Real Estate Investment Trusts (REITs) are transforming the way people invest in real estate—by allowing small investors to earn returns from income-generating properties without owning land or buildings directly.

In Kenya, REITs in Kenya are still emerging but gaining traction among institutional and retail investors. Whether you’re looking for passive income , portfolio diversification , or long-term appreciation , REITs offer a modern, hands-off approach to real estate investment.

📌 What Are REITs?

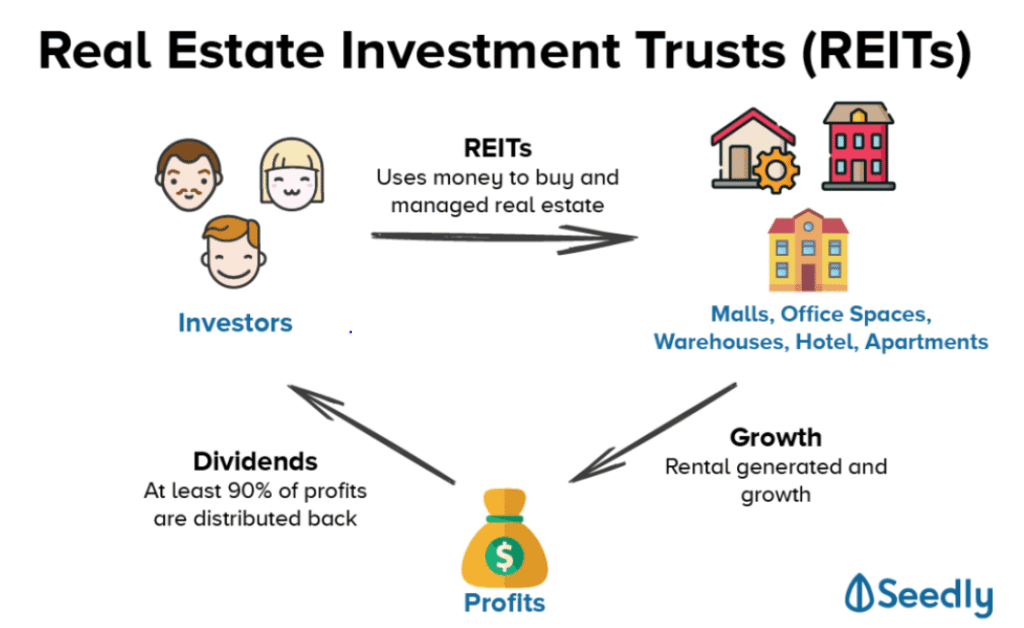

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate such as malls, office towers, hotels, or warehouses.

Instead of buying property outright, you buy shares in a trust—and receive regular dividends from rental yields .

Key Features:

- Minimum investment required

- Passive income through dividends

- Regulated by the Capital Markets Authority (CMA)

- Transparent and liquid compared to traditional real estate

📌 Example: If you own shares in a Nairobi mall REIT, you earn a portion of the rental income paid by tenants.

🧾 Types of REITs in Kenya

Here are the main types of REITs currently being explored or launched:

| Type | Description |

|---|---|

| Equity REITs | Owns and manages commercial properties like malls and office towers |

| Mortgage REITs | Lends money to property owners or buys mortgage-backed securities |

| Hybrid REITs | Combines equity and mortgage models |

📌 Kenya’s market is currently dominated by Equity REITs due to strong commercial real estate growth.

🔝 Top REITs Available in Kenya (2025)

While still relatively new, a few key players are shaping Kenya’s REIT landscape:

| REIT Name | Operator | Focus Property |

|---|---|---|

| Centum REIT | Centum Investment Company | Garden City Mall, Two Rivers Mall, and residential towers |

| Britam REIT | Britam Holdings | Commercial buildings and asset management |

| Nairobi REIT Fund | Local fund managers | Office and retail space in Nairobi CBD |

| Industrial REIT | Private Equity Firms | Warehouses and logistics-linked developments |

| Coastal REIT | Mombasa-based investors | Hotels and resorts along the Kenyan coast |

📌 These trusts allow small investors to benefit from large-scale developments without managing property directly.

📊 Expected Returns from Kenyan REITs

Investing in REITs can provide regular income and long-term capital gains:

| REIT Type | Average Annual Dividend Yield | Capital Appreciation Potential |

|---|---|---|

| Retail Mall REITs | 6% – 10% | Moderate |

| Office Space REITs | 7% – 12% | Strong |

| Industrial REITs | 8% – 14% | High |

| Coastal Tourism REITs | 6% – 10% | Seasonal variation |

📈 Compared to traditional savings accounts or bonds, REITs offer superior returns and stability.

🧭 How to Invest in REITs in Kenya

Here’s how you can start investing:

Step 1: Open a CDS Account

To trade REITs listed on the Nairobi Securities Exchange (NSE), you need a Central Depository & Settlement (CDS) account .

Step 2: Choose a REIT

Research available REITs and select one based on your goals and risk appetite.

Step 3: Buy Units or Shares

You can invest in REITs through:

- The NSE (for publicly traded REITs)

- Private funds (offered by developers or banks)

📌 Minimum investment varies—from KES 100,000 upwards depending on the fund.

📈 Benefits of Investing in REITs in Kenya

| Benefit | Explanation |

|---|---|

| Low Entry Barrier | Start with as little as KES 100,000 |

| Passive Income | Earn regular dividends from rental income |

| Diversification | Spread risk across multiple properties |

| Professional Management | No need to manage tenants or maintenance |

| Transparency | Publicly listed REITs publish quarterly reports |

📌 REITs are ideal for retirement planning, portfolio diversification, and steady income generation.

🚨 Risks and Challenges of REITs

Like any investment, REITs come with risks:

| Risk | Explanation |

|---|---|

| Market Volatility | REIT values can fluctuate with economic conditions |

| Tenant Vacancies | Low occupancy affects dividend payouts |

| Regulatory Gaps | Kenya’s REIT framework is still evolving |

| Limited Options | Only a few REITs are active in Kenya today |

| Developer Reliance | Returns depend on the success of underlying projects |

📌 Always review the REIT’s prospectus and consult a licensed financial advisor before investing.

🏢 How REITs Work With Major Developers

Some of Kenya’s top developers are exploring or already operating under REIT structures:

| Developer | REIT Involvement |

|---|---|

| Centum Investment Co. | OperatesCentum REIT, focusing on Garden City and Two Rivers Mall |

| Britam Properties | Offers REIT-linked income opportunities through asset management |

| Home Afrika Limited | Exploring REIT options for future housing schemes |

| Sameer Africa | Considering commercial REIT for Karen Country Homes and Muthaiga Villas |

| Garden City Group | Part of Centum REIT offering |

📌 These firms partner with the Capital Markets Authority (CMA) to ensure legal compliance.

📉 Market Trends Driving REIT Growth in Kenya

Several factors are making REITs more attractive:

| Trend | Impact |

|---|---|

| Government Housing Programs | Encouraging alternative financing models |

| Digital Platforms | Easier access to REITs via mobile apps and online brokers |

| Smart Cities Development | Tatu City and Konza attract institutional REIT investment |

| Rising Demand for Passive Income | More investors seek stable returns without direct ownership |

| Foreign Investor Interest | REITs appeal to expatriates and diaspora investors |

📈 As the sector matures, more REIT options will become available to local investors.

Frequently Asked Questions (FAQs)

Q1: Are there REITs in Kenya?

A1: Yes, Kenya launched its first REIT in 2020—offering small investors access to income-generating commercial properties.

Q2: Can I invest in REITs with KES 100,000 or less?

A2: Some REITs allow small investments through digital platforms and NSE-listed funds.

Q3: Is investing in REITs safe in Kenya?

A3: Yes—if you choose CMA-regulated REITs and conduct proper research.

Q4: Do REITs pay dividends?

A4: Yes—REITs distribute at least 80% of annual profits to investors as dividends.

Q5: Can foreigners invest in Kenyan REITs?

A5: Yes—through local brokerage platforms or digital investment apps linked to the Nairobi Securities Exchange.