The Kenyan real estate market in 2022 was marked by both challenges and opportunities. As the country continued recovering from the impacts of the pandemic, demand for housing, commercial space, and land investments remained strong—especially in urban centers like Nairobi , Mombasa , and Eldoret .

This guide explores:

- The key trends that shaped real estate in Kenya in 2022

- Property price movements across major cities

- Government-backed initiatives

- And how investors and developers adapted

Let’s take a closer look!

🔝 Key Real Estate Trends in Kenya (2022 Overview)

Here are the most significant developments that defined the Kenyan property market in 2022:

| Trend | Impact |

|---|---|

| Affordable Housing Program Growth | Government and SACCO-led schemes expanded access to homeownership |

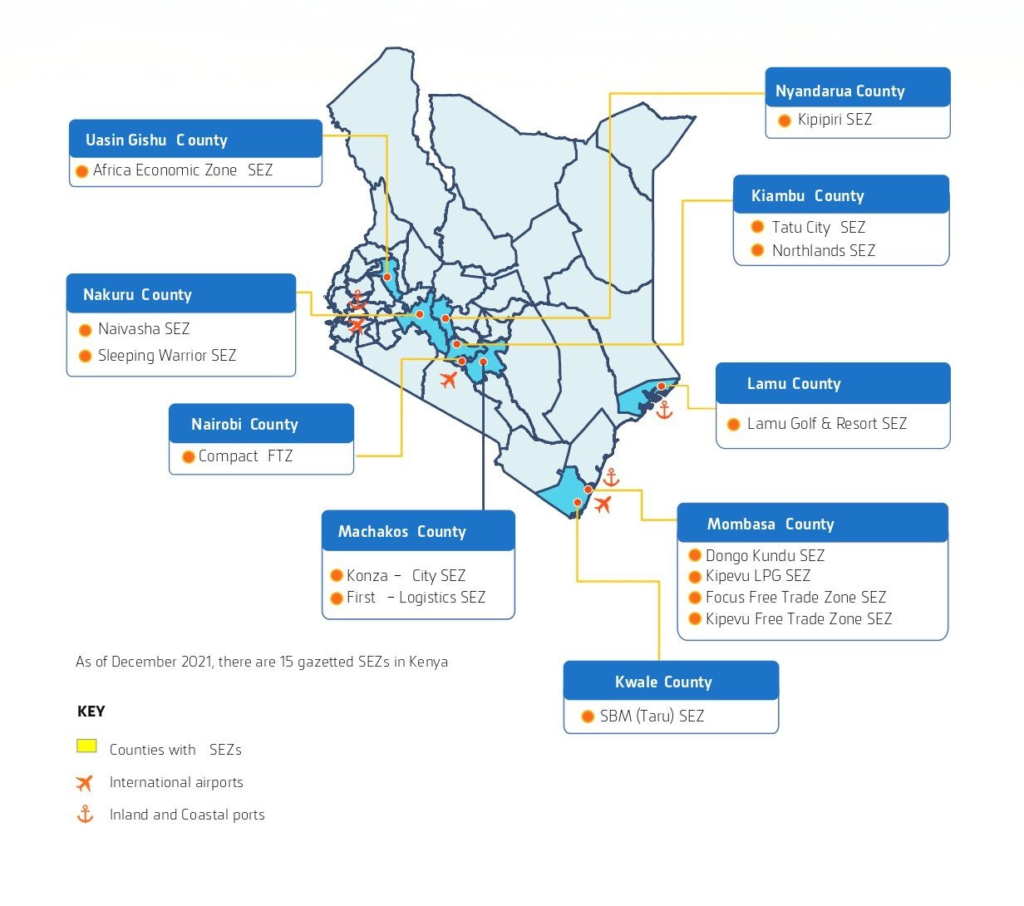

| Smart Cities Development | Tatu City and Konza Technopolis gained momentum |

| Digital Property Platforms Rise | Zameen Africa and Jengo Real Estate grew rapidly |

| Land Banking Gains Popularity | Strategic land purchases near transport hubs rose |

| Green Building Initiatives Begin | More developers adopt sustainable materials and energy-saving designs |

📌 These shifts laid the foundation for today’s more advanced and inclusive real estate landscape.

🏠 Types of Properties & Their Performance in 2022

Different property types delivered varying returns and demand levels.

1. Residential Rentals

- Average Yield: 5% – 7%

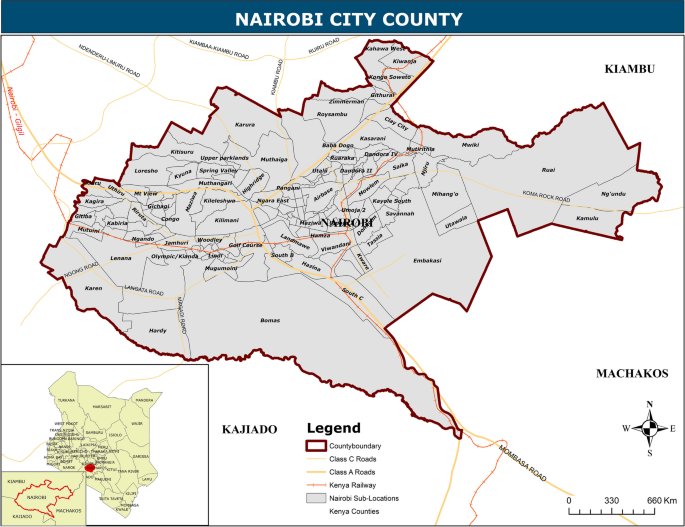

- Top Performing Areas: Karen, Kilimani, Ruiru

- Rental Growth: +5% in Nairobi suburbs

📌 Demand driven by professionals and expatriates seeking secure, mid-range apartments.

2. Commercial Property

- Office Space ROI: 6% – 10%

- Mall Foot Traffic: Garden City and Two Rivers Mall began gaining traction

- Vacancy Rates: Stood around 15% in Nairobi CBD

📌 Commercial leases were slower compared to residential due to hybrid work models.

3. Land Banking

- Appreciation Rate: 8% – 15% annually

- Most Sought-After Zones: Naivasha, Athi River, Konza-linked areas

📌 Investors focused on pre-infrastructure plots for long-term gains.

4. Coastal & Holiday Homes

- Short-Term Rental Yields: 10% – 20% seasonally

- Tourist Influx: Increased occupancy during December holidays

📌 Coastal towns like Diani and Malindi remained popular among locals and international buyers.

5. Government Housing Programs Launch

- Big Four Affordable Housing Scheme launched pilot phases

- Targeted delivery of 500,000 homes by 2027

- Partnering with SACCOs and banks for flexible financing

📌 Home Afrika Limited and Jamii Bora led early-stage project rollouts.

📊 Property Price Changes Across Kenya (2022 Overview)

| Location | Avg. Plot Price (50x100ft) | Annual Change |

|---|---|---|

| Lavington (Nairobi) | KES 2M – 4M | +5% |

| Westlands (Nairobi) | KES 1.2M – 2.5M | +7% |

| Ruiru | KES 700K – 1.2M | +10% |

| Naivasha | KES 400K – 900K | +12% |

| Diani Coast | KES 1.5M – 8M | +6% |

| Mlolongo | KES 600K – 1.2M | +9% |

📈 Nairobi outskirts and transport-linked areas saw the highest appreciation.

🧾 Top Developers in Kenya (2022 Recap)

Here are some of the most active and respected real estate developers of 2022:

| Developer | Key Projects | Notable Achievements |

|---|---|---|

| Home Afrika Limited | Umoja Village (Ruiru) | Piloted affordable housing scheme under Big Four Agenda |

| Jengo Real Estate | Digital listings platform | Introduced verified agent network and mobile-based transactions |

| Jamii Bora Housing Ltd | Nyumba Yetu Scheme | Focused on SACCO-backed financing and community-driven housing |

| Garden City Group (Centum) | Retail and mixed-use development | Announced expansion plans for future residential towers |

| Sameer Africa | Karen Country Homes | Continued delivering high-end gated communities |

| Britam Properties | Britam Tower | Strengthened portfolio of income-generating assets |

| Triton Properties | Triton Heights (Kilimani) | Launched tech-integrated apartment blocks |

| Konza Technopolis Authority | Smart city development | Attracted early investor interest in master-planned zones |

| Stima Housing Ltd | Mlolongo Affordable Housing | Grew membership-based home financing model |

| Local SACCOs & Cooperatives | Affordable housing schemes | Provided low-cost options through savings and loans |

📈 Emerging Markets That Gained Momentum in 2022

Several regions emerged as strong investment options:

| Area | Why It Performed Well |

|---|---|

| Athi River | Logistics hub development started gaining traction |

| Naivasha | Tourism and water resources attracted investors |

| Eldoret | Airport expansion and university-driven rental demand |

| Ruiru | Proximity to Nairobi with lower entry costs |

| Mlolongo | Affordable housing schemes and transport improvements |

📌 These locations offered better value than Nairobi CBD.

💰 Returns on Real Estate Investments (2022 Summary)

| Investment Type | Avg. Return |

|---|---|

| Residential Rentals | 5% – 7% |

| Commercial Leases | 6% – 10% |

| Land Appreciation | 8% – 15% |

| Crowdfunding Projects | Emerging trend – Eneza Investments launched |

📌 Nairobi and Mombasa remained top performers—while emerging zones offered good appreciation.

🚨 Common Risks Identified in 2022

Despite positive movement, several risks persisted:

| Risk | Explanation |

|---|---|

| Unverified Land Deals | Fake titles and unlicensed agents still common |

| Slow Legal Processes | Title verification delays affected deals |

| Market Saturation in Nairobi CBD | Oversupply reduced ROI in some segments |

| High Entry Costs | Some premium developments remained out of reach |

| Limited Mortgage Access | Mortgages were expensive and hard to qualify for |

📌 Due diligence remained crucial when investing.

📉 Real Estate Price Trends in Nairobi (2022)

| Area | Avg. Plot Price Increase |

|---|---|

| Karen | 5% |

| Lavington | 4% |

| Kilimani | 7% |

| Westlands | 6% |

| Ruiru | 10% |

| Naivasha | 12% |

| Mlolongo | 9% |

| Diani | 6% |

📌 Nairobi outskirts and transport-linked areas performed best.

📊 Top Counties for Real Estate Growth in 2022

| County | Key Developments |

|---|---|

| Nairobi | Affordable and mixed-use developments |

| Kiambu (Ruiru / Ruaka) | Affordable housing boom |

| Machakos (Mlolongo) | Infrastructure-linked appreciation |

| Uasin Gishu (Eldoret) | Student and healthcare-driven rentals |

| Mombasa | Coastal villas and port-side investments |

| Nakuru / Naivasha | Eco-housing and tourism-linked property |

📌 Nairobi and its satellite towns led in volume and value of transactions.

📈 Emerging Technologies in Real Estate (2022 Highlights)

| Innovation | Adoption in Kenya |

|---|---|

| Online Listing Platforms | Zameen Africa and Jengo launched full-scale digital tools |

| Mobile-Based Transactions | WhatsApp and USSD payments became common |

| Virtual Property Tours | Few platforms adopted them but interest grew |

| AI Tenant Matching | Still in early stages |

| Blockchain for Land Records | Discussions increased but no major rollout yet |

📌 Technology improved transparency and access to property data.

🧭 How Real Estate Developed in 2022

Here’s how key players and policies influenced the market:

1. Government Housing Programs

- Ministry of Transport and Housing pushed forward with Nyumba Kuni Pamoja and early Big Four Affordable Housing phases

2. Private Sector Expansion

- Developers like Home Afrika , Sameer Africa , and Prestige Group launched new estates

3. Digital Transformation

- Online listing sites and virtual tours gained popularity

4. Land Banking Growth

- Strategic land purchases near Thika Superhighway and Eldoret Airport increased

5. Foreign Investment

- Expat and diaspora buyers showed strong interest in coastal properties

📌 2022 set the stage for stronger growth in 2023–2025.

🎓 Careers in Real Estate – 2022 Insights

With growth came job opportunities:

| Role | Skills Required |

|---|---|

| Sales Agent | Strong communication, digital tools |

| Property Valuer | Surveying, ISK certification |

| Property Manager | Tenant relations, maintenance coordination |

| Marketing Executive | Social media, CRM tools, content creation |

| Customer Support | Excellent verbal and written communication |

🎓 Many companies provided training for beginners—making it easier than ever to enter the field.

🧾 Conclusion

2022 was a foundational year for Kenya’s real estate market. From affordable housing programs and digital platforms to land banking and government-backed financing , the industry took important steps toward accessibility and transparency.

Whether you’re buying your first home, investing in land, or exploring commercial property, understanding what happened in 2022 helps you make informed decisions moving forward.

Start researching today—and position yourself ahead of the next big real estate boom.

❓ Frequently Asked Questions (FAQs)

Q1: What were the biggest real estate trends in Kenya in 2022?

A: Affordable housing programs, digital platforms, land banking, and green building initiatives.

Q2: Are real estate prices rising in Kenya?

A: Yes, especially in Nairobi and coastal regions, though growth varied by location.

Q3: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q4: Can foreigners invest in real estate in Kenya?

A: Yes—through leasehold arrangements or crowdfunding platforms.

Q5: Are there REITs in Kenya?

A: Kenya launched its first REIT in 2020—more expected soon.