Investing in real estate is one of the most effective ways to build long-term wealth. In Kenya, the property market offers diverse opportunities for both local and international investors—from residential apartments in Nairobi to commercial spaces in Mombasa and land investments in fast-growing towns like Ruiru and Naivasha.

Whether you’re a first-time investor or looking to expand your portfolio, this guide will walk you through everything you need to know about how to invest in real estate in Kenya.

Step 1: Understand the Kenyan Real Estate Market

Before making any investment, it’s crucial to understand the current state of the market. The Kenyan real estate sector has evolved significantly over the past decade, with increasing urbanization and government support for affordable housing projects.

Key trends include:

- Growth of satellite towns around major cities

- Rise in demand for rental properties due to urban migration

- Development of infrastructure- roads, railways, utilities

- Increased interest from foreign investors

Research market reports from institutions like KNBS, World Bank, and real estate agencies to make informed decisions.

Caption:

Understanding market trends helps identify high-potential investment areas.

Step 2: Set Clear Investment Goals

Define what you want to achieve through your real estate investment:

- Are you investing for capital appreciation or rental income?

- Do you prefer short-term flips or long-term holdings?

- What is your budget and risk tolerance?

Setting clear goals will help you choose the right type of property and location.

Step 3: Choose the Right Type of Property

Kenya offers various real estate investment options. Here are the most popular ones:

Residential Properties

- Apartments

- Townhouses

- Flats

- Bungalows

Ideal for rental income, especially near schools, hospitals, and business districts.

Commercial Properties

These usually offer higher returns but require larger capital and longer lease agreements.

Land/Plots

- Undeveloped land

- Agricultural land

- Development plots

Land is often considered a safer investment, especially in areas earmarked for future development.

Affordable Housing Projects

Government-backed schemes like NHSIF- National Housing Scheme, provide low-cost housing options with flexible payment plans.

Caption:

Residential developments offer strong rental income potential in urban centers.

Step 4: Select the Best Location

Location plays a critical role in determining the success of your investment. Some top locations for real estate investment in Kenya include:

- Nairobi County: High demand for rentals and office spaces.

- Kilifi: Tourist hotspots with growing hospitality needs.

- Nanyuki: Strategic transport hubs with industrial and agricultural growth.

- Satellite towns like Ngong: Rapid urbanization and infrastructure development.

Look into upcoming projects such as the Standard Gauge Railway, road expansions, and new townships that could boost land values.

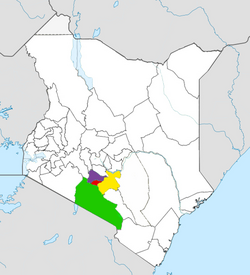

Caption:

A map showing top real estate investment hotspots across Kenya.

Step 5: Source Funds and Explore Financing Options

You can invest in Kenyan real estate using:

Personal Savings

Using your own funds gives you full control and avoids debt obligations.

Mortgages

Several banks in Kenya offer mortgage loans with varying interest rates and repayment terms. Top lenders include:

- Co-operative Bank

- Housing Finance Kenya

- DTB- now Kingdom Bank

- Absa Bank

Developer Payment Plans

Many developers offer installment-based payment systems, allowing you to pay over time without needing a bank loan.

Joint Ventures or Partnerships

Partnering with others allows pooling resources for bigger investments.

Caption:

Mortgage advisors help investors explore financing options for property purchases.

Step 6: Conduct Due Diligence

Never skip this step—due diligence protects you from fraud and legal complications.

Steps to take:

- Verify ownership by conducting a land search at the Ministry of Lands

- Confirm that the title deed is clean and transferable

- Check for any outstanding land rates or taxes

- Ensure there are no pending litigations on the property

- Engage a licensed lawyer to handle documentation

This ensures you’re investing in a legitimate asset free from disputes.

Caption:

Legal verification is essential before finalizing any real estate transaction.

Step 7: Purchase and Register the Property

Once due diligence is complete and financing is secured, proceed with the purchase.

The steps include:

- Signing a sale agreement

- Paying the deposit and balance as agreed

- Transferring the title deed to your name

- Paying stamp duty and registration fees

- Receiving the new title deed from the lands office

The entire process may take between 2 to 6 months depending on bureaucratic efficiency.

Caption:

Completion of property transfer signifies successful real estate investment.

Step 8: Manage Your Investment

After purchasing, decide how you’ll manage your property:

Self-Management

Suitable if you live nearby and have time to handle tenants and maintenance.

Hire a Property Manager

Professional managers handle tenant relations, rent collection, repairs, and legal issues—for a fee.

Use a Real Estate Agency

Some agencies offer full management services, especially for rental properties like BuyKenya

Regular maintenance and timely rent adjustments help preserve value and ensure steady returns.

Caption:

Effective property management ensures consistent rental income and tenant satisfaction.

Tips for First-Time Real Estate Investors in Kenya

- Start small and scale up as you gain experience

- Focus on areas with good infrastructure and growth potential

- Always work with licensed professionals—agents, lawyers, and valuers

- Keep track of changes in land laws and taxation policies

- Diversify your portfolio to spread risk

Conclusion

Investing in real estate in Kenya can be highly rewarding when approached strategically. From understanding the market to selecting the right property, securing financing, and managing your asset effectively, each step plays a vital role in ensuring long-term success.

With careful planning and informed decision-making, you can grow your wealth steadily through real estate—whether through rental income, capital gains, or both.

Ready to start investing in Kenyan real estate? Begin researching today and take the first step toward building lasting financial security through property ownership.