What Is a Real Estate Investment Trust (REIT)?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after stock exchanges, REITs allow individuals to invest in large-scale, income-producing properties without having to buy, manage, or finance them directly.

In Kenya, REITs are regulated by the Capital Markets Authority (CMA) under the Capital Markets Act.

Why Invest in REITs in Kenya?

Kenya’s growing economy, urbanization, and expanding middle class have led to increased demand for commercial and residential real estate — making REITs an attractive investment vehicle.

Key Benefits:

- Low entry barrier – You can start with small amounts

- Passive income – Regular dividends from rental income

- Liquidity – Unlike physical property, REITs can be traded on the Nairobi Securities Exchange (NSE)

- Diversification – Spread risk across different property types and locations

- Professional management – No need to handle tenant issues or maintenance

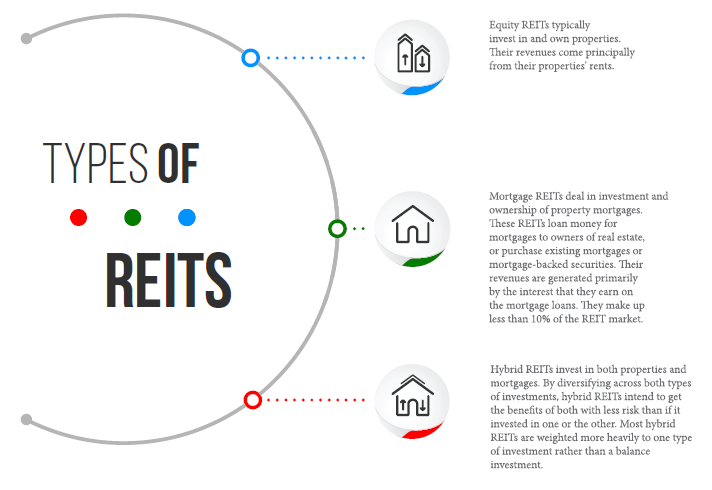

Types of REITs Available in Kenya

There are three main types of REITs based on asset class and operation:

1. Equity REITs

Own and operate income-generating properties like office blocks, shopping centers, and hotels.

2. Mortgage REITs

Provide financing for real estate by purchasing or originating mortgages and earning interest.

3. Hybrid REITs

Combine elements of both equity and mortgage REITs.

How Real Estate Investment Trusts Work in Kenya

Here’s a simplified breakdown of how REITs function:

- Pooling Funds: Investors contribute money into a trust.

- Property Acquisition: The REIT buys or develops income-generating real estate.

- Rental Income Generation: Properties are leased out to tenants.

- Profit Distribution: At least 80% of the REIT’s income must be distributed to investors as dividends.

- Trading on NSE: Some REITs are listed on the Nairobi Securities Exchange for easy buying and selling.

Top Real Estate Investment Trusts in Kenya

While the REIT market in Kenya is still emerging, a few key players have started to gain traction:

1. Stanlib Fahari I-REIT

- Focuses on commercial and retail real estate

- Listed on the Nairobi Securities Exchange

2. Absa REIT Fund

- Managed by Absa Asset Management

- Invests in prime commercial properties

3. Britam REIT Opportunities Fund

- Targets high-yield real estate across Kenya

- Open to institutional and individual investors

These REITs offer diversified exposure to Kenya’s booming real estate sector.

Legal Framework and Regulations

The Capital Markets Authority (CMA) regulates REITs in Kenya under the following guidelines:

- Minimum fund size: KES 50 million

- Must distribute at least 80% of annual taxable income to investors

- Must be listed on the Nairobi Securities Exchange within 5 years of registration

- Professional management required

- Independent trustee oversight

These regulations ensure transparency, investor protection, and long-term sustainability of REITs.

How to Invest in a REIT in Kenya

Investing in a REIT is similar to buying shares on the stock market.

Steps to Get Started:

- Open a Brokerage Account – With a licensed stockbroker registered with CMA.

- Research Available REITs – Review performance, portfolio, and dividend history.

- Buy Units – Through the Nairobi Securities Exchange or directly from fund managers.

- Monitor Performance – Track your investment and receive regular dividends.

You can start with as little as KES 10,000 depending on the fund.

Risks and Challenges of Investing in REITs

While REITs offer many advantages, it’s important to be aware of potential risks:

- Market volatility – Prices fluctuate based on economic conditions

- Regulatory changes – New laws may affect returns or operations

- Tenant defaults – Can impact rental income and dividends

- Limited control – Investors don’t influence property decisions

However, these risks are generally lower compared to direct real estate ownership.

Frequently Asked Questions

Are REITs a good investment in Kenya?

Yes, especially for those seeking passive income and diversification without managing properties.

Can foreigners invest in Kenyan REITs?

Yes, provided they meet regulatory requirements and use a local broker.

How often do REITs pay dividends?

Most REITs distribute dividends quarterly or semi-annually.

Conclusion

Real Estate Investment Trusts (REITs) offer a modern and accessible way to invest in Kenya’s booming real estate market. Whether you’re an individual investor looking for steady income or an institution seeking portfolio diversification, REITs provide a structured and professionally managed option.

By understanding how REITs work, knowing where to invest, and staying informed about market trends, you can build wealth through real estate without the complexities of property ownership.