Understanding the cost of real estate in Kenya is essential whether you’re buying your first home, investing in rental property, or developing land. Property prices vary widely depending on location, type, and market conditions — making it crucial to research before committing funds.

In this guide, you’ll learn:

- Current property price trends (2025)

- How much land costs across major cities

- Affordable vs luxury housing options

- Additional costs like legal fees and stamp duty

- Tips to invest wisely based on your budget

What Determines the Cost of Real Estate in Kenya?

Several factors influence how much real estate costs in Kenya:

- Location: Urban centers like Nairobi and Mombasa command higher prices than rural areas

- Property Type: Apartments, townhouses, villas, and commercial spaces all have different value ranges

- Infrastructure Development: Proximity to roads, schools, hospitals, and transport hubs increases demand

- Government Housing Schemes: Affordable homes are available through the Affordable Housing Program

- Market Trends: Demand from locals, expatriates, and investors affects pricing

These elements determine whether a property is affordable, mid-range, or premium.

Average Property Prices in Nairobi

Nairobi remains the most developed and expensive real estate market in Kenya.

Typical Price Ranges:

- Studio Apartment in Kilimani: KES 2 million – KES 3.5 million

- 2-Bedroom Apartment in Westlands: KES 6 million – KES 10 million

- 4-Bedroom Villa in Karen: KES 30 million – KES 70 million

- Gated Townhouse in Lavington: KES 15 million – KES 30 million

- Luxury Home in Runda: KES 80 million – over KES 100 million

Prices depend on amenities, security, and access to major roads and business districts.

Property Costs in Mombasa

Mombasa’s coastal appeal makes it a hotspot for both local and international buyers.

Common Property Values:

- Serviced Apartment in Nyali: KES 4 million – KES 8 million

- Beachfront Villa in Bamburi: KES 15 million – KES 50 million

- 3-Bedroom House in Mtwapa: KES 10 million – KES 25 million

Properties near the beach or within gated communities attract higher prices due to lifestyle and tourism demand.

Real Estate Prices in Kisumu

As Kenya’s third-largest city, Kisumu offers more affordable options compared to Nairobi and Mombasa.

Sample Price Range:

- 2-Bedroom Apartment in Central Kisumu: KES 2.5 million – KES 4 million

- 3-Bedroom House in Nyamasaria: KES 5 million – KES 9 million

Kisumu is ideal for budget-conscious buyers and investors seeking growth potential.

Land Costs Across Major Towns

Land remains one of the most popular investments due to its appreciation potential and relatively low maintenance.

Estimated Land Prices Per Acre (2025):

- Nairobi (Kilimani): KES 20 million – KES 40 million

- Mombasa (Nyali): KES 15 million – KES 30 million

- Kisumu: KES 5 million – KES 10 million

- Thika: KES 4 million – KES 8 million

- Ruiru: KES 6 million – KES 12 million

- Limuru: KES 3 million – KES 7 million

Land banking in emerging areas can be a smart long-term investment strategy.

Affordable Real Estate Options in Kenya

You don’t need a large budget to get started in real estate. Several developments offer accessible entry points.

Budget-Friendly Developments:

- Mkopo Rahisi Housing Scheme – Homes priced between KES 1.5 million and KES 3 million

- Jamii Bora Housing – Affordable units in Nairobi and Mombasa

- Mastermind Villas – Cost-effective homes along Thika Road

Satellite towns such as Thika, Ruiru, and Mlolongo also provide attractive options with strong future growth potential.

Luxury Real Estate Pricing in Kenya

For high-net-worth individuals and expatriates, Kenya offers premium properties in upscale neighborhoods.

Luxury Home Ranges:

- Karen and Lavington (Nairobi) – Upscale residences selling from KES 20 million

- Nyali and Bamburi (Mombasa) – Beachfront properties starting at KES 15 million

- Runda (Nairobi) – Exclusive gated estates valued at KES 80 million and above

These properties often come with private pools, landscaped gardens, and proximity to diplomatic zones.

Rental Market and Returns

If you’re investing for income, rental returns depend on location and property type.

Monthly Rent Estimates:

- Westlands (Nairobi): Studio apartments rent for KES 15,000/month

- Nyali (Mombasa): 2-bedroom apartments fetch KES 30,000 – KES 50,000/month

- Nyawawa (Kisumu): Single rooms let for KES 5,000 – KES 8,000/month

- Thika Road Corridor: 3-bedroom houses rent for KES 20,000 – KES 35,000/month

Well-located properties offer annual returns between 4% and 8%, making real estate a reliable source of passive income.

Additional Costs When Buying Property

Buying property involves more than just the listed price — always factor in these extra expenses:

Common Additional Costs:

- Stamp Duty: Typically 1% to 4% based on property use

- Legal Fees: Between KES 30,000 and KES 100,000

- Valuation and Survey Fees: From KES 15,000 to KES 50,000

- Registration and Transfer Fees: Vary by property type and location

Understanding these costs helps you plan better and avoid unexpected financial strain.

How to Invest Smartly Based on Your Budget

Whether you’re buying for personal use or investment, your approach should match your financial capacity.

Strategies for Different Budgets:

- Low Budget: Focus on single rooms, shared housing, or land in emerging towns

- Mid Budget: Consider 2–3 bedroom apartments in satellite towns or mid-tier Nairobi neighborhoods

- High Budget: Invest in Nairobi’s upscale areas or coastal luxury homes

Always conduct due diligence, work with licensed agents, and verify title deeds before purchasing.

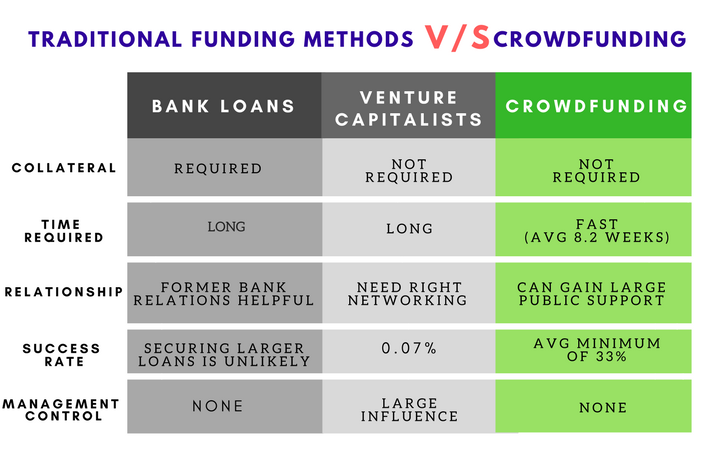

Financing Real Estate in Kenya

Several financing options make it easier to buy property even if you’re starting small.

Popular Methods:

- Bank Mortgages – Offered by Housing Finance Bank, Co-operative Bank, and Stanbic

- Affordable Housing Scheme – Government-backed loans for low- to mid-income earners

- Joint Ventures – Pool funds with friends or family

- Crowdfunding Platforms – Jamii Housing allows group investments

- Personal Savings – Ideal for small-scale investors who want full control

Most banks require a minimum down payment of 10%–30% and proof of stable income.

Frequently Asked Questions

How much does a house cost in Kenya?

It varies by location and size:

- Affordable units: KES 1.5 million – KES 4 million

- Mid-range homes: KES 5 million – KES 15 million

- Luxury properties: KES 20 million – over KES 100 million

Can foreigners buy property in Kenya?

Foreigners cannot own land on a freehold basis but can lease property for up to 99 years.

Is real estate a good investment in Kenya?

Yes, especially in well-connected areas where property values and rental yields are rising steadily.

Conclusion

The cost of real estate in Kenya varies significantly by location, property type, and market trends. Whether you’re buying your first studio apartment or investing in luxury homes and land, knowing how much to expect helps you make informed decisions and maximize returns.

By focusing on the right locations, understanding market dynamics, and planning your budget carefully, you can build wealth through real estate in Kenya — whether through rentals, resale, or long-term appreciation.