Kenya’s real estate market offers growing opportunities for both local and international investors. With rising urbanization, infrastructure development, and government-backed housing programs, how to start investing in real estate in Kenya has never been more accessible—even with small capital.

Whether you’re a first-time investor or looking to diversify your portfolio, this guide will walk you through:

- The best investment options

- Top locations for growth

- Legal steps to buy or lease

- And tips for avoiding fraud

Let’s get started!

🧭 Step-by-Step Guide: How to Invest in Real Estate in Kenya

Here’s how to begin your journey into real estate investment:

Step 1: Define Your Investment Goals

Ask yourself:

- Are you seeking passive income , capital appreciation , or both?

- Do you prefer residential rentals , land banking , or commercial property ?

📌 Clear goals help determine what type of property and location suits you best.

Step 2: Choose the Right Property Type

| Option | Best For |

|---|---|

| Residential Rentals | Monthly income from apartments or townhouses |

| Commercial Leases | Long-term rental contracts with businesses |

| Land Banking | Future value growth in emerging areas like Konza or Naivasha |

| Coastal Villas | Tourism-driven short-term rentals |

| Crowdfunding Projects | Small investors seeking shared ownership |

| REITs | Passive income via shares in commercial buildings |

📌 Each option comes with different entry costs and risk levels.

Step 3: Research Locations & Market Trends

Here are some of the most promising investment zones:

| Location | Highlights |

|---|---|

| Lavington (Nairobi) | Upscale developments with strong resale value |

| Kilimani (Nairobi) | Vibrant community and proximity to tech hubs |

| Ruiru | Affordable housing boom near Nairobi |

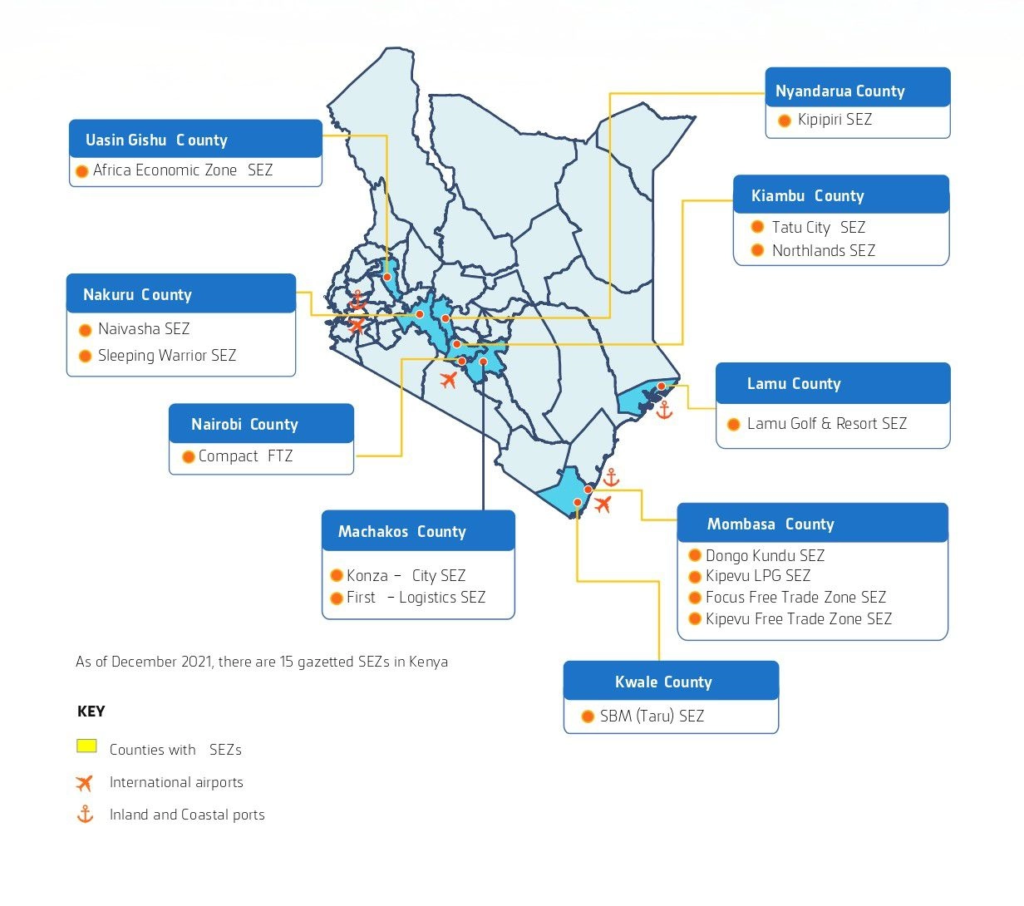

| Naivasha | Strategic transport links and land banking |

| Diani Coast | Expatriate buyers and seasonal tourism |

| Eldoret | Student population drives rental demand |

| Konza Technopolis Zone | Tech city development attracting global tenants |

📌 Emerging areas often offer better ROI than saturated Nairobi CBD.

Step 4: Set a Budget & Source Funding

Common Financing Options:

- Personal Savings

- SACCO Loans (e.g., Jamii Bora, Stima Housing)

- Bank Mortgages (offered by HF, Co-op Bank, NCBA)

- Crowdfunding Platforms (Zamara Africa, Eneza Investments)

- REITs (Centum REIT)

📌 Tip: Some SACCOs allow members to access low-interest loans for home purchase or land investment.

Step 5: Research Listings Online

Use these platforms to find verified property:

| Platform | Features |

|---|---|

| Buy Kenya | Updated listings, maps, agent connections |

| Property24 Kenya | Verified ads, mortgage guides, price filters |

| Jengo Real Estate | Digital listings and remote transactions |

| LinkedIn Networking | Connect with agents and developers |

| Local SACCOs & Co-operatives | Affordable housing schemes and community-based financing |

📌 Set alerts for keywords like “land for sale Nairobi” or “apartment for sale Karen”.

Step 6: Conduct Title Verification

Always verify ownership before making any payments:

What You Need:

- Hire a licensed surveyor and advocate

- Visit the Registrar of Titles or use digital verification tools

- Request a search of the title deed

- Confirm no encumbrances (mortgages, disputes)

📌 Never skip this step—it protects you from fraud and double selling.

Step 7: Select an Investment Model

Choose between:

- Direct ownership

- Land banking

- Crowdfunding platforms

- REITs (Real Estate Investment Trusts)

- Off-plan developer purchases

📌 Each model suits different budgets and investment goals.

Step 8: Make Your Investment

Once verified, proceed with your transaction:

- Pay deposit via escrow or bank transfer

- Sign a formal agreement

- Complete legal documentation with your lawyer

📌 Always keep copies of all paperwork for future reference.

📊 Expected Returns by Investment Type

| Investment Type | Avg. Annual Return |

|---|---|

| Residential Rentals | 5% – 8% |

| Commercial Properties | 7% – 12% |

| Land Banking | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 Nairobi outskirts and coastal regions tend to deliver the highest returns.

🏢 Top Platforms & Companies for Real Estate Investment

| Company | Investment Type | Minimum Entry Point |

|---|---|---|

| Zamara Africa | Crowdfunding | KES 50,000 |

| Eneza Investments | Digital real estate | KES 50,000 |

| Jengo Invest | Fractional ownership deals | KES 50,000 |

| CIC Asset Management | Mutual fund investments | KES 10,000 |

| Sanlam Kenya | Property unit trusts | KES 10,000 |

| Genghis Capital | Property investment funds | KES 50,000 |

| Home Afrika Limited | Affordable housing schemes | Varies by plot size |

| Jamii Bora Housing Ltd | SACCO-linked housing | SACCO membership required |

| Stima Housing Limited | Community-based housing | Varies by member contribution |

| Centum REIT | Income-generating commercial property | KES 100,000+ |

📌 These firms provide structured ways to invest—even if you’re just starting out.

🚨 Common Scams to Avoid When Investing

Here are the top risks and how to prevent them:

| Risk | How to Avoid It |

|---|---|

| Fake Title Deeds | Always conduct due diligence through a licensed lawyer or surveyor |

| Double Selling | Verify that the seller is the sole owner |

| Unlicensed Agents | Use only ISK-certified brokers |

| Phony Developers | Research company background and past projects |

| Off-Plan Scams | Check for developer licensing and project approvals |

📌 Pro tip: Work with certified professionals and consult with a lawyer before signing any deal.

📈 Emerging Trends That Impact Investment Decisions

| Trend | Effect on Market |

|---|---|

| Smart Cities Development | Tatu City and Konza attract long-term investment |

| Green Building Initiatives | Eco-friendly developments gain traction |

| Digital Platforms | Online listing sites improve access and transparency |

| REITs in Kenya | First launched in 2020—more expected soon |

| Affordable Housing Expansion | Government-backed programs reaching new investors |

📈 These trends are reshaping how property is bought, sold, and managed in Kenya.

📉 Challenges Facing New Investors

While the potential is high, there are still hurdles:

| Challenge | Explanation |

|---|---|

| High Construction Costs | Inflation raises material prices |

| Slow Legal Processes | Registration can take months |

| Market Saturation in Nairobi CBD | Oversupply affects ROI |

| Limited Financing Options | Mortgages remain expensive for many |

| Title Verification Delays | Legal processes slow down transactions |

📌 Solution: Focus on emerging zones and work with certified professionals.

🎓 Career Opportunities in Real Estate Investment

If you’re interested in working in real estate, here are popular roles:

| Role | Skills Required |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Real Estate Developer | Project management, finance, planning |

| PropTech Developer | Coding, data analysis, real estate knowledge |

| Property Manager | Customer service, CRM tools, maintenance coordination |

🎓 Many students enter the field after graduation from institutions like University of Nairobi and JKUAT.

🧾 Conclusion

Starting to invest in real estate in Kenya is more accessible than ever—thanks to crowdfunding, REITs, digital platforms, and affordable housing schemes.

From residential rentals in Ruiru to land banking in Naivasha and coastal villas in Diani, there’s something for every investor.

Now is the perfect time to research your options—and unlock your potential in one of East Africa’s fastest-growing economies.

❓ Frequently Asked Questions (FAQs)

Q1: Can I invest in real estate in Kenya with KES 100,000 or less?

A: Yes! Crowdfunding platforms like Zamara Africa and Eneza Investments accept small contributions.

Q2: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q3: Can foreigners invest in Kenyan real estate?

A: Yes—through leasehold arrangements, crowdfunding, or REITs.

Q4: Are there REITs in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial properties.

Q5: Do I need a license to invest in real estate in Kenya?

A: No license needed for investors—but always work with ISK-certified agents and legal experts.