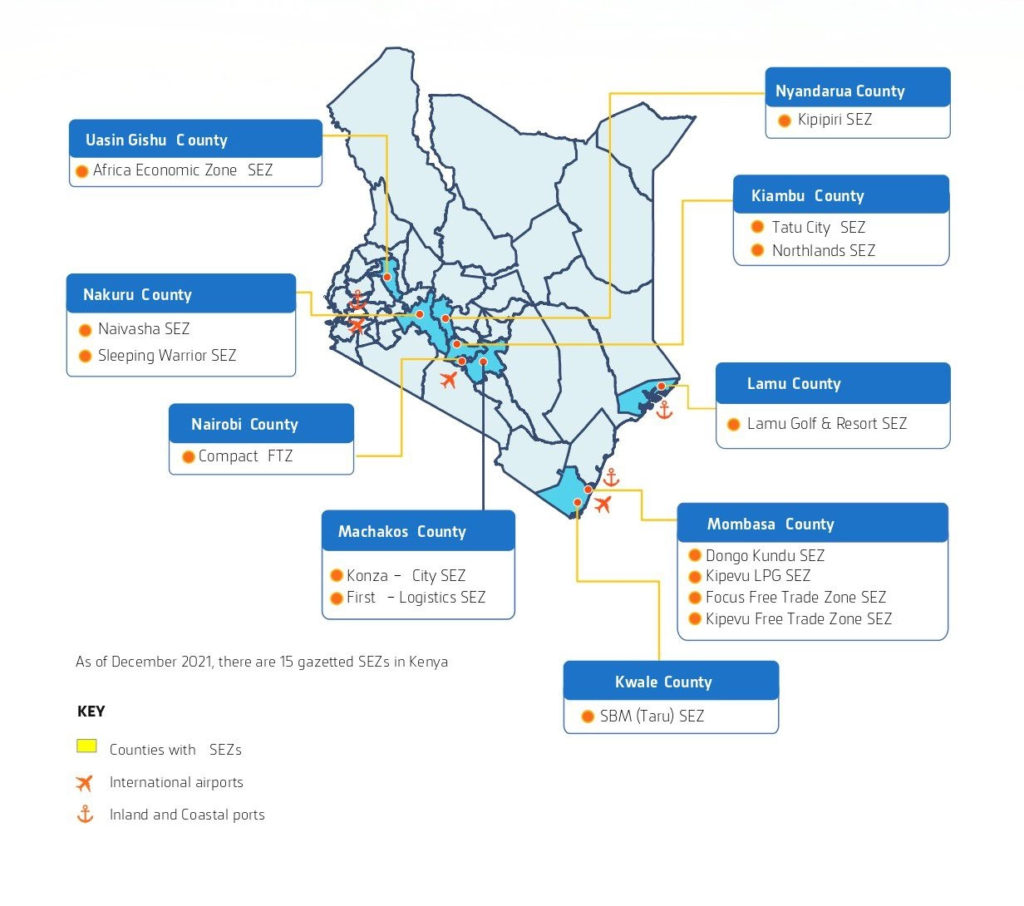

7. Konza Technopolis Zone

- Kenya’s first smart city project

- Tech-focused with government support

- Limited land supply = rising prices

📌 Expected ROI: 12%–20% over 5 years

🌊 Coastal Towns with High Rental Yields

The Kenyan coast is a hotspot for short-term rentals and lifestyle investments:

8. Diani

- Tourist-friendly area with high occupancy rates

- Short-term rentals via Airbnb yield 8%–15% annually

- Demand stays strong year-round

📌 Ideal for expatriates and remote workers seeking passive income.

📊 Comparison Table: Investment Zones & Returns

| Area | Property Type | Entry Cost Range | ROI (Annual) |

|---|---|---|---|

| Ruiru | Affordable Apartment | KES 2.5M – KES 4M | 10% – 15% |

| Lavington | Luxury Villa | KES 10M – KES 20M | 6% – 9% |

| Naivasha | Land Banking | KES 500K – KES 1M per plot | 10% – 20% |

| Diani | Coastal Villa | KES 8M – KES 15M | 8% – 15% |

| Konza | Smart City Plot | KES 500K – KES 1.5M per plot | 12% – 20% |

📈 These figures make Kenya one of the most attractive real estate markets in East Africa.

🧾 How to Invest Wisely in These Areas

Here are key steps to protect your investment:

- Work with ISK-Certified Agents

- Ensures legal compliance and transparency

- Verify Title Deeds

- Hire a licensed surveyor and advocate

- Use Digital Platforms

- Zameen Africa, Property24 Kenya, and Jengo Real Estate offer verified listings

- Explore Crowdfunding & REITs

- For hands-off investment in prime locations

- Consider Future Infrastructure Plans

- Research road expansions, railway lines, and tech city development

📌 Tip: Focus on areas with clear zoning laws and upcoming transport links.

🚨 Common Risks to Avoid When Investing

While Kenya offers great opportunities, some risks include:

| Risk | Explanation |

|---|---|

| Land Fraud | Fake title deeds and unlicensed agents remain a concern |

| Construction Delays | Some developers take longer than expected to complete projects |

| Market Saturation | Nairobi CBD and Karen face oversupply in certain segments |

| Unregulated Platforms | Not all online listing sites are trustworthy |

| Legal Delays | Title verification can take months if not handled properly |

📌 Solution: Always work with certified professionals and use trusted platforms.

📈 Emerging Trends That Make These Areas Profitable

Several trends are shaping investment decisions in 2025:

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract institutional investment |

| Green Building Initiatives | Eco-friendly developments command premium pricing |

| REITs Expansion | Retail investors now access commercial assets |

| Digital Property Platforms | Online tools improve access and reduce fraud |

| Affordable Housing Programs | Government schemes stabilize mid-market prices |

📈 These innovations are making real estate more inclusive and profitable.

Frequently Asked Questions (FAQs)

Q1: What are the best places to invest in real estate in Kenya today?

A1: Nairobi suburbs like Ruiru , Ruaka , and Konza-linked zones offer high appreciation and lower entry costs.

Q2: Can foreigners buy property in Kenya?

A2: Foreigners cannot own freehold land but can lease land for up to 99 years through legal agreements.

Q3: Is it safe to invest in land in Kenya?

A3: Yes—if you conduct proper title verification and work with certified professionals.

Q4: Are there REITs in Kenya?

A4: Yes, Kenya launched its first REIT in 2020—offering small investors access to income-generating commercial properties.

Q5: How do I verify land ownership in Kenya?

A5: Hire a licensed land surveyor and advocate to check title deeds at the Registrar of Titles .