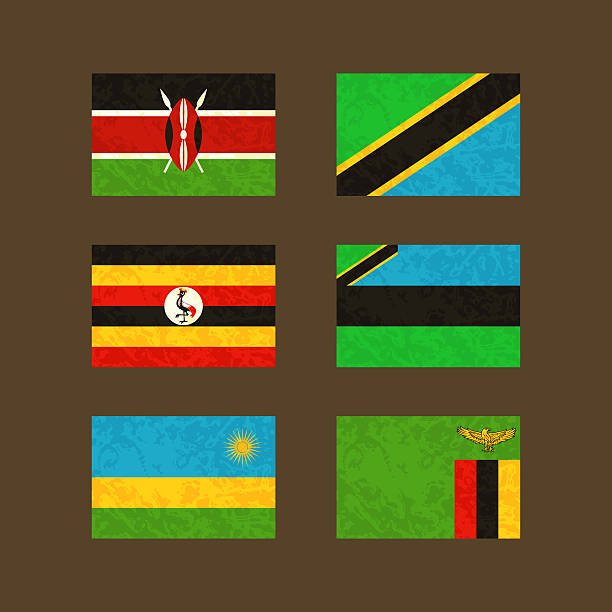

Kenya has become a key player in the African real estate market , attracting interest from neighboring countries like Uganda, Tanzania, Rwanda, and Somalia . With strong economic growth, infrastructure development, and increasing urbanization, African real estate in Kenya offers diverse opportunities for both local and regional investors.

📌 Why Kenya Attracts African Real Estate Investors

Here are several reasons why Kenya stands out:

| Reason | Explanation |

|---|---|

| Economic Stability | Strong currency and growing middle class support demand |

| Urbanization Rate | Over 4% annually—driving need for housing |

| Infrastructure Growth | SGR, expressways, and smart cities attract investment |

| Government Housing Programs | Affordable schemes under Big Four Agenda |

| Digital Transformation | Online platforms like Zameen Africa improve access |

📌 Kenya remains one of the top destinations for real estate investment in East Africa .

🧾 Types of Real Estate Available to African Investors

Here are the main categories of real estate available:

1. Residential Property

- Apartments, townhouses, gated communities

- Popular areas: Karen, Kilimani, Ruiru

📌 Ideal for passive income via rentals or long-term appreciation.

2. Land Banking

- Residential plots, agricultural land, industrial zones

- Emerging hotspots: Naivasha, Athi River, Konza-linked areas

📌 Land appreciation rate: 10%–20% annually in growth corridors.

3. Commercial Real Estate

- Office buildings, retail shops, malls

- High-demand locations: Upper Hill, Westlands, Mombasa Road

📌 Expected ROI: 7%–12% annually from rent and appreciation.

4. Industrial & Logistics Hubs

- Warehouses, cold storage units, factory buildings

- Growth hubs: Industrial Area (Nairobi), Port Reitz (Mombasa), Athi River

📌 Strategic for investors due to Kenya’s role as an East African logistics gateway.

5. Coastal & Holiday Homes

- Beachfront villas, short-term rentals, vacation cottages

- Top coastal regions: Diani, Malindi, Watamu

📌 Tourism-driven demand leads to strong seasonal rental yields.

📍 Top Locations for African Real Estate Investment in Kenya

| Location | Why It’s Popular |

|---|---|

| Karen | Upscale developments and strong resale value |

| Kilimani | Vibrant community and proximity to tech hubs |

| Ruiru / Ruaka | Affordable housing boom near Nairobi |

| Athi River | Strategic transport links and land banking |

| Diani Coast | Expatriate buyers and tourism appeal |

| Eldoret | Student population drives rental demand |

| Konza Technopolis Zone | Tech city development attracting global tenants |

📌 Nairobi outskirts and transport-linked areas offer better ROI than saturated CBD.

💰 Expected Returns on African Real Estate Investments in Kenya

| Investment Type | Avg. Annual Return |

|---|---|

| Residential Rentals (Nairobi) | 5% – 8% |

| Commercial Properties | 7% – 12% |

| Coastal Villas | 8% – 15% |

| Land Banking | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 Nairobi and Mombasa remain top performers—while emerging zones offer higher appreciation.

🧭 How to Invest in Real Estate in Kenya as an African Investor

Here’s how to get started:

Step 1: Define Your Investment Goal

Are you investing for personal use, rental income, or capital appreciation?

Step 2: Choose the Right Property Type

Residential, commercial, land, or crowdfunding—each has different entry costs.

Step 3: Research Listings Online

Use platforms like:

- Zameen Africa

- Property24 Kenya

- Jengo Real Estate

📌 Set alerts for keywords like “land for sale Nairobi” or “apartment for sale Karen”.

Step 4: Conduct Title Verification

Hire a licensed surveyor and advocate to verify ownership and boundaries.

📌 Never skip this step—it protects you from fraud!

Step 5: Select an Investment Model

Choose between:

- Direct ownership

- REITs

- Crowdfunding platforms

- SACCO-based housing

- Off-plan developer purchases

📌 Each model suits different budgets and risk appetites.

Step 6: Make Your Investment

Secure the deal through verified payment methods and legal agreements.

🏢 Top Developers Offering African Real Estate Deals in Kenya

| Developer | Headquarters | Signature Projects |

|---|---|---|

| Jengo Real Estate | Nairobi | Affordable housing, Ruiru developments |

| Knight Frank Kenya | Nairobi | Karen villas, corporate-linked homes |

| Savills Kenya | Nairobi | Institutional-grade property management |

| Home Afrika Limited | Nairobi | Umoja Village, The Rockwell |

| Garden City Group (Centum Investment Co.) | Nairobi | Garden City Mall, Two Rivers Mall |

| Sameer Africa | Nairobi | Karen Country Homes |

| Britam Properties | Nairobi | Britam Tower, premium office blocks |

| Prestige Group | Nairobi | Mid-range apartments, Kapiti Gardens |

| Jamii Bora Housing Ltd | Nairobi | Nyumba Yetu Scheme |

| Zamara Africa | Nairobi | Digital land investments |

🚨 Common Risks When Investing in African Real Estate in Kenya

| Risk | How to Avoid It |

|---|---|

| Fake Title Deeds | Always conduct due diligence through a licensed lawyer or surveyor |

| Double Selling | Verify that the seller is the sole owner |

| Unlicensed Agents | Use only ISK-certified brokers |

| Phony Developers | Research company background and past projects |

| Off-Plan Scams | Check for developer licensing and project approvals |

📌 Pro tip: Work with certified professionals and consult with a lawyer before signing any agreement.

📊 Comparison Table: Real Estate by Region in Kenya

| Location | Avg. Plot Price (50x100ft) | Growth Rate |

|---|---|---|

| Karen | KES 2.5M – 5M | +6% annually |

| Kilimani | KES 1.5M – 3M | +9% annually |

| Ruiru | KES 800K – 1.5M | +12% annually |

| Naivasha | KES 500K – 1M | +14% annually |

| Diani | KES 2M – 10M | +8% annually |

| Mlolongo | KES 800K – 1.5M | +10% annually |

| Athi River | KES 600K – 1.2M | +12% annually |

| Eldoret | KES 1.2M – 2.5M | +9% annually |

📌 Nairobi outskirts and transport-linked areas deliver the highest returns.

⚖️ Legal Framework for African Real Estate Investors

Foreign nationals cannot own freehold land but have alternative options:

| Option | Details |

|---|---|

| Leasehold Agreements | Up to 99 years for residential or commercial use |

| REITs | Access income-generating assets without direct ownership |

| Crowdfunding Platforms | Fractional ownership via Zamara Africa or Eneza Investments |

| Local Partnerships | Partner with Kenyan entities for joint ventures |

| Trust Structures | Some investors use family trusts for long-term holding |

📌 Always work with a certified advocate and surveyor before finalizing any deal.

📈 Emerging Trends Influencing African Real Estate Investment

| Trend | Impact on Market |

|---|---|

| Smart Cities Development | Tatu City and Konza attract international buyers |

| Green Building Initiatives | Eco-friendly developments gain traction |

| Digital Platforms | Online listing sites improve access and transparency |

| REITs and Crowdfunding | Opening up real estate to small investors |

| Affordable Housing Expansion | Government-backed programs reaching new buyers |

📈 These trends are reshaping how regional investors enter the Kenyan property market.

📉 Challenges Facing African Investors in Kenya

While Kenya is open to foreign investment, there are still hurdles:

| Challenge | Explanation |

|---|---|

| High Entry Barrier | Premium Nairobi developments remain expensive |

| Slow Legal Processes | Title verification can take months |

| Market Saturation in Nairobi CBD | Oversupply affects ROI in some segments |

| Unregulated Crowdfunding | Some platforms operate without oversight |

| Limited Mortgage Access | Few banks offer financing to non-residents |

📌 Solution: Focus on off-plan projects and work with licensed professionals.

📋 Step-by-Step Guide for African Investors in Kenya

Here’s how to proceed:

Step 1: Understand Ownership Rules

Foreigners can lease land for up to 99 years but cannot own freehold land outright.

Step 2: Research Listings Online

Use platforms like:

- Buy Kenya

- Property24 Kenya

- Jengo Real Estate

📌 Set alerts for keywords like “land for sale Nairobi” or “coastal villas for sale”.

Step 3: Contact a Licensed Agent

Work with ISK-certified brokers who understand cross-border transactions.

Step 4: Conduct Due Diligence

Verify title deeds, check for encumbrances, and confirm zoning laws.

📌 Always hire a licensed surveyor and advocate before investing.

Step 5: Explore Financing Options

Consider:

- Leasing land for long-term gains

- Crowdfunding platforms like Zamara Africa

- REITs for institutional-grade exposure

📌 Some developers offer flexible payment plans for international buyers.

Step 6: Secure Your Investment

Sign contracts, pay deposit, and complete legal documentation.

🎓 Careers in African Real Estate – Opportunities in Kenya

Here are popular roles in the sector:

| Role | Skills Required |

|---|---|

| Sales Agent | Strong communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Property Manager | Tenant relations, maintenance coordination |

| Marketing Executive | Social media, CRM tools, content creation |

| Customer Support | Excellent verbal and written communication |

🎓 Many companies provide training for beginners—making it easier than ever to enter the field.

🧾 Conclusion

Kenya’s real estate market continues to attract African investors looking for stable returns, strategic land appreciation, and lifestyle-driven property opportunities.

From Nairobi’s luxury apartments to affordable housing in Ruiru and coastal villas in Diani, Kenya offers diverse and profitable options for regional investors seeking long-term value.

Now is the perfect time to research your options—and unlock your future in Kenya’s booming property sector.

❓ Frequently Asked Questions (FAQs)

Q1: Can Africans invest in real estate in Kenya?

A: Yes—foreigners can lease land for up to 99 years or invest via crowdfunding and REITs.

Q2: Are real estate prices rising in Kenya?

A: Yes, especially in Nairobi and coastal regions, though growth varies by location.

Q3: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q4: What documents do I need to buy property in Kenya?

A: National ID, KRA PIN, sale agreement, and verified title deed.

Q5: Are there REITs in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial property.