The Kenyan real estate market is undergoing a major transformation. With rapid urbanization, government support for affordable housing, and the rise of technology-driven solutions , the sector is evolving faster than ever before.

In 2025, emerging trends in real estate in Kenya are reshaping how people buy, sell, rent, and invest in property. Whether you’re an investor, developer, or homebuyer, staying ahead of these trends can help you make smarter decisions.

In this blog post, we’ll explore:

- The most impactful real estate trends shaping Kenya

- How they’re affecting buyers, sellers, and investors

- And what to expect in the near future

Let’s dive in!

🔥 Top 10 Emerging Trends in Real Estate in Kenya (2025)

Here are the most impactful trends currently shaping Kenya’s property market:

1. Smart Cities & Master-Planned Urban Developments

What’s Happening:

Cities like Tatu City , Konza Technopolis , and Ruiru Smart City are being developed as fully integrated urban centers with residential, commercial, and recreational zones.

Why It Matters:

- Offers self-sustaining communities with modern infrastructure

- Attracts both local and foreign investors

- Supports job creation and economic growth

2. Green Building & Sustainable Development

What’s Happening:

More developers are adopting eco-friendly materials, energy-efficient designs, and sustainable construction practices.

Why It Matters:

- Reduces environmental impact

- Lowers utility costs for residents

- Meets global sustainability standards (e.g., LEED certification)

📌 Example: Kingsight Heights in Karen uses modular and energy-saving technologies.

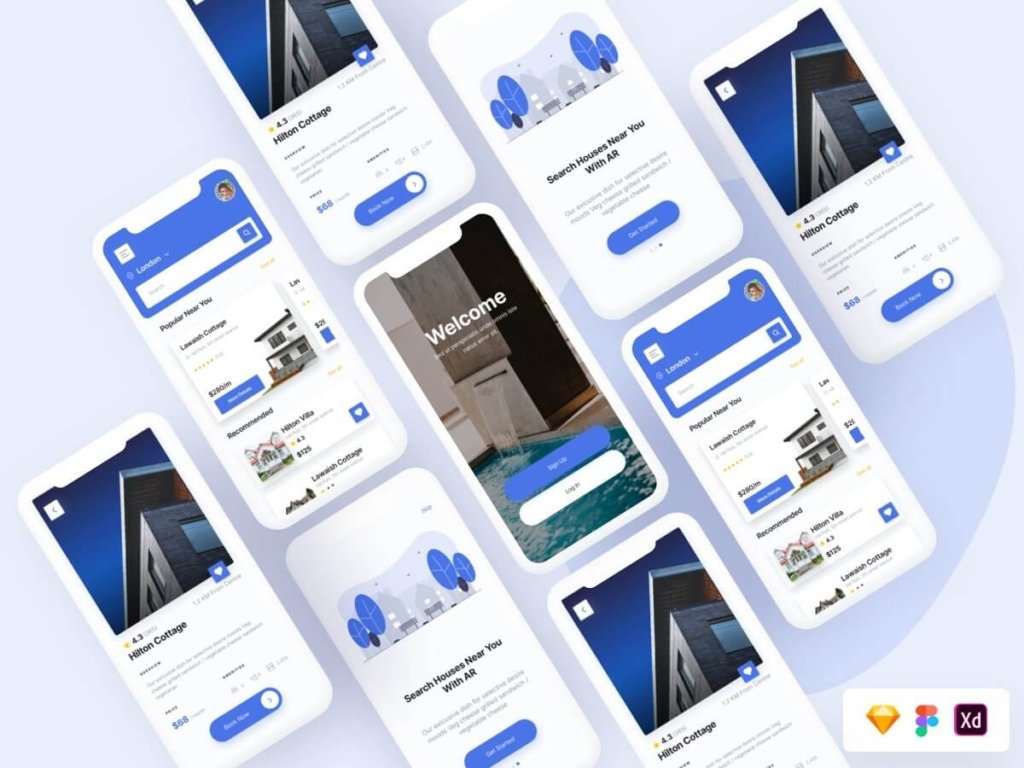

3. Digital Platforms & Online Property Listings

What’s Happening:

Websites and apps like Zameen Africa , Property24 Kenya , and Jengo Real Estate have made it easier than ever to search, compare, and invest in property from anywhere.

Why It Matters:

- Increases transparency and accessibility

- Speeds up the buying/selling process

- Enables virtual tours and remote transactions

4. Real Estate Crowdfunding & Fractional Ownership

What’s Happening:

Platforms like Zamara Africa and Eneza Investments allow small investors to pool funds and own shares in real estate projects.

Why It Matters:

- Low entry barrier—start with as little as KES 50,000

- Diversifies investment risk

- Democratizes access to prime properties

📌 Expected ROI: 8–15% annually depending on project type.

5. Affordable Housing Programs & Government Partnerships

What’s Happening:

The government continues to push forward with its Big Four Agenda , partnering with SACCOs, banks, and private developers to deliver affordable homes .

Why It Matters:

- Addresses housing deficit (estimated at over 2 million units)

- Encourages mortgage financing and long-term homeownership

- Makes property ownership accessible to middle-income earners

📌 Key Developers: Home Afrika, Jamii Bora Housing, Stima Housing

6. REITs (Real Estate Investment Trusts)

What’s Happening:

Kenya launched its first REIT in 2020, opening the door for small investors to earn income from income-generating commercial properties like malls and office towers.

Why It Matters:

- Allows retail investors to participate in large-scale real estate

- Offers regular returns through dividends

- Provides liquidity compared to traditional property investment

📌 Look out for more REIT launches in 2025 by firms like Centum and Britam.

7. Remote Property Management & Virtual Leasing

What’s Happening:

With increased internet penetration, landlords and property managers now use digital tools to manage rentals, collect payments, and conduct virtual inspections.

Why It Matters:

- Saves time and reduces physical visits

- Appeals to expatriates and overseas investors

- Enhances tenant experience through mobile apps and chatbots

📌 Tools used: PropTech platforms, WhatsApp, Google Workspace, and SMS alerts.

8. Land Banking in Emerging Areas

What’s Happening:

Investors are increasingly purchasing land in areas like Naivasha , Athi River , and Konza-linked zones before prices rise.

Why It Matters:

- Land appreciation rates range from 10–20% annually

- Strategic locations benefit from upcoming infrastructure projects

- Lower initial investment compared to built properties

📌 Tip: Always verify title deeds before investing.

9. Co-Living Spaces & Shared Housing Models

What’s Happening:

To meet demand from young professionals and students, co-living spaces offering shared amenities, flexible leases, and tech-enabled management are rising in popularity.

Why It Matters:

- Affordable option for millennials and remote workers

- High occupancy and rental yields

- Combines convenience with modern design

📌 Popular in areas like Kilimani, Westlands, and Eldoret.

10. Mixed-Use Developments

What’s Happening:

Developers are building complexes that combine residential, retail, and office space in one location—especially around Nairobi’s growth corridors.

Why It Matters:

- Promotes walkability and convenience

- Maximizes land use in high-density areas

- Boosts commercial foot traffic and rental income

📌 Examples: Garden City Mall, Two Rivers Mall, ABC Place

📊 Comparison Table: Real Estate Trends & Their Impact

| Trend | Impact | Growth Potential |

|---|---|---|

| Smart Cities | Improved urban planning and infrastructure | High |

| Green Buildings | Eco-friendly living and cost savings | Medium-High |

| Digital Platforms | Easier access and faster transactions | High |

| Crowdfunding | Inclusive investment opportunities | Medium |

| Affordable Housing | Broader homeownership access | High |

| REITs | Passive income for small investors | Medium-High |

| Remote Property Management | Efficient operations and tenant engagement | Medium |

| Land Banking | High appreciation potential | High |

| Co-Living Spaces | Affordable options for youth and expats | Medium |

| Mixed-Use Projects | Higher ROI and space efficiency | High |

🏗️ Key Locations Benefiting from These Trends

Several regions are seeing rapid change due to these trends:

| Location | Trend Driving Growth |

|---|---|

| Nairobi (Karen, Lavington, Ruiru) | Smart cities, mixed-use, and REITs |

| Mombasa & Coastal Regions | Tourism-driven real estate, co-living |

| Eldoret | Affordable housing, airport expansion |

| Naivasha | Land banking, logistics hub development |

| Konza Technopolis | Tech city development attracting global tenants |

💰 Return on Investment (ROI) by Trend

| Trend | Average ROI |

|---|---|

| Residential Rentals (Nairobi) | 5% – 8% annually |

| Commercial Properties | 7% – 12% annually |

| Land Banking | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 These figures make Kenya one of the most attractive real estate markets in East Africa.

🚧 Challenges Alongside the Trends

While exciting, these trends also come with challenges:

| Challenge | Explanation |

|---|---|

| Regulatory Gaps | Some new models lack clear legal frameworks |

| Title Verification Risks | Fraudulent deals still exist in crowdfunding and land banking |

| Market Saturation | Nairobi CBD and Karen facing oversupply in certain segments |

| High Entry Costs | Some premium developments remain out of reach for many |

📌 Pro tip: Always work with licensed brokers and legal experts before making big investments.

🎓 New Career Opportunities from Real Estate Trends

These trends are creating fresh job opportunities:

| Role | Skills Required |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| PropTech Developer | Coding, real estate knowledge |

| Green Building Consultant | Architecture, sustainability training |

| Crowdfunding Analyst | Finance, risk assessment |

| Remote Property Manager | CRM tools, customer service |

🎓 Students and career switchers can find roles even without prior experience in some cases.

📈 Future Outlook for the Kenyan Real Estate Sector

With continued investment in infrastructure, digital transformation, and policy support, Kenya’s real estate market is expected to grow steadily over the next decade.

Key drivers include:

- Expansion of Nairobi Expressway and Standard Gauge Railway

- Rise of smart cities and mixed-use developments

- Increased FDI in logistics and tourism

- Growth of digital platforms and crowdfunding models

Now is an excellent time to get involved—whether as a buyer, investor, or professional.

🧾 Conclusion

Kenya’s real estate market is no longer just about bricks and mortar—it’s about innovation, sustainability, and digital transformation.

From smart cities and green buildings to crowdfunding and remote property management , the emerging trends in real estate in Kenya are opening doors for a wider audience of investors, developers, and homebuyers.

Understanding these trends gives you a competitive edge—whether you’re buying your first home, starting a business, or exploring investment opportunities.

Stay informed, stay ahead, and unlock your potential in Kenya’s booming real estate market.

❓ Frequently Asked Questions (FAQs)

Q1: What are the biggest real estate trends in Kenya today?

A: The top trends include smart cities, green buildings, digital platforms, crowdfunding, and REITs.

Q2: Is real estate in Kenya a good investment in 2025?

A: Yes, especially in emerging areas like Naivasha, Konza, and Eldoret.

Q3: Can I invest in real estate with small capital in Kenya?

A: Yes! Through crowdfunding platforms like Zamara Africa and Eneza Investments.

Q4: Are there REITs available in Kenya?

A: Yes, Kenya launched its first REIT in 2020—more are expected soon.

Q5: How do I start a career in real estate with no experience?

A: Consider entry-level roles like sales agent, marketing assistant, or field officer.