The Kenyan real estate market is dynamic and influenced by a wide range of social, economic, and political forces. Whether you’re a buyer, investor, or developer, understanding the key factors affecting real estate in Kenya can help you make informed decisions and maximize returns.

In this comprehensive guide, we’ll explore:

- The main drivers influencing property prices

- How policy and infrastructure impact real estate

- Economic and demographic factors shaping demand

- And tips for navigating market fluctuations

Let’s dive in!

🔍 Top 10 Key Factors Affecting Real Estate in Kenya

Here are the most significant factors that influence the real estate sector in Kenya , from pricing to investment potential:

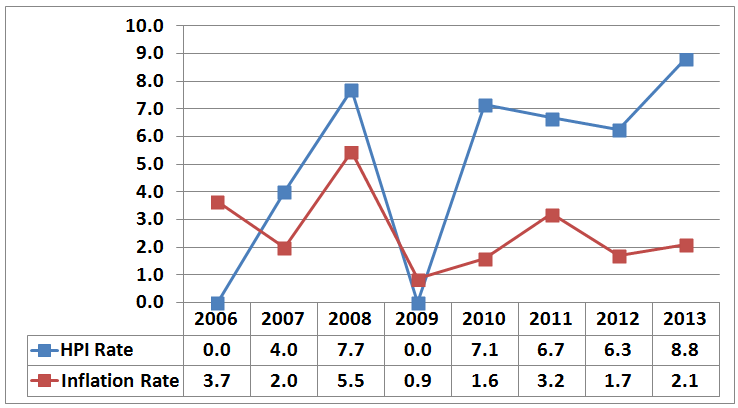

1. Economic Growth and Inflation

Impact:

A strong economy increases purchasing power and boosts demand for property. However, high inflation raises construction costs, mortgage rates, and property prices.

Example:

- High inflation (2023–2024) led to increased building material prices and higher mortgage interest rates.

- GDP growth supports long-term housing demand.

📌 Tip: Monitor inflation trends and interest rate changes before investing.

2. Government Policies and Housing Initiatives

Impact:

Policy decisions—especially under the Big Four Agenda —directly affect affordability, taxation, and development regulations.

Key Policies:

- Affordable housing program

- Kenya Mortgage Refinance Company (KMRC)

- Land reform initiatives and digitization of title deeds

📌 Benefit: Government-backed schemes lower entry barriers for middle-income buyers.

3. Interest Rates and Access to Credit

Impact:

Mortgage availability and interest rates significantly affect homebuyer activity.

| Financier | Avg. Mortgage Rate (2025) |

|---|---|

| Housing Finance Kenya | 13% – 16% p.a. |

| Co-operative Bank | 12% – 14% p.a. |

| KMRC Partner Banks | ~12% p.a. |

📉 Lower interest rates = More buyers = Higher demand and prices.

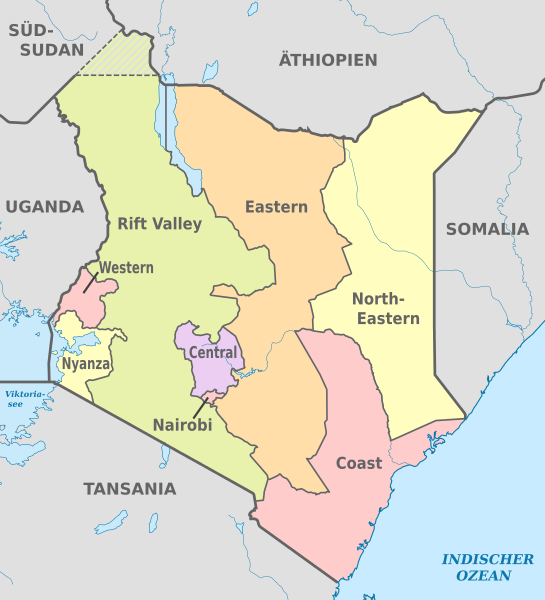

4. Urbanization and Population Growth

Impact:

Rapid urban migration drives up demand for housing—especially in cities like Nairobi , Mombasa , and Eldoret .

📊 Kenya’s population is growing at about 2.2% annually , increasing pressure on housing supply.

📌 Result: Rising property values in high-demand areas.

5. Infrastructure Development

Impact:

Roads, railways, airports, and utilities directly influence land value and development potential.

Major Projects Driving Growth:

- Standard Gauge Railway (SGR)

- Nairobi Expressway

- Thika Superhighway Expansion

- Jomo Kenyatta International Airport Upgrades

- Konza Technopolis Development

📈 Areas near these projects experience higher appreciation rates .

6. Land Laws and Ownership Restrictions

Impact:

Kenya has strict land ownership laws, especially for foreigners and unregistered entities.

Key Legal Considerations:

- Foreigners cannot own freehold land (only lease it for up to 99 years)

- Land tenure types: Freehold vs Leasehold

- Title deed verification process via Registrar of Titles

- Ongoing digitization of land records improves transparency

📌 Lack of clear title can reduce property value and investment appeal.

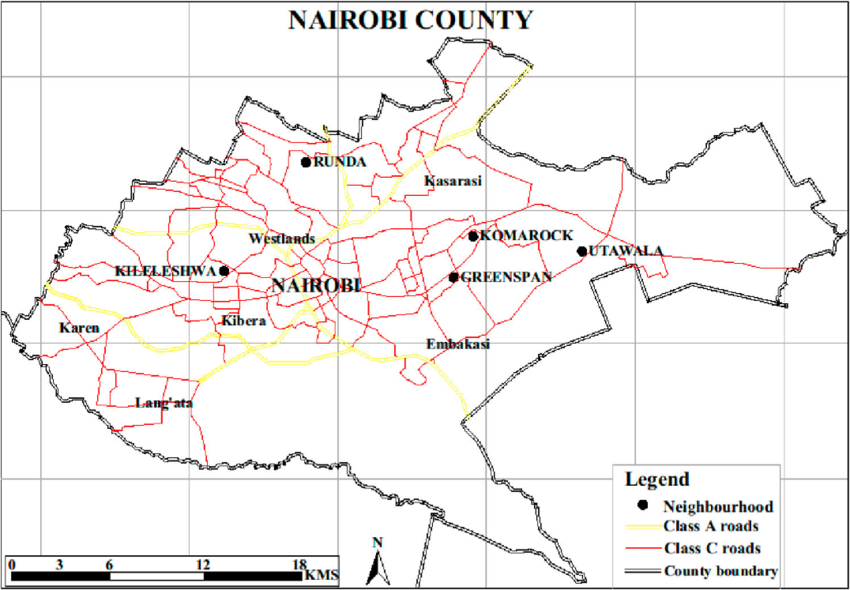

7. Location and Accessibility

Impact:

Proximity to schools, hospitals, transport hubs, and commercial centers plays a major role in property valuation.

Most Valuable Locations:

- Westlands-Nairobi

- Nyali-Mombasa

- Kipsigis-Eldoret

📌 Properties near amenities and transport routes tend to appreciate faster.

8. Supply and Demand Imbalance

Impact:

Kenya faces a housing deficit of over 2 million units , driving up prices and encouraging investment.

Why Supply Lags:

- Costly construction materials

- Bureaucratic approval processes

- Limited financing options for developers

📈 High demand + low supply = rising property values.

9. Technology and Digital Platforms

Impact:

Online listing platforms, crowdfunding, and virtual tours are changing how properties are bought and sold.

Popular Tools:

- BuyKenya

- Property24 Kenya

- Jengo Real Estate

- Zamara Africa- crowdfunding

💡 Technology increases transparency, speeds up transactions, and attracts young investors.

10. Foreign Investment and Diaspora Demand

Impact:

Kenyan diasporans and international investors are increasingly buying property in Kenya—especially along the coast and in Nairobi suburbs.

Reasons for Interest:

- Strong cultural ties

- Tourism and rental income opportunities

- Favorable exchange rates

📌 Coastal towns like Diani and Malindi see the highest foreign interest.

📊 Comparative Overview of Key Factors

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Economic Growth | Boosts demand and financing access | Inflation can raise construction costs |

| Government Policy | Encourages affordable housing | Regulatory delays may slow development |

| Infrastructure | Increases accessibility and land value | Construction can cause short-term disruption |

| Urbanization | Drives property demand | Can lead to informal settlements and overcrowding |

| Interest Rates | Low rates = more buyers | High rates = reduced demand |

| Land Laws | Protects against fraud | Limits foreign ownership |

| Location | Proximity to amenities boosts value | Remote areas depreciate over time |

| Technology | Improves access and efficiency | Some lack digital literacy |

| Diaspora Demand | Brings in foreign capital | May drive up prices beyond local reach |

| Supply-Demand Gap | Encourages new developments | Makes housing less affordable for many |

🧭 How These Factors Affect Different Property Types

| Property Type | Most Affected By | Least Affected By |

|---|---|---|

| Residential Homes | Location, urbanization, affordability programs | Foreign investment |

| Commercial Spaces | Infrastructure, economic growth | Diaspora demand |

| Coastal Villas | Foreign investment, tourism | Urbanization |

| Industrial Warehouses | Transport networks, logistics | Mortgage rates |

| Affordable Housing | Government policy, credit access | Location prestige |

📈 Emerging Trends Influencing Real Estate in Kenya (2025)

Several new dynamics are beginning to shape the market:

| Trend | Effect on Real Estate |

|---|---|

| Smart Cities- Tatu City | Drives future land value and planned development |

| Green Building Initiatives | Increases sustainability and long-term property value |

| REITs- Real Estate Investment Trusts | Offers small investors access to commercial property |

| Digital Crowdfunding Platforms | Democratizes property investment |

| Remote Work & Co-Living Models | Shift in housing preferences toward flexible living spaces |

🚨 Risks and Challenges in the Kenyan Real Estate Market

Despite its potential, real estate in Kenya faces several challenges:

| Risk | Explanation |

|---|---|

| Fraudulent Deals | Fake titles and unlicensed agents remain a concern |

| Slow Legal Processes | Title verification and registration can take months |

| Market Saturation in Nairobi CBD | Oversupply in some segments affects ROI |

| High Entry Costs | Prices still out of reach for many first-time buyers |

| Regulatory Gaps in New Models | Crowdfunding and REITs are still evolving |

📌 Pro tip: Always work with ISK-certified brokers and legal experts.

📉 Case Study: Nairobi vs. Emerging Markets

| Location | Price per Plot (50x100ft) | Growth Potential |

|---|---|---|

| Karen-Nairobi | KES 2M – KES 5M | Moderate – saturated |

| Ruiru | KES 800K – KES 1.5M | High – emerging zones |

| Naivasha | KES 500K – KES 1M | Very High – infrastructure-linked |

| Diani-Coast | KES 2M – KES 10M | High – tourism-driven |

| Eldoret | KES 400K – KES 1M | Medium-High – educational hub |

📈 Investing outside Nairobi can offer better growth potential due to lower entry costs and infrastructure development.

🎓 Career Opportunities in Real Estate Amid Changing Factors

As the market evolves, so do career opportunities:

| Role | Relevant Skills |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Mortgage Consultant | Financial analysis, customer service |

| Real Estate Developer | Project management, finance, planning |

| PropTech Developer | Coding, data analysis, real estate knowledge |

🎓 Students and professionals can benefit from studying real estate economics and technology.

🧾 Conclusion

The real estate market in Kenya is shaped by a complex mix of economic, legal, technological, and infrastructural factors . Understanding these influences allows investors, buyers, and developers to make smarter decisions and capitalize on opportunities.

Whether you’re looking to invest in Nairobi, coastal regions, or emerging zones like Naivasha, staying informed about market dynamics will help you navigate risks and unlock long-term value.

Now is an excellent time to get involved in Kenya’s real estate market—if you know what to watch for.

❓ Frequently Asked Questions (FAQs)

Q1: What is the biggest factor affecting real estate in Kenya today?

A: Location and infrastructure development have the strongest impact on property value and demand.

Q2: Do interest rates affect house prices in Kenya?

A: Yes—lower mortgage rates increase affordability and stimulate demand.

Q3: How does government policy influence real estate?

A: Policies like the Big Four Affordable Housing Program encourage investment and improve access.

Q4: Is real estate in Kenya affected by inflation?

A: Yes—rising inflation increases building material costs and slows down development.

Q5: Are real estate prices rising in Kenya?

A: Yes, especially in Nairobi and coastal regions, though growth varies by location.