Why Invest in Real Estate in Kenya?

Kenya’s economy is one of the most stable and fastest-growing in East Africa, making it a hotspot for real estate opportunities.

Key Drivers of Real Estate Growth:

- Rising middle class with increased purchasing power

- Urban migration to cities like Nairobi, Mombasa, and Kisumu

- Government investments in transport and housing

- Tech boom in Nairobi (“Silicon Savannah”)

- Favorable laws for foreign investors (leasehold up to 99 years)

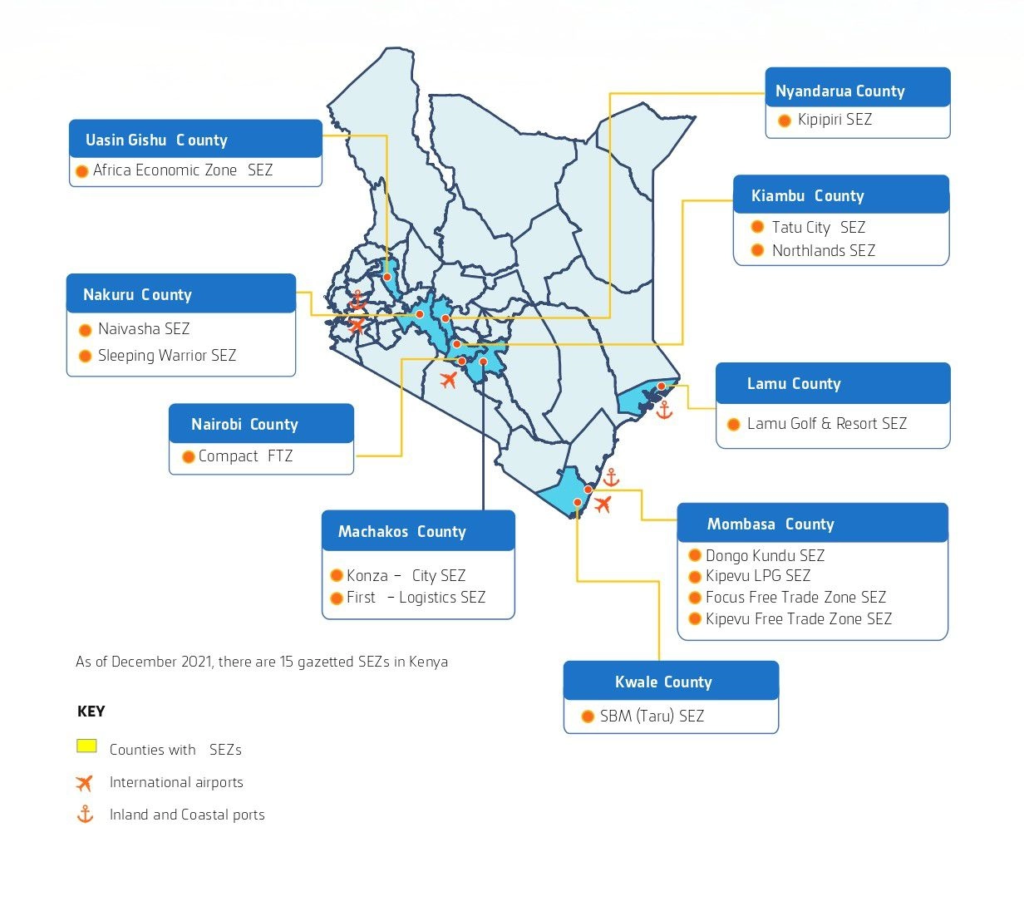

Top Cities for Real Estate Investment

Different regions offer unique investment opportunities based on demand, price trends, and future development plans.

1. Nairobi

The capital city is the most developed and offers high-end residential and commercial properties. Popular areas include:

2. Mombasa

Kenya’s coastal hub is ideal for tourism-related properties and beachfront homes. Areas like Nyali and Bamburi are highly sought after.

3. Kisumu

Fast-developing secondary cities with lower entry costs and rising demand from professionals and students.

4. Machakos

Satellite towns near Nairobi experiencing rapid growth due to affordable housing and improved infrastructure.

Types of Real Estate Investments in Kenya

There are several ways to invest in real estate depending on your budget and goals.

1. Residential Properties

Includes apartments, townhouses, and single-family homes. Ideal for steady rental income.

2. Commercial Properties

Offices, retail shops, and mixed-use buildings typically offer higher returns but require more capital.

3. Land Banking

Buying undeveloped plots in emerging areas for long-term appreciation.

4. Fixer-Uppers

Properties needing renovation sold at lower prices. Investors buy, upgrade, and either rent or sell for profit.

How to Start Investing in Real Estate in Kenya

Follow these steps to begin your real estate investment journey:

Step 1: Define Your Investment Goals

Are you investing for:

- Monthly rental income?

- Long-term appreciation?

- Short-term flipping?

Your goal will determine your strategy and property type.

Step 2: Choose the Right Location

Focus on areas with:

- Good infrastructure

- Proximity to schools, hospitals, and shopping centers

- Future development plans by the government or private developers

Step 3: Set a Realistic Budget

Include:

- Property price

- Legal fees and stamp duty

- Registration costs

- Renovation or furnishing expenses

Beginners can start small with studio flats or shared housing units.

Step 4: Explore Financing Options

You can fund your investment through:

- Personal savings

- Bank mortgages (offered by Housing Finance, Co-op Bank, Stanbic)

- Crowdfunding platforms like Jamii Housing

- Joint ventures or partnerships

Legal Process of Buying Property in Kenya

Understanding the legal framework ensures a smooth and secure transaction.

Steps Involved:

- Find a Property – Use platforms like Realestate.co.ke or work with a licensed agent.

- Conduct Due Diligence – Verify title deeds, check for encumbrances, and confirm ownership.

- Sign a Sale Agreement – A preliminary contract outlining terms.

- Pay Deposit – Usually 10% of the total price.

- Apply for Transfer – Submit forms at the Lands Office and pay required fees.

- Wait for Registration – Takes approximately 3–6 months.

Always involve a licensed conveyance lawyer to handle documentation and ensure compliance.

Rental Market and Returns

Kenya offers competitive rental yields, especially in urban areas.

Average Monthly Rents (as of 2025):

- Nairobi: Studio apartments – KES 15,000 to KES 25,000

- Mombasa: One-bedroom flat – KES 12,000 to KES 20,000

- Kisumu: Single room – KES 5,000 to KES 8,000

If managing properties remotely, consider hiring a property management company to help with tenant screening, rent collection, and maintenance.

Common Mistakes to Avoid

Avoid these pitfalls to protect your investment:

❌ Buying without verifying title deeds

❌ Ignoring hidden costs like service charges and taxes

❌ Investing solely based on hearsay

❌ Over-leveraging with too much debt

❌ Failing to plan for vacancies or repairs

Frequently Asked Questions

Can foreigners invest in real estate in Kenya?

Yes, foreigners can lease property for up to 99 years. Freehold ownership is restricted to Kenyan citizens.

Is real estate a good investment in Kenya?

Yes, especially in urban areas where demand exceeds supply and rental yields are favorable.

What is the average return on real estate investment?

It ranges between 4% and 8%, depending on location and property type.

Conclusion

Real estate investment in Kenya offers excellent opportunities for wealth creation and passive income. Whether you’re buying your first apartment or expanding into commercial property, following the steps outlined in this guide will help you make informed decisions and avoid costly mistakes.

With careful planning, research, and strategic execution, real estate can be a powerful tool for building long-term financial security in Kenya.