Are you new to real estate investing in Kenya? You’re not alone. Many Kenyans—from first-time buyers to expatriates—are discovering the benefits of investing in property, whether it’s for passive income , capital appreciation , or retirement planning .

This beginner’s guide will walk you through:

- The basics of real estate investment

- Types of properties available

- How to start with small capital

- And tips for avoiding fraud

Let’s dive in!

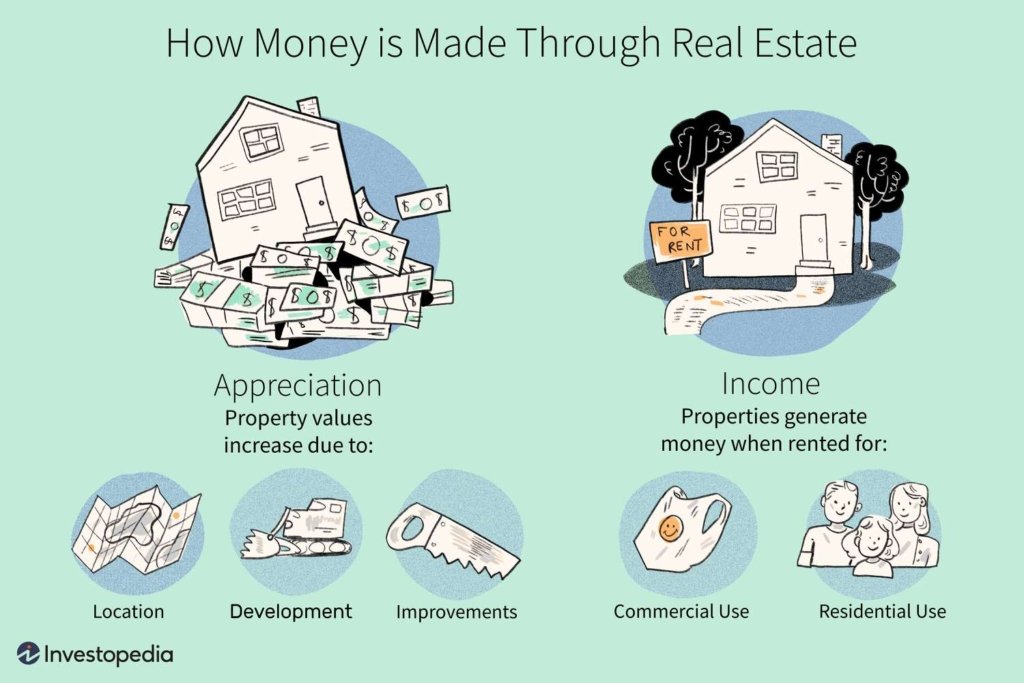

🧭 Step 1: Understand What Real Estate Investment Means

Real estate investment involves buying, owning, and managing property to generate returns through:

| Income Source | Description |

|---|---|

| Rentals | Earn monthly income by leasing out apartments or land |

| Resale | Buy property at a lower price and sell when value rises |

| Land Banking | Purchase undeveloped plots and hold until infrastructure increases value |

📌 It doesn’t always require large sums—especially with crowdfunding platforms now available.

📌 Step 2: Decide on Your Investment Type

Here are your options as a beginner:

Option 1: Direct Property Ownership

- Buy an apartment, townhouse, or land plot

- Rent it out or sell later at a higher value

📌 Best for those with KES 2M+ and interest in hands-on management.

Option 2: Land Banking

- Buy undeveloped land in growth areas like Naivasha , Athi River , or Konza-linked zones

- Hold until value increases (10%–20% annually)

📌 Ideal for long-term gains and requires less maintenance than buildings.

Option 3: Crowdfunding Platforms

- Invest through online platforms like Zamara Africa or Eneza Investments

- Contribute as little as KES 50,000 to fund development projects

📌 Returns range between 8%–14% annually , depending on project type.

Option 4: REITs (Real Estate Investment Trusts)

- Buy shares in commercial property funds like Centum REIT

- Earn dividends without owning physical property

📌 Minimum investment starts at KES 100,000 .

Option 5: SACCO-Based Housing Schemes

- Join SACCOs offering housing programs with flexible payment plans

- Build equity over time through regular contributions

📌 Popular schemes include Stima Housing and Jamii Bora Nyumba Yetu .

📍 Step 3: Choose the Right Location

Some areas offer better returns and growth potential than others:

| Location | Why It’s Hot |

|---|---|

| Karen | High-value homes and strong resale market |

| Kilimani | Vibrant community and proximity to amenities |

| Ruaka | Affordable housing boom near Nairobi |

| Athi River | Strategic transport links and land banking |

| Diani | Tourism-driven short-term rental yields |

📌 Pro tip: Look for areas where infrastructure is being developed —like roads, rail, or malls.

💰 Step 4: Set a Budget & Source Funds

Here’s how much you might need to start:

| Investment Type | Minimum Amount |

|---|---|

| Residential Apartment | KES 2M – KES 6M |

| Land Plot (50x100ft) | KES 500K – KES 1.5M |

| Crowdfunding Project | KES 50K – KES 200K |

| REIT Shares | KES 100K+ |

| SACCO Housing Scheme | Varies by member contribution plan |

📌 Consider starting small with crowdfunding or land banking before moving into full ownership.

📊 Step 5: Research Listings Online

Use these platforms to find verified real estate opportunities:

| Platform | Features |

|---|---|

| Buykenya.com | Updated listings, maps, agent connections |

| Property24 Kenya | Verified ads, mortgage guides, price filters |

| Jengo Real Estate | Digital listings and remote transactions |

| Facebook Marketplace | Direct seller connections |

| LinkedIn Networking | Connect with agents and developers |

📌 Tip: Use search filters like “For Sale” and set up email alerts for keywords like “land for sale Nairobi”.

⚖️ Step 6: Conduct Due Diligence Before Buying

Before making any investment, verify:

| Document | Purpose |

|---|---|

| Title Deed | Confirms ownership and prevents fraud |

| NOC (No Objection Certificate) | From developer or landlord if applicable |

| Surveyor Report | Verifies boundaries and size |

| Advocate Confirmation | Ensures no legal disputes or mortgages |

| Zoning Permit | Confirms land can be used for residential or commercial purposes |

📌 Never skip title verification—it protects you from fraud and double selling.

🧑💼 Step 7: Work With Licensed Professionals

Always use certified help:

| Professional | Role |

|---|---|

| Buykenya.com | Helps source and negotiate deals |

| Licensed Surveyor | Confirms land size and boundary |

| Certified Advocate | Handles legal paperwork and title verification |

| Property Manager (Optional) | Manages rentals and tenant relations |

📌 Working with licensed experts ensures a smoother and safer investment process.

🏢 Step 8: Choose an Investment Model That Fits You

Here’s how different models suit various budgets:

| Investment Type | Risk Level | Time Commitment | Entry Point |

|---|---|---|---|

| Residential Rentals | Low-Medium | Medium | KES 2M+ |

| Commercial Property | Medium-High | High | KES 5M+ |

| Land Banking | Medium | Low | KES 500K – KES 2M |

| Crowdfunding | Low | Low | KES 50K+ |

| REITs | Low | Very Low | KES 100K+ |

📌 Start with what you can afford—and scale over time.

📋 Step 9: Make Your Investment

Once you’ve chosen your model, here’s how to proceed:

For Direct Property Buyers:

- Visit the property in person

- Agree on price and terms

- Sign agreement and pay deposit

- Complete legal transfer through a licensed advocate

For Crowdfunding Investors:

- Register on platforms like Zamara Africa or Eneza Investments

- Browse available projects

- Select one and make payment via M-Pesa or bank transfer

- Track progress and receive returns upon completion

📌 Always keep copies of all documentation.

📉 Step 10: Monitor Your Investment

Depending on your model:

| Strategy | Monitoring Method |

|---|---|

| Residential Rentals | Monthly rent reports, maintenance logs |

| Land Banking | Title deed updates, valuation checks |

| Crowdfunding Projects | Dashboard access, SMS/email updates |

| REITs | Dividend statements and asset performance reports |

📌 Some investors use digital tools like WhatsApp and Google Workspace for property tracking.

📊 Expected Returns for Beginner Investors

| Investment Type | Avg. Annual Return |

|---|---|

| Residential Rentals | 5% – 8% |

| Coastal Villas | 8% – 15% |

| Land Banking (Naivasha) | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 These figures make Kenya one of the most attractive real estate markets in East Africa.

🚨 Common Scams to Avoid as a Beginner

Here’s how to protect yourself:

| Scam Type | How to Avoid It |

|---|---|

| Fake Title Deeds | Always conduct due diligence through a licensed lawyer or surveyor |

| Double Selling | Verify that the seller is the sole owner |

| Unlicensed Agents | Use only ISK-certified brokers |

| Phony Developers | Research company background and past projects |

| Fraudulent Payments | Use escrow services or verified payment plans |

📌 Pro tip: Never pay large sums upfront without verified documentation.

📈 Emerging Trends for New Investors

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract beginner-friendly land investments |

| Green Building Initiatives | Eco-friendly developments gain traction |

| Mobile-Based Transactions | Faster deal closures via WhatsApp and mobile banking |

| Affordable Housing Programs | Government-backed schemes reaching new buyers |

| Digital Platforms | Online listing sites improve access and transparency |

📈 These trends are reshaping how beginners enter the market.

🎓 Career Opportunities After Investing

If you want to grow beyond personal investment, consider becoming:

| Role | Skills Required |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Property Manager | Tenant relations, maintenance coordination |

| Customer Support Executive | Excellent verbal and written communication |

| Marketing Officer | Social media, CRM tools, content creation |

🎓 Many students begin with part-time roles before advancing into leadership positions.

🧾 Conclusion

Learning how to invest in real estate in Kenya for beginners is more accessible than ever—thanks to digital platforms, affordable housing schemes, and smart investment models like crowdfunding and REITs.

From residential rentals to land banking and crowdfunding , there’s something for every budget and risk profile.

Start researching today—and unlock your future in one of Kenya’s fastest-growing industries.

❓ Frequently Asked Questions (FAQs)

Q1: Can I invest in real estate in Kenya with KES 100,000 or less?

A: Yes! Crowdfunding platforms like Zamara Africa and Eneza Investments accept small contributions.

Q2: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q3: Do I need a license to invest in real estate in Kenya?

A: No license needed for investors—but always work with ISK-certified agents and legal experts.

Q4: Are there REITs in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial properties.

Q5: Can foreigners invest in real estate in Kenya?

A: Yes—foreigners can lease land for up to 99 years or invest via crowdfunding and REITs.