The cost of real estate in Kenya varies widely depending on location, property type, and market trends. Whether you’re buying your first home, investing in land, or looking to rent an apartment, understanding the real estate in Kenya costs helps you make informed decisions.

In this guide, we’ll explore:

- Residential and commercial property prices

- Land costs by region

- Rental rates in Nairobi, Mombasa, and beyond

- Commission, taxes, and hidden expenses

Let’s dive in!

🏡 Residential Property Costs in Kenya (2025 Overview)

Here are current residential property price ranges:

| Property Type | Location | Price Range (KES) |

|---|---|---|

| 3-Bedroom Apartment | Kilimani, Nairobi | 4M – 6M |

| Luxury Villa | Karen, Nairobi | 10M – 20M |

| Affordable House | Ruiru | 2.5M – 4M |

| Gated Community Unit | Kapiti Gardens | 3M – 5M |

| Student Housing | Eldoret | 1.5M – 3M |

📌 Nairobi remains the most expensive—but towns like Ruiru , Ruaka , and Naivasha offer better affordability and appreciation potential.

🌳 Land Costs Across Kenya

Land is one of the most popular investments due to appreciation potential.

| Plot Size | Location | Cost per Plot (KES) |

|---|---|---|

| 50x100ft | Karen | 2M – 4M |

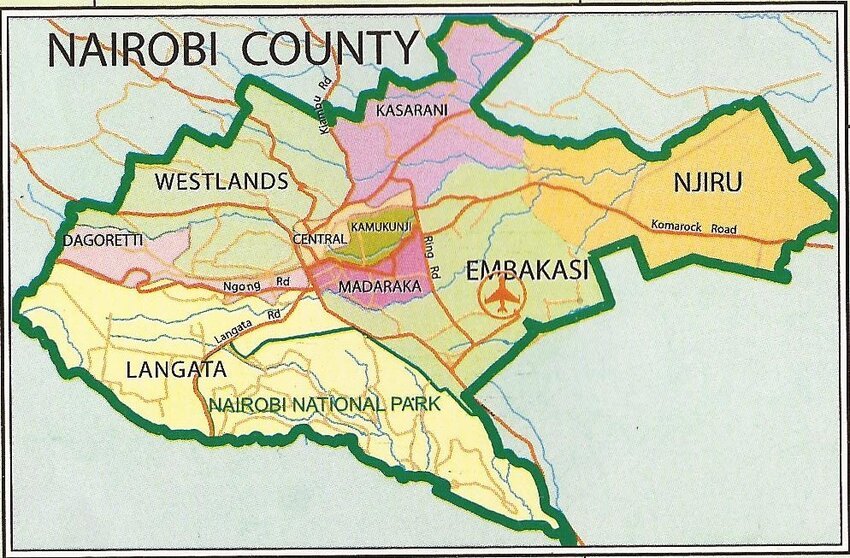

| 50x100ft | Westlands | 1.5M – 3M |

| 50x100ft | Ruiru | 800K – 1.5M |

| 1 Acre | Naivasha | 2M – 4M |

| 1 Acre | Athi River | 3M – 6M |

| 50x100ft | Mlolongo | 600K – 1.2M |

| Coastal Plot (Diani) | Diani Beach | 2M – 10M |

📌 Land banking offers strong returns—especially in Konza-linked zones with infrastructure growth.

📊 Commercial Property Costs in Kenya

Commercial spaces are key for investors seeking long-term leases and higher income.

| Property Type | Location | Price Range (KES) |

|---|---|---|

| Office Space (100 sq.ft.) | Upper Hill, Nairobi | 4M – 8M |

| Retail Shop (50–100 sq.ft.) | Mombasa Road | 1.5M – 3M |

| Warehouse (1,000 sq.ft.) | Industrial Area | 5M – 10M |

| Mall Unit | Garden City | 10M+ |

| 1 Acre of Commercial Land | Athi River | KES 5M – KES 8M |

📌 Commercial properties often generate 7%–12% annual return via rentals.

💰 Rental Market Costs in Kenya

Here’s what tenants can expect to pay monthly:

| Property Type | Location | Monthly Rent (KES) |

|---|---|---|

| Studio Apartment | Kilimani | 20,000 – 30,000 |

| 2-Bedroom Apartment | Westlands | 35,000 – 50,000 |

| 3-Bedroom Townhouse | Karen | 60,000 – 90,000 |

| 1-Bedroom Apartment | Ruiru | 15,000 – 25,000 |

| Coastal Holiday Home (Diani) | Diani Beach | 80,000 – 150,000/month (seasonal variation) |

📌 Expatriates and short-term renters pay premium rates—especially along the coast.

🧾 Hidden Costs of Buying Real Estate in Kenya

When purchasing property, always budget for these additional costs:

| Fee | Description |

|---|---|

| Stamp Duty | 2% for residential, 4% for commercial property |

| Legal Fees | Advocate fees for title verification and transfer |

| Surveyor Fees | Confirming boundaries and plot size |

| Registration Fees | Paid at the Registrar of Titles |

| Agency Commission | 2% – 5% of sale price (if using a licensed agent) |

📌 These costs typically add up to 5%–10% of total purchase value .

🧮 Step-by-Step Breakdown of Total Real Estate Costs

Here’s how much it really costs to buy property in Kenya:

Example: Buying a 3-Bedroom Apartment in Kilimani

| Item | Amount (KES) |

|---|---|

| Property Price | 4,000,000 |

| Stamp Duty (2%) | 80,000 |

| Legal Fees | 50,000 – 100,000 |

| Surveyor Fee | 30,000 – 50,000 |

| Agency Commission (2%) | 80,000 |

| Total Estimated Cost | KES 4.2 million – KES 4.3 million |

📌 Always factor in post-purchase costs like maintenance, insurance, and land rates .

📉 Real Estate Costs by Region (2025 Comparison)

| Area | Avg. Plot Cost (50x100ft) | Annual Growth Rate |

|---|---|---|

| Karen | KES 2.5M – KES 4M | +5% – +7% |

| Kilimani | KES 1.5M – KES 3M | +7% – +9% |

| Ruiru | KES 800K – KES 1.5M | +10% – +12% |

| Naivasha | KES 500K – KES 1M | +10% – +14% |

| Diani Coast | KES 2M – KES 6M | +6% – +10% |

| Mlolongo | KES 600K – KES 1.2M | +9% – +11% |

📌 Emerging areas like Athi River and Naivasha offer lower entry costs and high appreciation.

💸 Ongoing Costs After Buying Property

These are the regular expenses to consider:

| Cost | Description |

|---|---|

| Land Rates | Paid annually to Nairobi City County or Mombasa County |

| Property Insurance | Protects against damage or theft |

| Maintenance Fees | Repairs, painting, landscaping |

| Utility Bills | Water, electricity, internet |

| Property Management Fees | If hiring a third-party manager |

📌 For landlords: Budget for tenant turnover , vacancy periods , and repair costs .

📈 How Much Can You Earn from Real Estate?

| Investment Type | Expected ROI |

|---|---|

| Residential Rentals | 5% – 8% annually |

| Commercial Leases | 7% – 12% annually |

| Land Banking | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 Returns vary based on location and market conditions.

🚨 Common Scams That Add Hidden Costs

Here are costly risks to avoid:

| Scam Type | Financial Impact |

|---|---|

| Fake Title Deeds | Loss of deposit or full investment |

| Double Selling | Paying for a property already sold to someone else |

| Unlicensed Agents | Poor advice and misrepresentation |

| Phony Developers | Fraudulent land deals and fake projects |

| Off-Plan Scams | Construction delays or no delivery |

📌 Always verify titles through a licensed lawyer or surveyor.

🧭 How to Track Real Estate Costs in Kenya

Use these tools to stay updated:

| Tool | Purpose |

|---|---|

| Buy Kenya | Verified listings and pricing |

| Property24 Kenya | Real-time market insights |

| Jengo Real Estate | Transparent pricing and agent support |

| Google Trends | Monitor regional interest and demand |

| Local SACCOs | Affordable housing schemes with clear payment plans |

📌 Set alerts for keywords like “land for sale Nairobi” or “apartment for sale Karen”.

📊 Average Real Estate Cost Trends in Nairobi (2025)

| Area | Avg. Plot Price Increase |

|---|---|

| Karen | +6% |

| Lavington | +5% |

| Kilimani | +9% |

| Westlands | +8% |

| Ruiru | +12% |

| Naivasha | +14% |

| Mlolongo | +10% |

| Diani | +6% – +8% |

📌 Nairobi outskirts and transport-linked areas continue to outperform CBD in appreciation.

🧑💼 Careers in Real Estate Based on Cost Knowledge

If you understand property costs, here are job opportunities:

| Role | Skills Required |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Property Manager | Tenant relations, maintenance coordination |

| Mortgage Consultant | Finance and loan advisory skills |

| Crowdfunding Broker | Digital marketing, investor education |

🎓 Many professionals start with certificate courses and grow into leadership roles.

🧾 Conclusion

Understanding real estate in Kenya costs helps ensure transparency, profitability, and long-term success—whether you’re buying, renting, or investing.

From residential apartments to land banking , each segment has its own set of upfront and ongoing expenses. By knowing what to expect, you can budget wisely and avoid financial surprises.

Start researching today—and unlock your future in Kenya’s booming real estate market.

❓ Frequently Asked Questions (FAQs)

Q1: What is the average cost of a house in Kenya?

A: Between KES 2M and KES 20M , depending on location and size.

Q2: How much does land cost in Kenya?

A: A 50x100ft plot ranges from KES 500K to KES 4M in major cities.

Q3: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q4: Do foreigners pay the same real estate costs as locals?

A: Foreigners can lease land but not own freehold—costs are similar for transactions.

Q5: Are there REITs in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial property.