📈 Why Real Estate in Kenya Is Profitable

Here are the key reasons why real estate continues to deliver strong returns:

| Reason | Impact |

|---|---|

| Urbanization & Population Growth | Rising demand for housing and rentals |

| Government Housing Programs | Affordable schemes boost market participation |

| Infrastructure Development | Roads, railways, and tech cities increase land value |

| Digital Platforms | Online listings make buying and selling easier |

| Tourism & Coastal Demand | Diani, Malindi, and Watamu attract expats and investors |

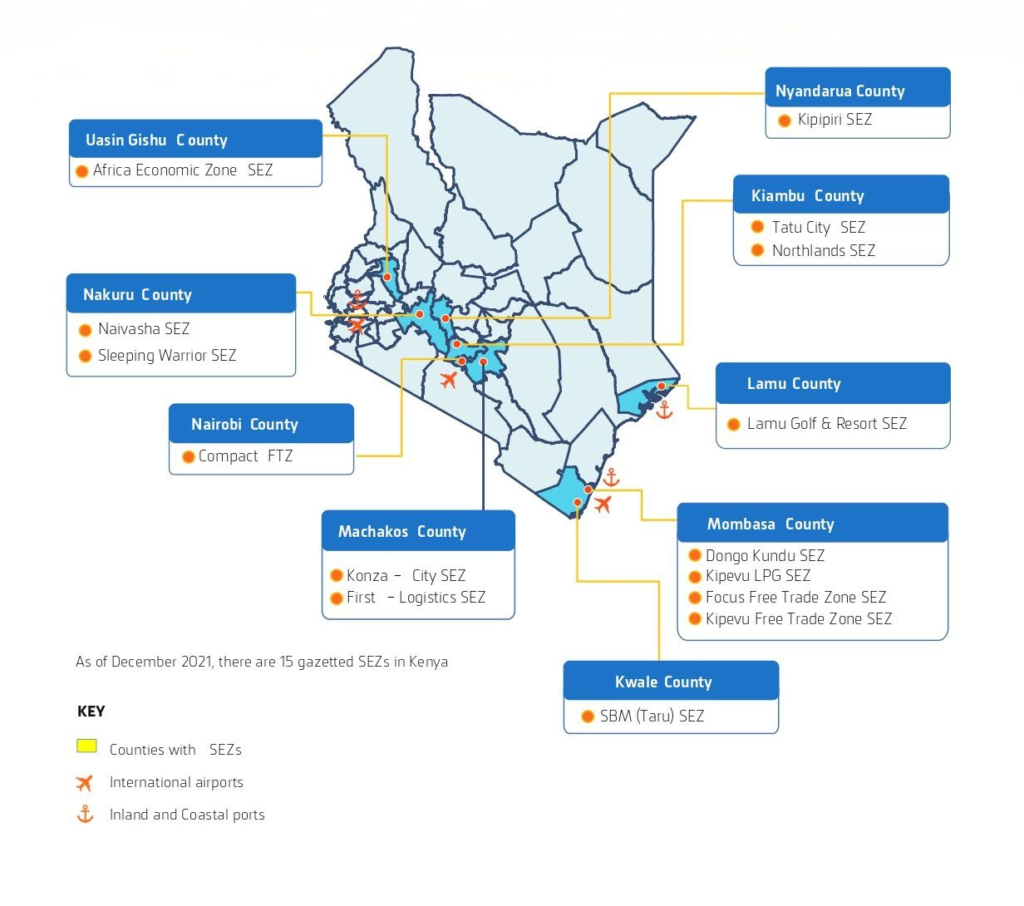

📌 Nairobi, Mombasa, and emerging towns like Naivasha and Athi River are seeing steady appreciation rates.

🧾 Average Returns by Property Type (2025 Data)

Here’s what investors typically earn from different types of real estate in Kenya:

| Investment Type | Average Return |

|---|---|

| Residential Rentals (Nairobi) | 5% – 8% annually |

| Commercial Properties | 7% – 12% annually |

| Coastal Villas (Diani, Malindi) | 8% – 15% annually |

| Land Banking (Konza-linked zones) | 10% – 20% appreciation annually |

| Crowdfunding Projects | 8% – 14% return on investment |

| REITs (Real Estate Investment Trusts) | 6% – 10% dividend yield |

📈 These figures make real estate one of the most attractive asset classes in Kenya.

📍 Top Locations Offering Strong Returns

Some areas offer better profitability than others due to growth and infrastructure development:

| Location | Property Type | Annual Appreciation |

|---|---|---|

| Lavington | Luxury homes | 6% – 9% |

| Kilimani | Mid-range apartments | 7% – 10% |

| Ruiru | Affordable housing | 10% – 15% |

| Naivasha | Land banking | 10% – 20% |

| Diani Coast | Beachfront villas | 8% – 15% |

| Konza Technopolis Zone | Smart city plots | 12% – 20% |

📌 Investing in these regions early can lead to significant capital gains over time.

🏢 Types of Real Estate Investments That Pay Off

Here are the most profitable real estate strategies in Kenya:

1. Residential Rentals

Ideal for middle-income buyers seeking passive income.

📌 High-demand areas: Karen, Lavington, Embakasi South

2. Land Banking

Buying undeveloped land before infrastructure projects arrive.

📌 Popular zones: Naivasha, Athi River, Konza-linked areas

3. Coastal Short-Term Rentals

Beachfront properties rented via Airbnb or local agencies.

📌 Best in Diani, Malindi, and Watamu

4. Affordable Housing Projects

Supported by government and SACCO financing.

📌 Developers: Home Afrika, Jamii Bora, Stima Housing

5. Commercial Property Leasing

Office spaces and retail shops in Nairobi’s business districts.

📌 Areas: Upper Hill, Westlands, Mombasa Road

6. Crowdfunding & REITs

New models allowing small investors to participate in large developments.

📌 Platforms: Zamara Africa, Eneza Investments, Centum REIT

🧭 How to Invest Profitably in Kenyan Real Estate

Here’s how to ensure your investment pays off:

Step 1: Choose the Right Location

Focus on areas with upcoming infrastructure or high rental demand.

Step 2: Verify Title Deeds

Always work with licensed surveyors and lawyers to avoid fraud.

Step 3: Select the Right Property Type

Luxury homes, affordable units, land, or commercial spaces—each has its own ROI.

Step 4: Explore Financing Options

Use mortgage programs under the Big Four Affordable Housing Scheme .

Step 5: Consider Digital Platforms

Zameen Africa and Property24 Kenya provide verified listings and agent support.

📌 Tip: Use land banking or crowdfunding if you’re starting with limited capital.

🚨 Risks and Challenges in Real Estate Investment

While real estate is profitable, there are risks:

| Risk | Explanation |

|---|---|

| High Entry Costs | Nairobi and coastal property prices can be steep |

| Construction Cost Inflation | Cement, steel, and timber prices have risen sharply |

| Title Fraud | Fake title deeds remain a concern without proper verification |

| Market Saturation in Nairobi CBD | Oversupply affects rental yields |

| Regulatory Delays | Some approvals take months to complete |

📌 Solution: Always use ISK-certified professionals and conduct full legal checks.

📊 Emerging Trends That Boost Profitability

Several trends are reshaping the sector—and creating new opportunities:

| Trend | Impact on Profits |

|---|---|

| Smart Cities (Tatu City, Konza) | Attract long-term investors and developers |

| Green Building Initiatives | Eco-friendly developments command premium pricing |

| REITs Expansion | Offers liquidity and passive income through shares |

| Remote Property Management | Enables overseas investors to manage Nairobi or coastal assets |

| Crowdfunding Platforms | Low entry point for small investors |

📈 These innovations are opening up real estate to more people and increasing overall profitability.

🎓 Careers in Real Estate: Another Way to Profit

If you’re not ready to buy property, consider working in the sector:

| Role | Description |

|---|---|

| Real Estate Agent | Earn commission from sales and rentals |

| Property Valuer | Licensed professionals assess land and building values |

| Developer | Build and sell property at profit margins of 15–30% |

| Property Manager | Oversees residential or commercial estates |

| PropTech Developer | Create digital tools for real estate transactions |

🎓 Many students from University of Nairobi , JKUAT , and Technical University of Kenya enter the field after graduation.

📉 Factors That Influence Real Estate Profitability

Here are the main drivers affecting returns:

| Factor | Impact |

|---|---|

| Location | Proximity to schools, hospitals, and transport increases value |

| Infrastructure Development | Railways, expressways, and malls drive land appreciation |

| Government Policy | Affordable housing laws and zoning changes affect ROI |

| Urbanization | More people moving to Nairobi and Mombasa = higher demand |

| Foreign Investment | Expatriates and diaspora buyers influence coastal and Nairobi markets |

📌 Example: Land near the Nairobi Expressway has appreciated by 15% annually over the last two years.

Frequently Asked Questions (FAQs)

Q1: Is real estate a good investment in Kenya?

A1: Yes, especially in Nairobi, Mombasa, and emerging zones like Naivasha and Athi River.

Q2: What is the average return on property investments in Kenya?

A2: Between 5% and 15% annually , depending on location and type.

Q3: Can foreigners invest in real estate in Kenya?

A3: Yes, foreigners can lease land for up to 99 years and invest in property through legal agreements.

Q4: Are REITs a good way to invest in real estate in Kenya?

A4: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial assets.

Q5: How do I verify land ownership in Kenya?

A5: Hire a licensed land surveyor and advocate to check title deeds at the Registrar of Titles .