In recent years, real estate crowdfunding has emerged as a game-changer in Kenya’s property market. By allowing multiple investors to pool funds and invest in real estate projects, this innovative model is making property ownership more accessible than ever—especially for young professionals, middle-income earners, and first-time investors.

With rising property prices and limited access to mortgages, crowdfunding offers a low-cost, flexible, and scalable way to participate in Kenya’s booming real estate sector.

What Is Real Estate Crowdfunding?

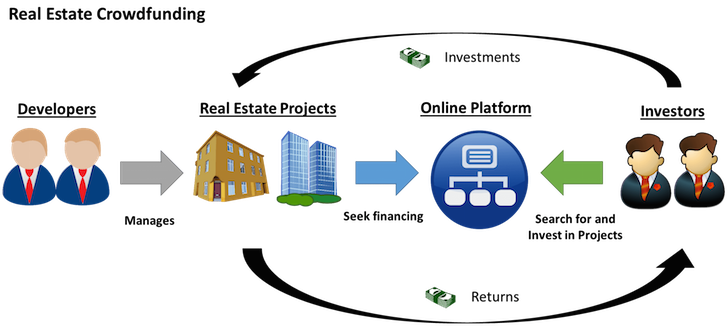

Real estate crowdfunding is a method where a group of investors collectively funds a real estate project—such as an apartment complex, townhouse development, or commercial building—through an online platform. In return, investors earn a share of the rental income or capital gains when the property is sold.

Think of it as “fractional ownership”—you don’t need to buy an entire house to profit from real estate.

How Real Estate Crowdfunding Works in Kenya

- Choose a Platform

Investors register on a real estate crowdfunding or proptech platform. - Browse Projects

Developers list vetted real estate opportunities with details on location, budget, expected returns, and investment period. - Invest Online

You can start with as little as KES 10,000 to KES 100,000, depending on the project. - Earn Returns

Once the property is developed or rented, you receive monthly or quarterly income from rent or profits upon sale. - Exit Strategy

Most platforms allow investors to exit after a set period or transfer shares to other investors.

✅ Benefits of Real Estate Crowdfunding in Kenya

| Benefit | Description |

|---|---|

| 💡 Low Entry Cost | Invest in prime real estate without needing millions upfront. |

| 🏦 Passive Income | Earn rental returns without managing tenants or repairs. |

| 🔀 Diversification | Spread your investment across multiple projects and locations. |

| 🌐 Transparency | Digital platforms provide real-time updates and legal documentation. |

| 🏗️ Supports Affordable Housing | Funds can be directed to government-backed or mid-income housing projects. |

⚠️ Risks & Challenges

While promising, real estate crowdfunding in Kenya is still in its early stages. Be aware of the following:

- Lack of Regulation: No specific laws from the Capital Markets Authority (CMA) govern crowdfunding yet.

- Project Delays: Construction or development may be delayed due to funding, permits, or mismanagement.

- Low Liquidity: It may be difficult to sell your share quickly if you need cash.

- Fraud Risk: Unverified platforms or developers can pose a threat—always do due diligence.

Top Real Estate Crowdfunding & Investment Platforms in Kenya

Although full-scale real estate crowdfunding is still emerging, several platforms and models are paving the way:

1. MyRoof Africa

A leading proptech platform connecting investors with off-plan and completed properties. Offers fractional investment options and advisory services.

2. M-Changa

Primarily a social crowdfunding platform, but increasingly used for land purchases and housing projects by investment groups.

3. Real Estate SACCOs & Investment Clubs

Many informal and formal investment groups pool funds to buy land or develop rental units—often operating like crowdfunding collectives.

4. PropTech Startups e.g., Nesty, RentFirst, Flatio Africa

These digital platforms are introducing tools for shared ownership, rental management, and investor collaboration.

Legal & Regulatory Status

As of now, there is no dedicated legal framework for real estate crowdfunding in Kenya. However:

- Projects structured as investment securities may fall under the Capital Markets Act.

- Always ensure your investment is backed by legal agreements e.g., trust deeds, shareholder contracts.

- Work with licensed developers, real estate agents, and legal advisors to minimize risk.

The Future of Crowdfunding in Kenya’s Real Estate Market

With a housing deficit of over 2 million units and growing urbanization, real estate crowdfunding has massive potential to:

- Democratize property ownership

- Finance affordable housing under the Big Four Agenda

- Engage the diaspora and youth in wealth creation

- Promote financial inclusion

As regulation improves and trusted platforms scale, crowdfunding could become a mainstream investment tool.

💡 Tips for Safe Real Estate Crowdfunding

✅ Only invest through verified and transparent platforms

✅ Research the developer’s track record and project feasibility

✅ Review all legal documents before investing

✅ Start small and diversify across projects

✅ Monitor your investment regularly through the platform

Final Thoughts

Real estate crowdfunding in Kenya is more than a trend—it’s the future of inclusive, digital-first property investment. While risks exist, the opportunity to earn passive income and long-term capital growth with minimal capital is too valuable to ignore.

By investing wisely and staying informed, you can be part of Kenya’s real estate revolution—one small share at a time.

📞 Ready to Start?

Explore trusted platforms, join real estate investment groups, or consult a financial advisor to begin your crowdfunding journey today.

Join The Discussion