Commercial real estate in Kenya has become one of the most attractive sectors for both local and international investors. With rapid urbanization, economic growth, and expanding multinational businesses, demand for prime commercial spaces is on the rise.

Whether you’re looking to invest in office buildings, retail centers, industrial warehouses, or mixed-use developments, Kenya offers a diverse and growing market with strong returns.

In this guide, we’ll explore:

- The current state of commercial real estate in Kenya

- Top investment locations

- Types of commercial properties

- Leading developers and projects

- And tips for making smart investments

Why Invest in Commercial Real Estate in Kenya?

Kenya’s capital, Nairobi , is often referred to as the “Silicon Savannah” due to its booming tech and startup ecosystem. Combined with strong infrastructure development and government support, the country presents an ideal environment for commercial real estate growth.

Key Drivers:

- Rising demand from SMEs and multinational companies

- Expansion of retail and hospitality sectors

- Government-backed infrastructure projects

- Increasing foreign direct investment- FDI

- Growth of co-working and flexible office spaces

📈 Expected Returns: Between 7% and 12% annually , depending on location and property type.

Types of Commercial Real Estate in Kenya

There are several types of commercial properties available for investment:

1. Office Spaces

Popular in Nairobi’s business districts such as Upper Hill, Kilimani, and Mombasa Road.

Average Rent: KES 150 – KES 400 per sq. ft./month

Occupancy Rate: 70–90%

2. Retail Centers & Shopping Malls

From neighborhood shops to large malls like Garden City and Two Rivers.

Top Malls:

- Garden City Mall- Westlands

- Two Rivers Mall- Limuru Road

- Junction Mall- Karen

- Village Market- Muthaiga

3. Industrial & Warehousing Facilities

Growth in e-commerce and logistics has increased demand for warehouses near Nairobi and Mombasa ports.

Key Areas:

- Industrial Area- Nairobi

- Athi River

- Mombasa Port Zone

4. Hotel & Hospitality Properties

Tourism and business travel have revived interest in hotels, especially in Nairobi and coastal cities.

Popular Areas:

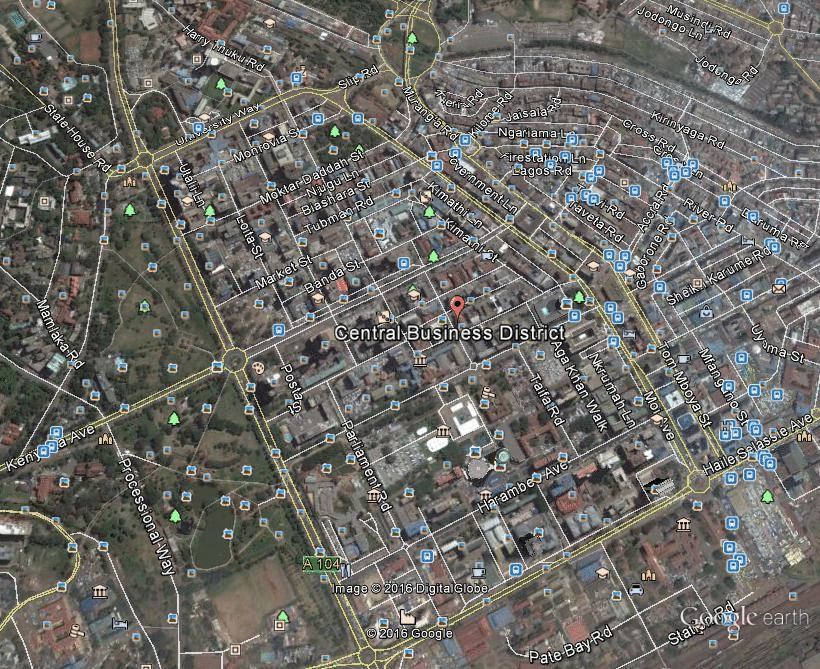

- Nairobi CBD

- Mombasa Beachfront

- Malindi and Watamu

5. Mixed-Use Developments

Combining residential, retail, and office spaces in one complex—ideal for high-density areas.

Examples:

- The Hub Karen

- ABC Place

- Britam Tower

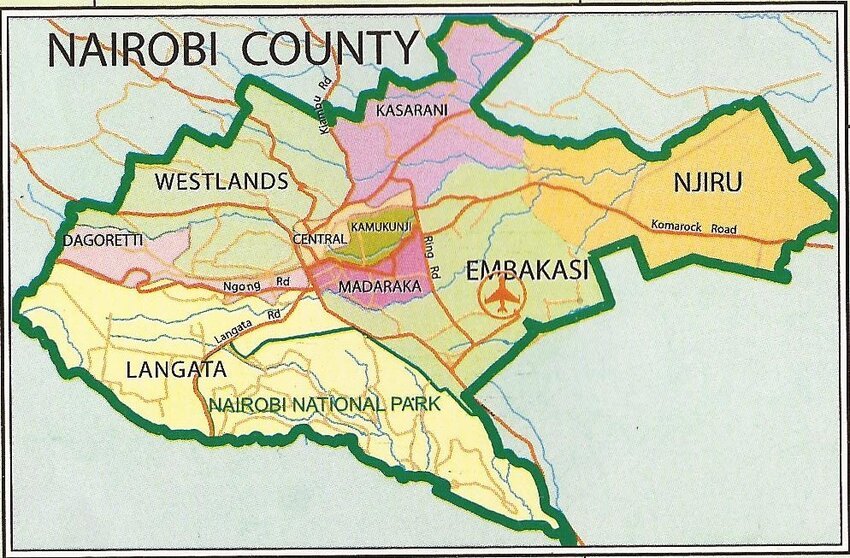

Top Locations for Commercial Real Estate Investment

Here are some of the best areas to invest in commercial property in Kenya:

| Location | Highlights |

|---|---|

| Upper Hill | High-end office rentals, proximity to embassies and corporate HQs |

| Westlands | Retail boom, popular with young professionals and students |

| Mombasa Road | Industrial and logistics hub with affordable options |

| Langata | Upscale commercial and mixed-use developments |

| Mombasa CBD | Coastal trade center with tourism-driven demand |

Leading Developers in Commercial Real Estate

These firms are shaping Kenya’s commercial landscape with innovative and high-value projects.

| Developer | Notable Projects |

|---|---|

| Garden City Group- Centum | Garden City Mall, Two Rivers Mall |

| Savills Kenya | Office tower management and advisory services |

| Knight Frank Kenya | Valuation and leasing of premium commercial assets |

| Britam Holdings | Britam Tower – iconic Nairobi landmark |

| Sameer Africa | Muthaiga Country Club Villas and commercial blocks |

How to Invest in Commercial Real Estate in Kenya

Step-by-Step Guide:

- Define Your Investment Goal : Are you looking for rental income, long-term appreciation, or both?

- Research the Market : Study vacancy rates, rent trends, and future development plans.

- Choose the Right Location : Focus on areas with strong tenant demand and infrastructure growth.

- Verify Title Deeds : Always work with licensed surveyors and lawyers.

- Negotiate the Deal : Consider payment terms, lease agreements, and exit strategies.

- Manage the Property : Hire a professional property manager or manage it yourself.

📌 Tip: Join the Real Estate Association of Kenya- REAK or consult with RICS-certified professionals for expert guidance.

Challenges in the Sector

While commercial real estate in Kenya offers great potential, investors should be aware of common challenges:

- High upfront costs

- Lengthy legal processes

- Vacancy risks in certain areas

- Market saturation in Nairobi CBD

- Regulatory changes affecting land use

However, these can be mitigated with proper due diligence and strategic planning.

Future Outlook (2025–2027)

Kenya’s commercial real estate market is expected to grow steadily over the next few years, driven by:

- Expansion of Nairobi Expressway and Standard Gauge Railway

- Rise of smart cities like Konza Technopolis

- Digital transformation and remote working influencing office design

- Increased FDI in logistics and manufacturing

With the right strategy, now is a great time to enter the market.

Conclusion

Commercial real estate in Kenya is more than just bricks and mortar—it’s a powerful wealth-building tool. Whether you’re investing in office towers, retail centers, or industrial parks, the opportunities are vast and growing.

By understanding market trends, choosing the right location, and working with trusted professionals, you can build a successful and profitable portfolio in Kenya’s dynamic commercial real estate sector.

Frequently Asked Questions (FAQs)

Q1: Can foreigners invest in commercial real estate in Kenya?

A: Yes, foreigners can lease land for up to 99 years but cannot own freehold land outright.

Q2: What is the average return on commercial property in Kenya?

A: Between 7% and 12% annually , depending on location and property type.

Q3: Is it safe to invest in commercial land in Kenya?

A: Yes, especially if you conduct proper title verification and work with certified professionals.

Q4: How do I verify land ownership in Kenya?

A: Visit the Registrar of Titles or hire a licensed land surveyor and lawyer.

Q5: Are there REITs (Real Estate Investment Trusts) in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to income-generating commercial properties.