Real estate in Kenya offers strong investment opportunities—from Nairobi’s affordable housing boom to coastal villas and land banking in emerging zones. Whether you’re a first-time buyer, expatriate, or institutional investor, understanding how to invest in real estate in Kenya is essential for maximizing returns and minimizing risk.

In this guide, you’ll learn:

- The most profitable real estate investment options

- Legal steps to buy or lease land

- Financing and mortgage access

- And how to avoid common property scams

Let’s dive in!

🧭 Step-by-Step Guide to Investing in Kenyan Real Estate

Here’s how to legally invest in property as a local or foreign investor:

Step 1: Define Your Investment Type

Are you investing in:

- Residential homes

- Commercial property (offices, shops)

- Land for future appreciation

- Crowdfunding or REITs

📌 Decide based on your budget, goals, and whether you plan to live in the property or rent it out.

Step 2: Choose Your Location

Some areas offer better ROI than others:

| Location | Why It’s Popular |

|---|---|

| Karen | High-end residential market with secure neighborhoods |

| Ruiru | Affordable housing with strong appreciation |

| Diani Coast | Tourism-driven rentals and lifestyle appeal |

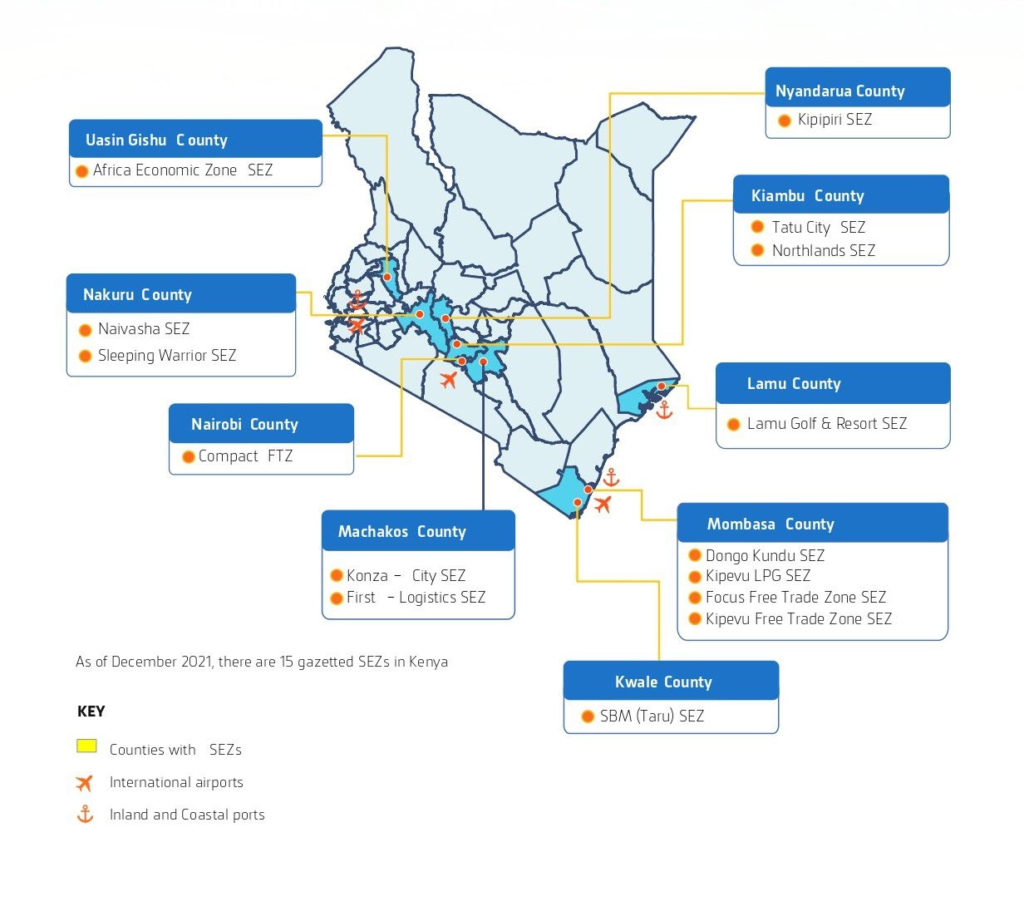

| Konza Technopolis Zone | Tech city development attracting global tenants |

| Athi River | Student-focused rental demand from Moi University |

Step 3: Research Listings Online

Use platforms like:

- Zameen Africa

- Property24 Kenya

- Jengo Real Estate

📌 Set alerts for keywords like “land for sale Nairobi” or “apartment for sale Karen”.

Step 4: Conduct Title Verification

Hire a licensed surveyor and advocate to verify:

- Title deed authenticity

- Encumbrances (mortgages, disputes)

- Zoning and planning permissions

📌 Never skip title verification—it protects you from fraud and legal issues.

Step 5: Explore Financing Options

Consider these ways to fund your investment:

| Option | Details |

|---|---|

| Mortgage Loan | Available through banks like HF Kenya, Co-op Bank, and NCBA |

| SACCO Housing Scheme | Jamii Bora and Stima Housing offer flexible payment plans |

| Land Leasing | Foreign investors can lease land for up to 99 years |

| Crowdfunding Platforms | Zamara Africa and Eneza Investments allow small-scale entry |

| REITs (Real Estate Investment Trusts) | Centum REIT allows retail investors to earn dividends |

📌 Tip: Government-backed schemes under the Big Four Agenda offer lower interest rates.

Step 6: Make an Offer & Sign Agreement

Once you find a property:

- Negotiate price and terms

- Pay booking fee if applicable

- Sign sale agreement or lease contract

📌 Always review the document with a lawyer before signing.

Step 7: Complete Legal Transfer

Your advocate prepares transfer documents and completes registration at the Registrar of Titles .

📌 Timeline: Typically takes 4–8 weeks , depending on complexity.

🏡 Types of Real Estate You Can Invest In

Here are the main categories of property available:

| Property Type | Highlights |

|---|---|

| Affordable Homes | Umoja Village, Nyumba Yetu Scheme |

| Luxury Villas | Karen Country Homes, Muthaiga Villas |

| Land Banking | Naivasha, Athi River, Konza-linked plots |

| Commercial Property | Retail shops in Garden City Mall, office spaces in Upper Hill |

| Coastal Rentals | Short-term villas in Diani and Malindi |

📌 Each type offers different returns—residential rentals yield 5%–8% annually , while land banking can appreciate by 10%–20% over time.

🧑💼 Work With Licensed Professionals

To ensure a smooth and safe transaction:

| Professional | Role |

|---|---|

| ISK-Certified Agent | Helps with property search and negotiations |

| Licensed Advocate | Verifies title deeds and handles legal transfers |

| Land Surveyor | Confirms plot size and boundary |

| Valuer | Assesses fair market value for purchase or mortgage |

| Bank Mortgage Officer | Guides you through financing options |

📌 Avoid unlicensed brokers—they increase the risk of fraud.

💰 Expected Returns by Investment Type

| Investment | Average Annual Return |

|---|---|

| Residential Rentals | 5% – 8% |

| Commercial Properties | 7% – 12% |

| Coastal Short-Term Rentals | 8% – 15% |

| Land Banking (Konza-linked) | 10% – 20% appreciation |

| REITs | 6% – 10% dividend yield |

📈 These figures make Kenya one of the most attractive real estate markets in East Africa.

🚨 Risks and Challenges to Watch Out For

Despite its potential, real estate investment comes with risks:

| Risk | Explanation |

|---|---|

| Title Fraud | Fake or duplicated title deeds still exist |

| Double Selling | Some sellers sell the same property twice |

| Market Saturation | Nairobi CBD and Karen face oversupply in some segments |

| High Entry Costs | Prices still out of reach for many first-time buyers |

| Construction Cost Inflation | Rising material prices affect new builds |

📌 Solution: Always work with ISK-certified brokers and conduct full due diligence.

📈 Emerging Trends in Real Estate Investment (2025)

Several trends are reshaping how people invest in property:

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract long-term investors |

| Green Building Initiatives | Eco-friendly developments command premium pricing |

| Digital Platforms | Online listing sites increase transparency and access |

| REITs Expansion | Retail investors now access commercial assets |

| Remote Property Management | Overseas investors manage Nairobi or coastal assets via apps |

📈 These changes are making real estate more inclusive and profitable.

Frequently Asked Questions (FAQs)

Q1: Can foreigners invest in real estate in Kenya?

A1: Yes—foreigners can lease land for up to 99 years through legal agreements.

Q2: What is the average return on real estate investment in Kenya?

A2: Between 5% and 15% annually , depending on location and property type.

Q3: Is it safe to invest in land in Kenya?

A3: Yes—if you conduct proper title verification and work with certified professionals.

Q4: Are there REITs in Kenya?

A4: Yes—Kenya launched its first REIT in 2020—offering small investors access to commercial developments.

Q5: How do I verify land ownership in Kenya?

A5: Hire a licensed land surveyor and advocate to check title deeds at the Registrar of Titles .