One of the most frequently asked questions by international investors is: Can foreigners own real estate in Kenya? The short answer is yes — but with legal limitations.

While foreign nationals cannot own land on a freehold basis, they can acquire and manage property through leasehold agreements or real estate investment structures that allow long-term use and control.

This guide will walk you through everything you need to know about foreign ownership of real estate in Kenya, including:

- Legal framework and restrictions

- Types of ownership available to foreigners

- How to invest safely and legally

- Top cities for foreign buyers

- Risks and best practices

Can Foreigners Legally Own Property in Kenya?

Under the Kenyan Constitution (2010) and the Land Act, non-citizens cannot own land in Kenya on a freehold basis. However, they are allowed to hold property under a leasehold agreement for up to 99 years, renewable depending on government policy and land availability.

Foreign individuals and companies can:

- Lease land from the National Land Commission (NLC) or private owners

- Own buildings constructed on leased land

- Invest in real estate through local entities or REITs (Real Estate Investment Trusts)

This makes Kenya an attractive destination for foreign real estate investors who wish to benefit from the country’s growing property market without full land ownership rights.

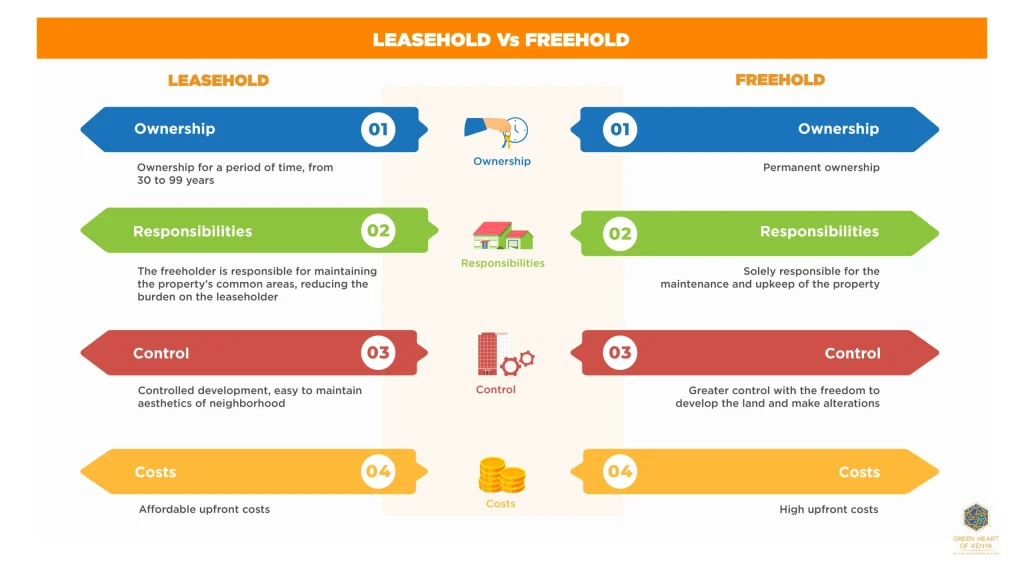

Types of Property Ownership Available to Foreigners

There are several ways foreigners can legally invest in real estate in Kenya:

1. Leasehold Ownership

- Most common method for foreign investors

- Leases can last between 33, 44, or 99 years

- Renewal depends on government regulations and land classification

2. Ownership Through a Kenyan Company

Foreign investors can set up a locally registered company (with at least one Kenyan shareholder) to purchase property on a freehold basis.

3. Investing via REITs (Real Estate Investment Trusts)

REITs allow foreigners to invest indirectly in income-generating properties listed on the Nairobi Securities Exchange.

4. Joint Ventures with Local Partners

Collaborating with a Kenyan citizen or firm enables shared ownership and legal compliance.

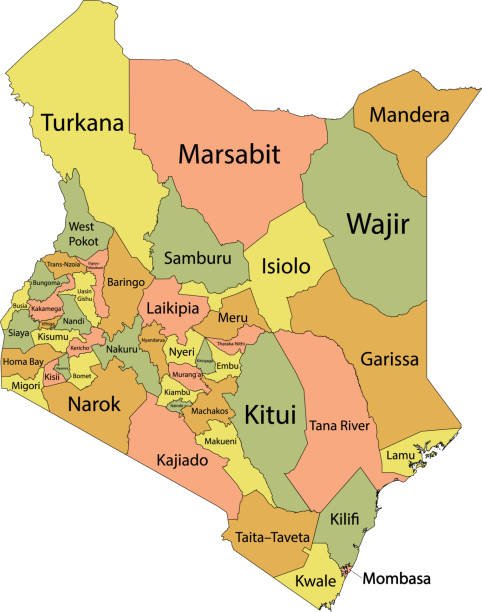

Popular Cities for Foreign Real Estate Investors

Certain areas in Kenya are particularly appealing to international buyers due to tourism, expatriate communities, and infrastructure development.

Top Locations:

- Nairobi – For commercial investments and high-end residential properties

- Mombasa – Coastal homes and beachfront investments

- Malindi – Popular among retirees and vacation home buyers

- Kisumu – Emerging market with good rental demand

- Thika – Affordable options near Nairobi

Each location offers different investment opportunities based on budget, lifestyle preferences, and return expectations.

Legal Process for Foreigners Buying Property in Kenya

Buying property as a foreigner requires careful navigation of legal procedures.

Step-by-Step Guide:

- Find a Property – Use licensed agents or platforms like Realestate.co.ke.

- Conduct Due Diligence – Verify title deeds, check for encumbrances, and ensure clear ownership.

- Negotiate Terms – Especially important if entering into a joint venture or lease agreement.

- Engage a Licensed Lawyer – Essential for document verification and transfer process.

- Register the Lease or Transfer – Submit forms at the Lands Office and pay required fees.

Always work with a licensed conveyance lawyer to avoid future disputes or complications.

Documents Required for Foreign Real Estate Buyers

Foreign investors must provide specific documentation to complete a property transaction:

Key Documents:

- Valid passport and entry visa

- PIN certificate (Personal Identification Number for tax purposes)

- Police clearance certificate

- Proof of funds or financing

- Title deed verification report

- Signed sale agreement or lease contract

Your lawyer will help ensure all documents meet NLC and government requirements.

Real Estate Investment Opportunities for Foreigners in Kenya

Foreigners have several investment avenues beyond direct property ownership.

Common Options:

- Beachfront Villas in Mombasa or Malindi – Ideal for personal use or holiday rentals

- Commercial Properties in Nairobi – Offices, shops, and mixed-use developments

- Land Banking in Thika – Long-term appreciation potential

- Serviced Apartments and Townhouses – Great for rental income

- REIT Investments – Passive income through professionally managed portfolios

These options allow foreigners to build wealth in Kenya’s booming real estate sector while staying within legal boundaries.

Financing Real Estate as a Foreign Investor

Financing options for foreign buyers are limited compared to locals, but still viable.

Available Methods:

- Cash Purchase – Most straightforward and preferred by sellers

- Offshore Financing – Some banks offer international mortgages

- Local Mortgages – Rarely available to non-residents; may require a Kenyan co-signer

- Joint Ownership with a Kenyan Citizen – Allows access to local financing and legal ownership

Most foreign investors opt for cash purchases to avoid complications with local banks.

Risks and Challenges for Foreign Investors

While Kenya welcomes foreign real estate investment, there are risks to be aware of:

- Unclear land titles – Always verify ownership with a professional

- Lengthy registration process – Property transfers can take 3–6 months

- Legal restrictions – No freehold ownership for non-citizens

- Market fluctuations – Prices vary based on political stability and economic trends

- Tax implications – Capital gains and rental income may attract taxation

Working with a qualified real estate lawyer and licensed agent helps reduce these risks significantly.

Frequently Asked Questions

Can a foreigner buy land in Kenya?

No, foreigners cannot own land on a freehold basis. They can only lease land for up to 99 years.

Can I get a mortgage as a foreigner in Kenya?

It’s rare but possible with a Kenyan co-applicant or permanent residency status.

Is it safe for foreigners to invest in Kenyan real estate?

Yes, provided due diligence is conducted and transactions are handled by professionals.

What is the cost of buying property in Kenya for foreigners?

Costs vary widely by location and type. Studio apartments start at KES 2 million, while luxury villas in Mombasa or Malindi can exceed KES 50 million.

Conclusion

Foreigners can invest in real estate in Kenya through leasehold arrangements, local company structures, or indirect investment vehicles such as REITs. While freehold ownership is restricted, leasehold rights and strategic partnerships make property investment accessible and profitable.

By understanding the laws, working with qualified professionals, and choosing the right location, international buyers can confidently enter Kenya’s dynamic real estate market and enjoy strong returns.