The Kenyan real estate market has long been dominated by high-net-worth individuals and developers. But today, thanks to the rise of real estate investment funds , even small investors can now participate in the property boom—without owning land or buildings directly.

These funds allow you to invest money into professionally managed portfolios that include residential, commercial, and industrial properties. Whether you’re looking for passive income , portfolio diversification , or long-term appreciation , real estate funds offer a modern, accessible way to grow your wealth.

In this guide, we’ll explore:

- What real estate investment funds are

- Types of funds available in Kenya

- Top providers and platforms

- How to start investing

- And tips for choosing the right fund

Let’s dive in!

📌 What Are Real Estate Investment Funds?

Real estate investment funds pool money from multiple investors to acquire, develop, or manage income-generating properties like apartments, office buildings, malls, and warehouses.

Instead of buying and managing property yourself, you earn returns through:

- Rental income distributions

- Capital appreciation

- Dividends (for REITs)

These funds are ideal for people who want exposure to real estate without the burden of ownership, maintenance, or tenant management.

🔝 Types of Real Estate Investment Funds in Kenya

Here are the main types of real estate funds currently available in Kenya:

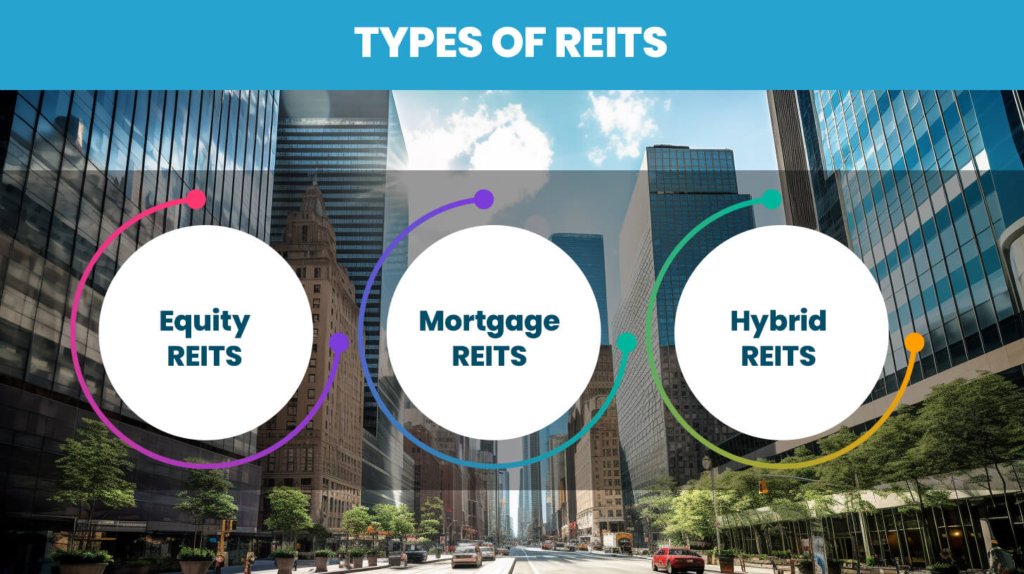

1. REITs (Real Estate Investment Trusts)

Overview:

Kenya launched its first REIT in 2020 under regulation by the Capital Markets Authority (CMA) .

How It Works:

- Investors buy shares in a trust that owns commercial or residential properties

- Returns come from rental income distributed as dividends

Example:

- Centum REIT – Focused on commercial properties like Garden City Mall and Two Rivers Mall

📌 Expected Return: 6%–10% annually in dividends + potential capital gains

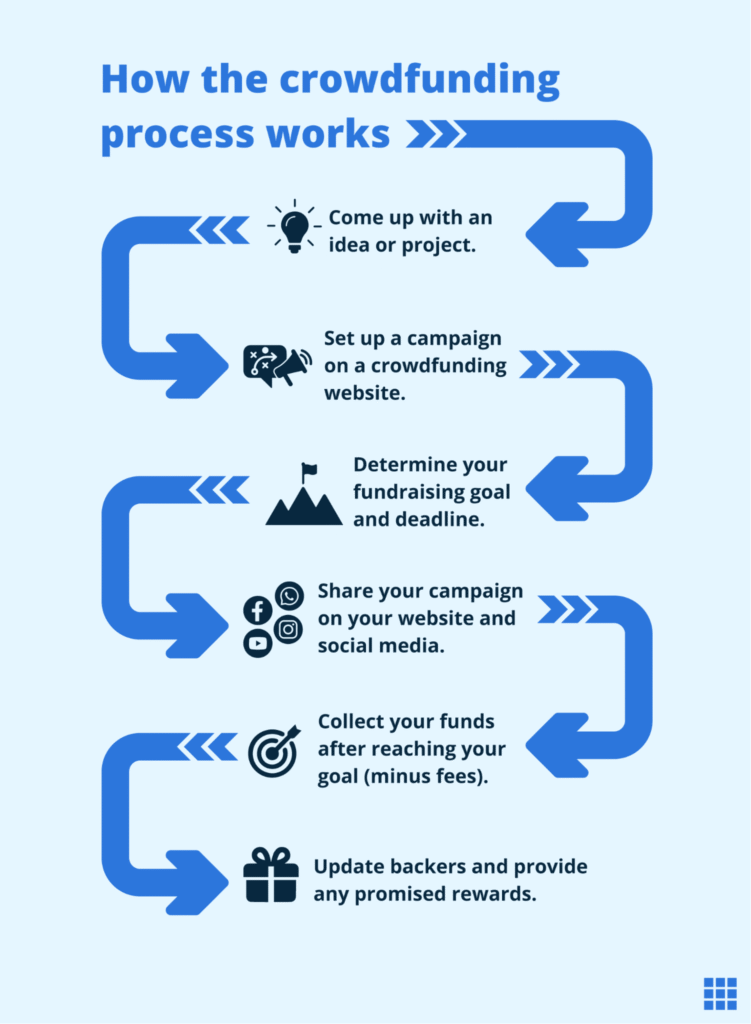

2. Crowdfunding Platforms

Overview:

Digital platforms that let individuals invest small amounts into real estate projects alongside others.

How It Works:

- Choose a project e.g. apartment block, land development

- Contribute as little as KES 50,000

- Earn profits when the property is sold or rented out

Popular Platforms:

- Zamara Africa

- Eneza Investments

- Jengo Invest

📌 Expected Return: 8%–14% return on investment , depending on the project

3. Property Mutual Funds & Unit Trusts

Overview:

Managed funds that invest in a diversified portfolio of real estate assets across different sectors.

How It Works:

- Investors buy units in the fund

- Fund managers handle all property operations

- Returns are paid out periodically

Providers:

- CIC Asset Management

- Genghis Capital

- Sanlam Kenya

📌 Ideal for hands-off investors seeking long-term growth

4. SACCO-Based Housing Funds

Overview:

Many SACCOs (Savings and Credit Cooperatives) have introduced housing schemes where members contribute regularly toward affordable homes.

How It Works:

- Members save monthly

- Loans are issued at favorable rates for home purchase

- Some SACCOs partner with developers for bulk buying power

📌 Great for middle-income earners looking to own property over time

5. Private Equity Real Estate Funds

Overview:

Firms like Centum Investment Company and Actis- Tatu City manage private equity funds focused on large-scale developments.

How It Works:

- Minimum investments start at KES 5M+

- Targeted at high-net-worth individuals and institutions

- Focuses on commercial and mixed-use developments

📌 These funds often deliver high returns , especially in Nairobi and coastal areas

🧭 How to Invest in Real Estate Funds in Kenya

Here’s a simple step-by-step process to get started:

Step 1: Choose Your Investment Type

Decide whether you want:

- REITs (low risk, steady returns)

- Crowdfunding (medium risk, higher returns)

- SACCO schemes (community-based, low entry point)

- Private equity (high risk, high reward)

Step 2: Research Platforms & Providers

Look into:

- Past performance

- Reviews and user feedback

- Legal compliance and licensing

Step 3: Register and Open an Account

Most platforms require:

- National ID

- Bank details

- Email verification

Step 4: Select a Project or Fund

Choose a specific property or opt for a general real estate fund

Step 5: Make Your Investment

Transfer funds via M-Pesa, bank transfer, or online payment

Step 6: Monitor & Reinvest

Track your returns and decide whether to reinvest or withdraw earnings

📌 Tip: Always read the terms and conditions before investing

🏢 Top Real Estate Investment Fund Providers in Kenya

| Provider | Type | Minimum Investment |

|---|---|---|

| Centum REIT | REIT | KES 100,000+ |

| Zamara Africa | Crowdfunding | KES 50,000 |

| Eneza Investments | Crowdfunding | KES 50,000 |

| CIC Asset Management | Mutual Fund | KES 10,000 |

| Sanlam Kenya | Property Unit Trusts | KES 10,000 |

| Jengo Invest | Digital Real Estate Fund | KES 50,000 |

| Genghis Capital | Property Investment Fund | KES 50,000 |

📊 Expected Returns by Fund Type

| Fund Type | Average Annual Return |

|---|---|

| REITs | 6% – 10% (dividends + appreciation) |

| Crowdfunding | 8% – 14% |

| SACCO Housing Schemes | 5% – 9% (equity build-up) |

| Property Mutual Funds | 7% – 12% |

| Private Equity Funds | 10% – 20% |

📈 These returns make real estate funds one of the most attractive alternatives to traditional property investment

📍 Top Locations for Fund-Based Real Estate Investment

Some areas are more popular among fund managers due to strong demand and infrastructure growth:

| Location | Why It’s Popular |

|---|---|

| Nairobi- Karen | High rental demand and value appreciation |

| Mombasa Road | Logistics and commercial activity |

| Konza Technopolis Zone | Tech city development driving future growth |

| Naivasha | Strategic transport links and land banking |

| Coastal Regions- Diani | Tourism-driven short-term rental yields |

🚨 Risks and Challenges of Real Estate Investment Funds

While real estate funds offer many benefits, they also come with risks:

| Risk | Explanation |

|---|---|

| Lack of Regulation | Many crowdfunding platforms are not yet fully regulated |

| Developer Default | If a project fails, returns may be delayed or lost |

| Market Fluctuations | Property values can drop during economic downturns |

| Illiquidity | Some funds lock in capital for months or years |

| Platform Fraud | Unregulated sites may mismanage funds |

📌 Pro tip: Only invest through licensed or well-reviewed platforms

📈 Emerging Trends in Real Estate Investment Funds (2025)

The sector is evolving fast. Here’s what’s shaping the future of real estate funds in Kenya:

| Trend | Impact |

|---|---|

| Blockchain Integration | Secure, transparent transactions and fractional ownership |

| Green Building Funds | Eco-friendly developments attract ESG-focused investors |

| Mobile-Based Investment Apps | More Kenyans investing via mobile apps and USSD codes |

| Partnerships with Banks | Easier access to mortgage-linked real estate funds |

| Government Support | Encouraging alternative financing under the Big Four Agenda |

🎓 Who Can Invest in Real Estate Funds?

Real estate funds are open to:

- Individual retail investors

- SACCO members

- Institutional investors

- Expatriates (through leasehold arrangements)

No prior experience is needed—just the willingness to learn and invest wisely.

📈 Benefits of Investing in Real Estate Funds

| Benefit | Description |

|---|---|

| Low Entry Barrier | Start with as little as KES 50,000 |

| Passive Income | Earn regular returns without managing property |

| Diversification | Spread risk across multiple properties |

| Professional Management | Leave the work to experts |

| Transparency | Most platforms provide regular updates |

⚖️ Legal Framework for Real Estate Funds in Kenya

Currently, the regulatory environment is still developing:

| Fund Type | Regulated By |

|---|---|

| REITs | Capital Markets Authority (CMA) |

| Crowdfunding | No formal regulation yet |

| SACCO Housing Schemes | SACCO Societies Regulatory Authority (SASRA) |

| Private Equity | CMA & Companies Act |

📌 As the market matures, expect stronger oversight and investor protections

📉 Real Estate Fund Performance (2025 Outlook)

Kenya’s real estate fund market is growing steadily, driven by:

- Rising smartphone and internet penetration

- Increased interest in digital investing

- Government support for alternative finance

- Growing urbanization and housing deficit

With the right strategy, real estate funds will continue to gain traction among young professionals, expatriates, and retirement savers.

🧾 Conclusion

Real estate investment funds in Kenya are opening up new doors for investors who want to benefit from property markets without the hassle of owning or managing buildings.

From REITs and mutual funds to crowdfunding and SACCO schemes , there are diverse ways to participate in the booming Kenyan real estate market.

Now is the perfect time to explore your options—and start building wealth through real estate, even with limited capital.

❓ Frequently Asked Questions (FAQs)

Q1: Are there REITs in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to income-generating commercial properties.

Q2: Can I invest in real estate funds with KES 100,000 or less?

A: Yes! Crowdfunding platforms like Zamara Africa and Eneza Investments accept small contributions.

Q3: Is investing in real estate funds safe in Kenya?

A: It depends on the provider—always verify the platform and developer before investing.

Q4: Do real estate funds pay dividends?

A: Yes, especially REITs, which distribute a portion of rental income to investors.

Q5: Can foreigners invest in real estate funds in Kenya?

A: Yes—especially through REITs and crowdfunding platforms.