With rapid urbanization, growing population, and increasing demand for housing, many investors are asking: Is real estate a good investment in Kenya?

The short answer is yes — but like any investment, it requires research, strategy, and understanding of the market. In this guide, we’ll explore why real estate remains a strong investment option in Kenya, highlight key growth areas, and provide tips to help you make informed decisions.

Why Real Estate is a Good Investment in Kenya

Kenya’s real estate sector has seen consistent growth over the past decade, driven by several key factors:

1. Urbanization and Population Growth

Over 30% of Kenya’s population lives in urban areas, with cities like Nairobi, Mombasa, and Kisumu expanding rapidly. This creates high demand for residential and commercial properties.

2. Affordable Housing Initiatives

The government’s affordable housing program under the National Housing Development Corporation (NHDC) encourages private sector participation and offers long-term investment opportunities.

3. Infrastructure Development

Improved roads, railways (like the Standard Gauge Railway), and utilities have boosted property values in previously underserved areas.

4. Tourism and Coastal Expansion

Mombasa, Diani, Malindi, and Lamu attract both local and international buyers, making coastal real estate a lucrative option.

5. Stable Rental Market

Rental yields in major towns range from 5% to 10%, offering steady passive income for property owners.

Rapid urban development supports strong real estate investment potential.

Top Locations for Real Estate Investment in Kenya

Choosing the right location is crucial when investing in real estate. Here are some of the best areas to consider:

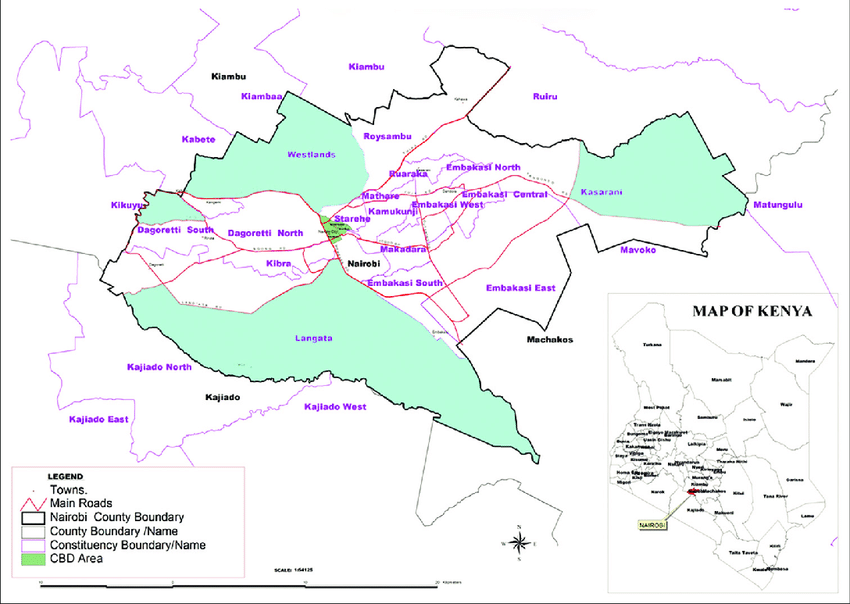

Nairobi

The capital city offers a mix of luxury apartments, townhouses, and commercial spaces. Popular estates include Karen, Kilimani, Runda, and Lavington.

Mombasa

Ideal for tourism-driven investments, with rising demand for beachfront homes and hotels.

Naivasha

A fast-growing town near Lake Naivasha with agricultural and industrial expansion driving land value increases.

Thika

Satellite towns near Nairobi with modern housing developments and improved transport links.

Nakuru

A major Rift Valley city attracting investors due to educational institutions, growing industries, and infrastructure upgrades.

Strategic locations across Kenya offer diverse real estate investment opportunities.

Types of Real Estate Investments in Kenya

There are multiple ways to invest in real estate in Kenya. The most common include:

Residential Properties

Apartment units, townhouses, and bungalows are popular for rental income, especially near universities, hospitals, and business districts.

Commercial Properties

Office buildings, retail shops, and warehouses offer higher returns but require larger capital.

Land/Plots

Land is often considered a safer long-term investment, particularly in areas earmarked for future development.

Affordable Housing Projects

Government-backed schemes such as those under the NHDC provide accessible entry points for new investors.

Holiday Homes

Properties in coastal or lake-side towns can be rented out seasonally to tourists or expatriates.

Residential developments offer strong rental income potential in urban centers.

Benefits of Investing in Kenyan Real Estate

Real estate offers more than just financial returns. Here are some of the main benefits:

Appreciation Over Time

Property values in well-developed areas tend to rise steadily, offering long-term gains.

Passive Income Through Rent

Consistent demand for rentals ensures regular cash flow with minimal day-to-day involvement.

Portfolio Diversification

Real estate provides a tangible asset that balances well against stock market volatility.

Tax Advantages

Investors can benefit from deductions on mortgage interest, maintenance costs, and depreciation.

Security and Tangible Value

Unlike stocks or bonds, real estate is a physical asset that retains value even during economic downturns.

Real estate investment offers both financial security and long-term growth.

Risks and Challenges to Consider

While real estate in Kenya is generally a solid investment, there are risks to be aware of:

Legal and Title Issues

Fraudulent titles and unclear land ownership remain concerns. Always conduct due diligence through a licensed lawyer.

Bureaucracy and Delays

Transferring property can take months due to slow government processing.

Maintenance Costs

Owning rental property comes with ongoing expenses like repairs, insurance, and management fees.

Market Fluctuations

Local economic changes or oversupply in certain areas may affect property prices.

High Initial Investment

Buying land or property typically requires significant upfront capital compared to other investment types.

Due diligence protects investors from legal complications in real estate transactions.

Tips for First-Time Real Estate Investors in Kenya

If you’re new to real estate investment, here are some practical tips to get started:

- Start small and scale up as you gain experience.

- Focus on areas with strong infrastructure and growth potential.

- Always work with licensed professionals — agents, lawyers, and valuers.

- Research market trends and avoid emotional buying.

- Keep track of changes in land laws and taxation policies.

Begin your real estate journey by researching available options and market conditions.

Conclusion

So, is real estate a good investment in Kenya?

Yes — with the right approach, real estate can be a profitable and secure way to build wealth. Whether you’re investing in rental property, land, or commercial space, Kenya’s growing economy and urban expansion create favorable conditions for long-term gains.

By doing thorough research, working with trusted professionals, and staying informed about market trends, you can make smart real estate investments that grow in value over time