Kenya’s real estate sector has emerged as one of the fastest-growing industries in East Africa. With rapid urbanization, rising middle-class incomes, and strong government support for affordable housing, real estate growth in Kenya is accelerating—creating new opportunities for investors, developers, and homebuyers alike.

🔍 Overview of Kenya’s Real Estate Market

Kenya’s property market has experienced steady growth over the past decade, with Nairobi leading the way in residential, commercial, and mixed-use development. Other cities like Mombasa , Eldoret , and Kisumu are also seeing increasing demand.

📊 Market Snapshot (2025):

| Metric | Value |

|---|---|

| Urban population growth | 4% annually |

| Housing deficit | Over 2 million units |

| Average property price increase | 5%–10% per year |

| Mortgage penetration | Less than 1% (low but growing) |

| REITs launched | 1 (Centum REIT) |

📌 The market is evolving with new trends such as digital platforms, smart cities, and green building initiatives.

🚀 Key Drivers of Real Estate Growth in Kenya

Several factors are fueling the expansion of Kenya’s real estate industry:

1. Urbanization & Population Growth

Kenya’s urban population is growing at around 4% per year , driven by rural-to-urban migration and a young, expanding workforce.

Impact:

- Increased demand for housing

- Rising rental prices in Nairobi and Mombasa

- Pressure on city planning and infrastructure

📌 Nairobi alone accounts for over 30% of national real estate activity .

2. Infrastructure Development

Major infrastructure projects are transforming access and land value across the country.

Key Projects:

- Standard Gauge Railway (SGR) – Improved transport between Nairobi and Mombasa

- Nairobi Expressway – Reduced traffic congestion and increased property values

- Thika Superhighway Upgrade – Spurred development along Nairobi’s northern corridor

- Jomo Kenyatta International Airport Expansion – Boosted commercial real estate in Nairobi

- Konza Technopolis – Tech city attracting global tenants and investors

📈 These projects have significantly improved connectivity and land appreciation rates.

3. Government Affordable Housing Programs

The Big Four Agenda includes a major push for affordable housing under the Ministry of Transport and Infrastructure.

Goals:

- Deliver 500,000 affordable homes by 2027

- Partner with SACCOs, banks, and private developers

- Reduce housing deficit through subsidized financing

📌 Developers like Home Afrika Limited and Jamii Bora Housing are leading this initiative.

4. Foreign Investment & Diaspora Demand

Expatriates and members of the Kenyan diaspora continue to invest heavily in property, especially along the coast and in Nairobi suburbs.

Why Foreigners Invest:

- Strong cultural ties

- Tourism-driven short-term rentals

- Favorable exchange rates

📌 Coastal towns like Diani and Watamu see the highest foreign interest.

5. Digital Transformation in Real Estate

Online listing platforms like Buy Kenya , Property24 Kenya , and Jengo Real Estate have revolutionized how properties are bought, sold, and rented.

Benefits:

- Increased transparency

- Broader reach to buyers and renters

- Faster transactions via virtual tours and mobile payments

💡 Digital tools are making real estate more accessible to younger generations.

6. Smart Cities and Master-Planned Developments

Cities like Tatu City , Konza Technopolis , and Ruiru Smart City are being developed as fully integrated urban centers with residential, commercial, and recreational zones.

Why It Matters:

- Offers self-sustaining communities with modern infrastructure

- Attracts both local and foreign investors

- Supports job creation and economic growth

7. Land Banking in Emerging Areas

Investors are increasingly purchasing land in areas like Naivasha , Athi River , and Konza-linked zones before prices rise.

Expected Appreciation:

- 10% – 20% annually

- Strategic locations benefit from upcoming infrastructure projects

📌 Always verify title deeds before investing in off-plan land deals.

8. Green Building and Sustainable Development

More developers are adopting eco-friendly materials, energy-efficient designs, and sustainable construction practices.

Benefits:

- Reduces environmental impact

- Lowers utility costs for residents

- Meets global sustainability standards

📌 Example: Kingsight Heights in Karen uses modular and energy-saving technologies.

9. Real Estate Crowdfunding & REITs

New financial models are opening doors for small investors.

Platforms:

- BuyKenya

- Eneza Investments

- Centum REIT

📌 Expected ROI: 8% – 15% annually , depending on project type.

10. Commercial and Industrial Growth

With Nairobi becoming a regional business hub and Mombasa port handling increasing cargo, demand for office and warehouse space is rising.

High-Demand Zones:

- Upper Hill – Corporate offices

- Westlands – Retail and tech startups

- Industrial Area -Nairobi – Warehouses and logistics hubs

- Mombasa Road Corridor – Commercial expansion

📈 Nairobi commercial property rents increased by 7% in 2024 .

📊 Comparison Table: Real Estate Growth Factors

| Factor | Impact on Market | Growth Potential |

|---|---|---|

| Urbanization | Drives property demand | High |

| Government Policy | Encourages affordable housing | Medium-High |

| Infrastructure | Increases land value | High |

| Foreign Investment | Brings in capital | High |

| Technology | Speeds up transactions | Medium-High |

| Land Banking | Long-term appreciation | Very High |

| Green Building | Future-focused appeal | Medium |

| Crowdfunding & REITs | Democratizes investment | Medium-High |

| Commercial Growth | Raises income potential | High |

| Smart Cities | Future-proof investments | High |

📍 Top Locations Benefiting from Real Estate Growth

Here are some of the most sought-after areas for real estate investment:

| Location | Growth Driver |

|---|---|

| Karen | Upscale developments and security |

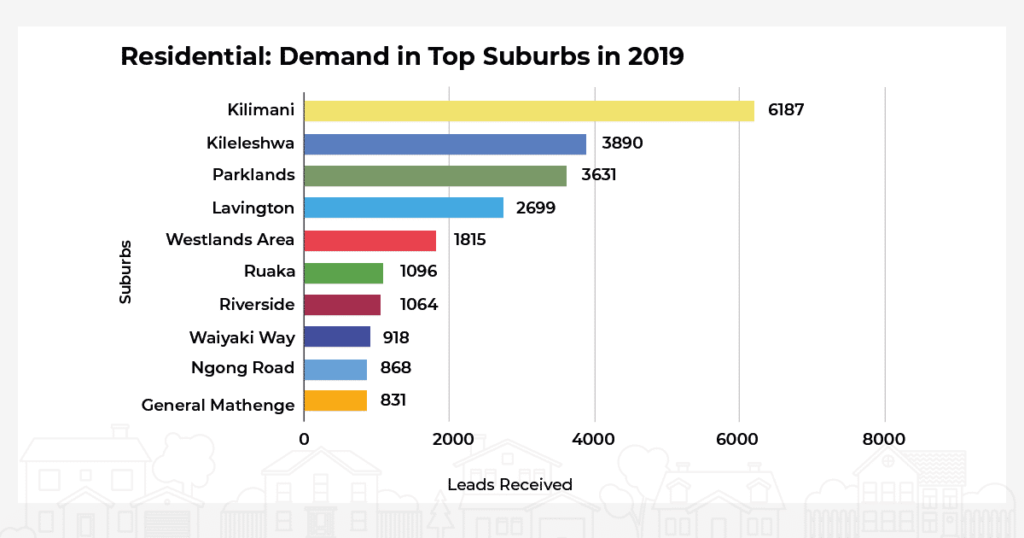

| Kilimani | Proximity to universities and tech hubs |

| Ruiru | Affordable housing boom near Nairobi |

| Thika Road Corridor | Industrial and residential growth |

| Diani | Tourist-driven investment |

| Naivasha | Strategic transport links and land banking |

| Eldoret | Educational and healthcare hub driving demand |

💰 Return on Investment (ROI) by Trend

| Trend | Average Annual Return |

|---|---|

| Residential Rentals (Nairobi) | 5% – 8% |

| Commercial Properties | 7% – 12% |

| Land Banking | 10% – 20% appreciation |

| Crowdfunding Projects | 8% – 14% return |

| REITs | 6% – 10% dividend yield |

📈 These figures make Kenya one of the most attractive real estate markets in East Africa.

🏗️ Emerging Real Estate Development Zones

| Zone | Reason for Growth |

|---|---|

| Tatu City | Master-planned urban center near Thika |

| Konza Technopolis | Tech city development attracting global tenants |

| Ruiru | Affordable housing schemes and proximity to Nairobi |

| Athi River | Logistics hub and industrial growth |

| Eldoret | Educational base and airport expansion |

| Naivasha | Strategic location and water resources |

| Watamu | Tourism-driven real estate and expat demand |

🧭 Challenges Alongside Growth

Despite positive momentum, there are still hurdles:

| Challenge | Explanation |

|---|---|

| High Construction Costs | Inflation raises material prices |

| Limited Financing Options | Mortgages remain expensive for many |

| Title Verification Risks | Fraudulent deals still exist |

| Slow Legal Processes | Registration can take months |

| Market Saturation in Nairobi CBD | Oversupply affects ROI |

📌 Pro tip: Always work with ISK-certified brokers and legal experts.

📈 Emerging Trends in Real Estate Growth (2025 Outlook)

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract long-term investment |

| Mobile-Based Investment Apps | More Kenyans investing via digital platforms |

| Green Building Initiatives | Eco-friendly developments gain traction |

| Affordable Housing Expansion | More low-cost loans becoming available |

| REITs and Crowdfunding | Opening up real estate to small investors |

These trends are reshaping how property is bought, sold, and managed in Kenya.

🎓 Career Opportunities in Growing Real Estate Sector

As the market expands, so do job opportunities:

| Role | Skills Required |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Real Estate Developer | Project management, finance, planning |

| PropTech Developer | Coding, data analysis, real estate knowledge |

| Property Manager | Customer service, CRM tools, maintenance coordination |

🎓 Students and career switchers can benefit from studying real estate economics and technology.

📉 Future Outlook for Kenya’s Real Estate Market

With continued investment in infrastructure, digital transformation, and policy support, Kenya’s real estate market is expected to grow steadily over the next decade.

Emerging areas like Konza , Naivasha , and Athi River are expected to see significant development—making now a great time to invest.

🧾 Conclusion

Kenya’s real estate growth is being driven by a mix of urbanization, government policies, infrastructure development, and digital innovation .

From affordable housing programs to smart cities and crowdfunding platforms , the market offers diverse opportunities for buyers, investors, and professionals.

Whether you’re looking to buy your first home, invest in land, or explore commercial property, understanding these growth trends will help you make informed decisions—and unlock your potential in Kenya’s booming real estate sector.

❓ Frequently Asked Questions (FAQs)

Q1: What is driving real estate growth in Kenya?

A: Urbanization, infrastructure development, and government-backed housing programs are the main drivers.

Q2: Are real estate prices rising in Kenya?

A: Yes, especially in Nairobi and coastal regions, though growth varies by location.

Q3: Is it safe to invest in land in Kenya?

A: Yes, especially if you conduct proper title verification and work with certified professionals.

Q4: How much commission do real estate agents earn in Kenya?

A: Between 2% and 5% for sales, and 1 month’s rent for leases.

Q5: Can foreigners invest in real estate in Kenya?

A: Yes! Through leasehold arrangements, crowdfunding platforms, and REITs.