What Are Real Estate Shares?

Real estate shares refer to stocks or securities linked to real estate companies or Real Estate Investment Trusts (REITs) . These allow investors to own a portion of income-generating properties like malls, offices, residential complexes, and industrial parks — without having to purchase land or buildings directly.

📈 Think of it like buying shares in a company — except the company owns and manages real estate.

Types of Real Estate Shares Available in Kenya

Here are the main ways you can invest in real estate shares in Kenya :

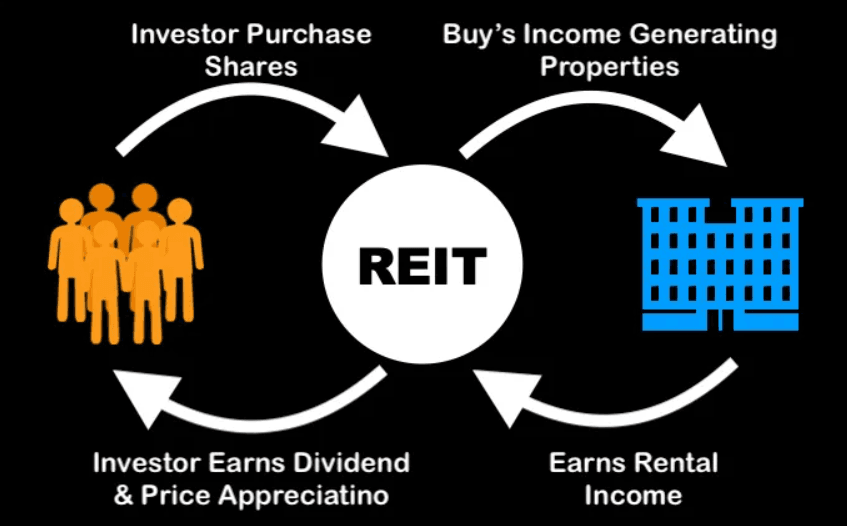

1. Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate. They’re required by law to distribute most of their profits as dividends — making them attractive for passive income seekers.

Kenya is currently developing its REIT framework under the Capital Markets Authority (CMA), and several institutions are preparing to launch REIT products.

2. Stock Market Listings

Some Kenyan firms listed on the Nairobi Securities Exchange (NSE) are involved in real estate development and construction. Investing in these stocks gives indirect exposure to the property sector.

Examples include:

- Reckitt Investments Ltd – Owns commercial and residential property

- Kenya Re Insurance Company – Holds a large property portfolio

- Mumias Sugar Company – Owns significant land and infrastructure assets

3. Crowdfunding Platforms

Online platforms like Jamii Funder , Pezesha , or international services such as Bricknode and Fundrise allow small investors to pool money and fund real estate projects in Kenya.

These platforms often offer returns through rental income or capital appreciation.

Benefits of Investing in Real Estate Shares

✅ Low Entry Barrier – You can start with as little as KES 5,000.

✅ Liquidity – Unlike physical property, shares can be bought and sold quickly.

✅ Diversification – Spread your risk across multiple properties and locations.

✅ Passive Income – Many real estate-related stocks and REITs pay regular dividends.

✅ No Management Hassles – No need to deal with tenants, maintenance, or repairs.

How to Buy Real Estate Shares in Kenya

Here’s how you can start investing today:

Step 1: Open a Brokerage Account

Use a licensed stockbroker registered with the Capital Markets Authority (CMA) , such as:

- Genghis Capital

- Aurora Investment Bank

- Stanbic IBTC

- NCBA Securities

Step 2: Research Real Estate-Linked Stocks

Look for companies on the NSE that have significant real estate holdings or development projects.

Step 3: Monitor REIT Developments

Stay updated on upcoming Kenyan REIT launches through the CMA or financial news outlets like Business Daily Africa and The Standard.

Step 4: Explore Crowdfunding Platforms

Sign up on real estate crowdfunding sites that accept Kenyan investors.

Challenges to Be Aware Of

While real estate shares offer many benefits, here are some potential risks:

⚠️ Market Volatility – Stock prices can fluctuate based on economic conditions.

⚠️ Regulatory Delays – Kenya’s REIT market is still emerging.

⚠️ Platform Risks – With crowdfunding, always verify platform legitimacy before investing.

Frequently Asked Questions (FAQs)

Q: Can I invest in real estate without buying land in Kenya?

A: Yes — through real estate shares, REITs, NSE-listed companies, and crowdfunding platforms.

Q: Are REITs available in Kenya?

A: Not yet widely available, but the CMA is actively working on formalizing REIT structures.

Q: How do I buy real estate shares in Kenya?

A: Through licensed brokers on the Nairobi Securities Exchange or via online crowdfunding platforms.

Q: Do real estate shares pay dividends?

A: Yes — especially REITs and real estate-linked stocks, which often distribute regular dividends.