1. Location: The Golden Rule of Real Estate 📍

Where a property is located plays a major role in its value and desirability.

Popular areas include:

- Nairobi (Lavington, Kilimani, Ruiru)

- Mombasa (Nyali, Mtwapa, Bamburi)

- Kisumu (Oloo, Jomo)

- Naivasha (near Lake Naivasha and flower farms)

📈 Properties near schools, hospitals, shopping centers, and transport hubs often appreciate faster than those in remote locations.

2. Infrastructure Development 🏗️

Well-developed infrastructure significantly boosts property demand and value.

Major infrastructure projects influencing real estate include:

- Nairobi Expressway

- Standard Gauge Railway (SGR)

- Expansion of Jomo Kenyatta International Airport

- Road upgrades in towns like Nakuru and Eldoret

Properties near these developments tend to appreciate faster , making them attractive for investors.

3. Economic Conditions 💰

A stable economy encourages investment and increases purchasing power.

Key economic indicators affecting real estate:

- Interest rates : High mortgage rates can reduce buyer demand.

- Inflation : Rising inflation can increase construction costs and slow down property development.

- Employment rates : More jobs mean more people can afford to buy or rent homes.

4. Government Policies and Regulations ⚖️

Real estate in Kenya is heavily influenced by government policies, land laws, and taxation.

Important policy changes include:

- Affordable Housing Program under the Big Four Agenda

- Land registration reforms

- Stamp duty and transfer tax updates

Understanding these regulations helps buyers avoid legal pitfalls and ensures smooth transactions.

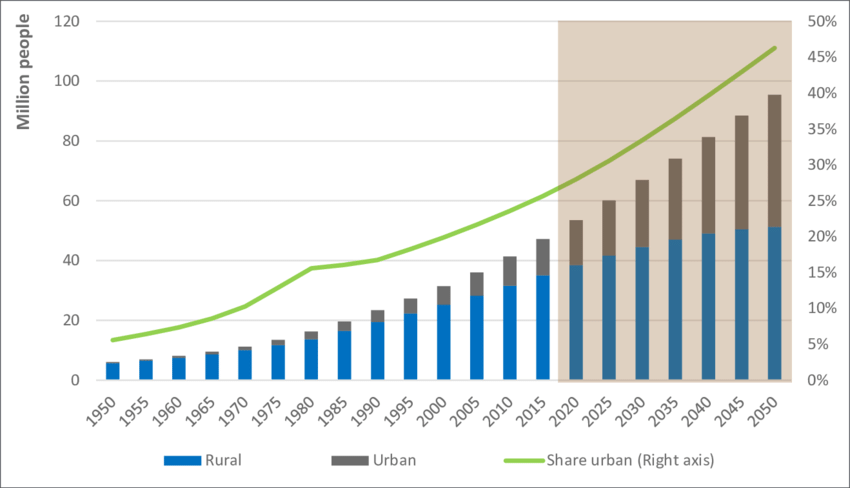

5. Population Growth and Urbanization 🌆

Kenya’s population is growing rapidly — currently over 56 million , and projected to reach 85 million by 2050 .

This growth leads to increased demand for housing, especially in cities like Nairobi, Mombasa, and Kisumu.

📈 More people = more housing needs = rising property prices.

6. Security and Safety 🔒

Buyers and renters prioritize safety when choosing where to live.

Areas with low crime rates and good community policing attract more residents and command higher rents and sale prices.

🛡️ Gated communities and estates with 24/7 security are particularly popular among middle- and high-income earners.

7. Population Growth and Urbanization 🚰⚡

Properties with reliable access to basic services like water, electricity, internet, and waste management are more valuable.

Developments with modern amenities such as swimming pools, gyms, and recreational spaces also enjoy premium pricing.

8. Foreign Investment and Expatriate Demand 🌍

Foreign investors and expatriates play a significant role in Kenya’s luxury and rental markets.

Cities like Nairobi and Mombasa attract expats working in NGOs, diplomatic missions, and multinational companies — driving up demand for quality housing.

💼 Expats often pay premium prices for well-located, secure, and furnished properties.

9. Environmental and Climate Factors 🌳🌦️

Natural disasters or environmental degradation can negatively affect property values.

For example:

- Flooding in low-lying areas can reduce buyer interest.

- Proximity to green spaces and clean environments increases appeal.

🌿 Sustainable and eco-friendly developments are gaining popularity across Kenya.

10. Market Trends and Buyer Behavior 📊

Understanding current market trends helps buyers and sellers time their moves.

For example:

- In a buyer’s market , prices may drop due to excess supply.

- In a seller’s market , demand outpaces supply, leading to price increases.

Monitoring trends through platforms like BuyRentKenya , Zimmo , and Realtor East Africa gives you an edge.

Conclusion: Many Factors Shape Kenya’s Real Estate Landscape

From location and infrastructure to economic health and legal frameworks, multiple factors affect real estate in Kenya . Understanding how they interact can help you make informed decisions — whether you’re buying your dream home or building an investment portfolio.

As Kenya continues to grow and develop, staying aware of these influences will ensure you stay ahead in one of Africa’s most exciting property markets.

Frequently Asked Questions (FAQs)

Q: What are the main factors affecting real estate prices in Kenya?

A: Location, infrastructure, economic conditions, population growth, and government policies are the biggest influencers.

Q: How does the Standard Gauge Railway (SGR) affect property prices?

A: Areas along the SGR route have seen increased development and property appreciation due to improved connectivity.

Q: Do gated communities sell faster than open estates?

A: Yes, due to perceived safety and better amenities, gated communities are highly sought after.

Q: Is now a good time to invest in Kenyan real estate?

A: Yes — with ongoing infrastructure projects and rising demand, it remains a strong investment opportunity.