What Are Real Estate Investment Groups?

A real estate investment group is a collective of individuals who come together to invest in property as a team. These groups may operate informally among friends or formally through structured platforms that facilitate group investments.

Key Features:

- Shared capital for larger property purchases

- Collective decision-making on investments

- Risk diversification across members

- Access to expert advice and mentorship

- Potential for higher returns through volume buying

These groups often focus on residential rentals, land banking, commercial property, or affordable housing developments.

Why Join a Real Estate Investment Group in Kenya?

Investing alone can be challenging due to high entry costs and the complexities of property management. Real estate investment groups offer several advantages:

Benefits:

- Lower financial burden – Share upfront costs with other investors

- Access to better deals – Buy bulk or off-plan properties at discounted rates

- Shared responsibilities – Property management, maintenance, and tenant issues are handled collectively

- Learning opportunities – Gain insights from experienced investors

- Diversification – Invest in multiple properties or locations with smaller contributions

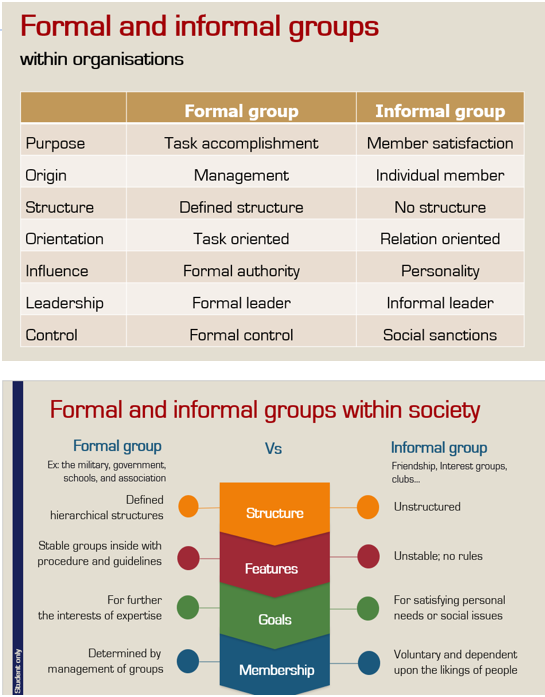

Types of Real Estate Investment Groups in Kenya

There are different models and structures for real estate investment groups depending on how they operate and where they invest.

1. Informal Investor Clubs

Small groups formed by friends, family, or colleagues pooling money to buy property together.

2. Formal Investment Platforms

Digital platforms that organize group investments and manage legal and financial processes.

3. Land Banking Groups

Focus on buying undeveloped plots in emerging areas for long-term appreciation.

4. REIT-Based Investment Groups

Groups investing collectively in Real Estate Investment Trusts (REITs) listed on the Nairobi Securities Exchange.

5. Affordable Housing Cooperatives

Community-based groups targeting government-backed affordable housing schemes.

Top Real Estate Investment Platforms & Groups in Kenya

Several platforms and organizations help individuals form or join real estate investment groups:

1. Jamii Housing

A digital platform that allows investors to pool funds and participate in group-owned properties. Focuses on affordable housing and land development.

2. Mkopo Rahisi Housing Scheme

Government-backed program offering subsidized homes to Kenyan citizens. Investors can form groups to qualify for bulk discounts.

3. REA Group (Realestate.co.ke)

Provides market data and connects investors with developers and joint venture opportunities.

4. Kenya Real Estate Investors Association (KREIA)

Offers networking, mentorship, and group investment opportunities for members.

5. Local Investment Clubs

Many community-based investor groups meet regularly to discuss opportunities and pool resources.

How to Join a Real Estate Investment Group

Joining an existing group is a great way to start investing with minimal effort. Here’s how to get started:

Steps to Join:

- Research Available Groups – Use online platforms or attend real estate events.

- Attend Meetings or Webinars – Learn about the group’s goals and investment style.

- Review Membership Requirements – Some groups charge fees or require minimum contributions.

- Commit Funds – Decide how much you want to invest.

- Sign Legal Agreements – Ensure clear terms around profit sharing, decision-making, and exit strategies.

How to Start Your Own Real Estate Investment Group

If you can’t find a group that fits your goals, consider starting your own.

Steps to Form a Group:

- Define Your Investment Goal – Residential, commercial, land, etc.

- Recruit Members – Invite trusted individuals or use social media/forums.

- Set Clear Rules – Draft agreements on contributions, voting rights, and profit sharing.

- Choose a Legal Structure – Consider registering as a cooperative or limited liability partnership.

- Find Properties Together – Use platforms like Realestate.co.ke or partner with developers.

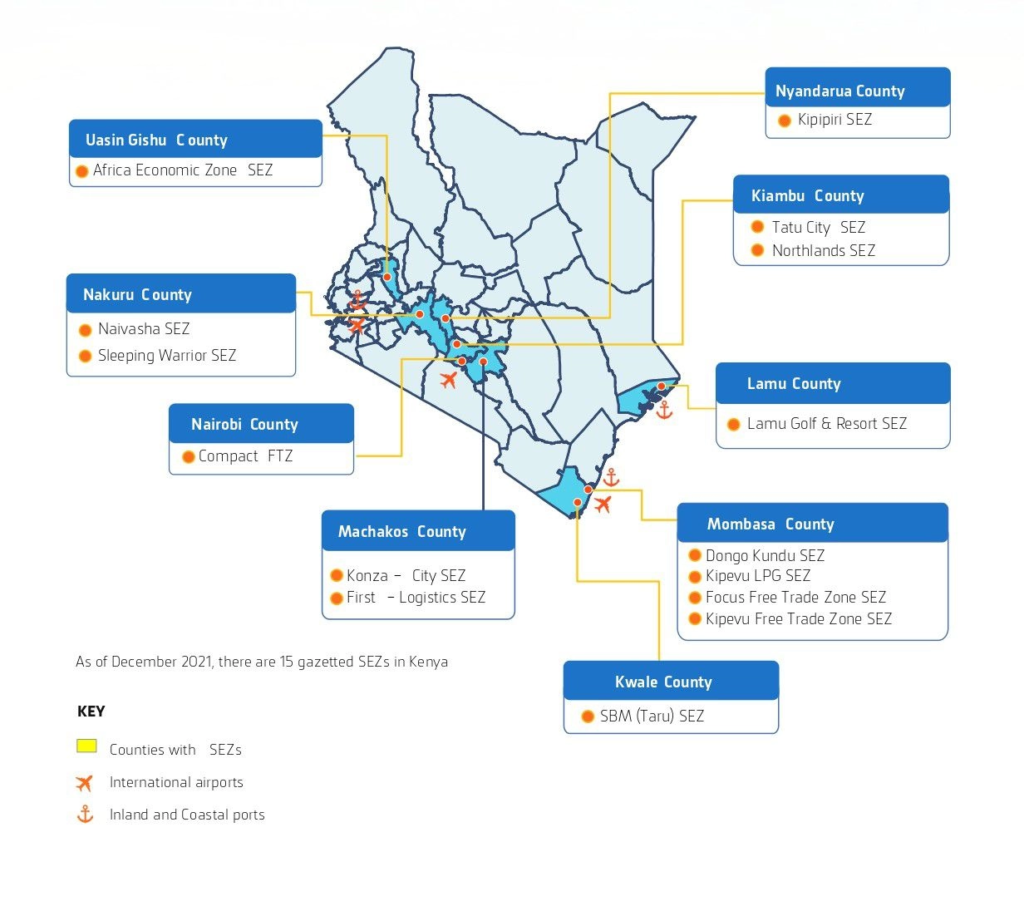

Popular Real Estate Investment Areas for Group Investments

Certain regions are particularly attractive for group investments due to affordability and growth potential.

Top Locations:

- Nairobi Satellite Towns – Ruiru, Thika, Machakos

- Coastal Regions – Mombasa, Malindi, Diani

- Secondary Cities – Kisumu, Nakuru, Eldoret

- Gated Communities – Runda, Karen, Lavington

Tips for Successful Group Investing

Maximize your return and minimize conflict with these expert-backed strategies:

✅ Set clear expectations and roles

✅ Use formal agreements and legal support

✅ Keep finances transparent and auditable

✅ Make decisions democratically or delegate authority

✅ Have an exit plan for individual members

Avoid deals that promise unusually high returns without proper documentation or legal backing.

Frequently Asked Questions

Can foreigners join real estate investment groups in Kenya?

Yes, though some restrictions apply depending on ownership structure and land tenure type.

Are real estate investment groups regulated in Kenya?

Some are registered under the Capital Markets Authority or Cooperative Societies Act, but many operate informally.

What is the minimum investment amount?

It varies by group and project, but many allow entry from as low as KES 50,000.