📌 Types of Real Estate Taxes in Kenya

Here are the main taxes that affect real estate owners and investors:

1. Stamp Duty

What It Is:

A tax paid when transferring land or property ownership.

Rate:

- Residential Property : 2% of sale price

- Commercial Property : 4% of sale price

📌 Paid by the buyer and collected by the Registrar of Titles .

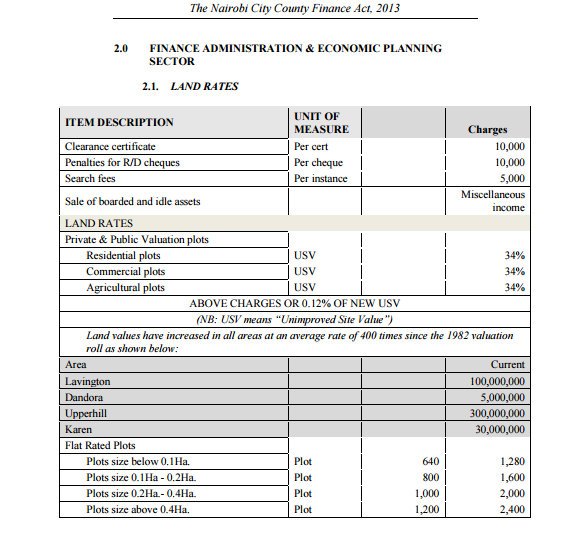

2. Land Rates

What It Is:

Local property tax charged by county governments based on land value.

Who Pays:

All property owners in urban areas like Nairobi, Mombasa, and Kisumu.

📌 Collected by local municipal councils or city authorities.

3. Capital Gains Tax

What It Is:

A tax on profits made from selling property.

Current Status:

- Capital gains tax on land was abolished in 2015

- However, gains from shares in REITs or real estate companies may be taxable

📌 Always consult a tax expert before selling property.

4. Income Tax on Rental Income

What It Is:

Rent earned from property is considered taxable income.

Tax Rate:

- 30% flat rate on gross rent (if not itemized)

- Lower if expenses like maintenance, mortgage interest, or management fees are claimed

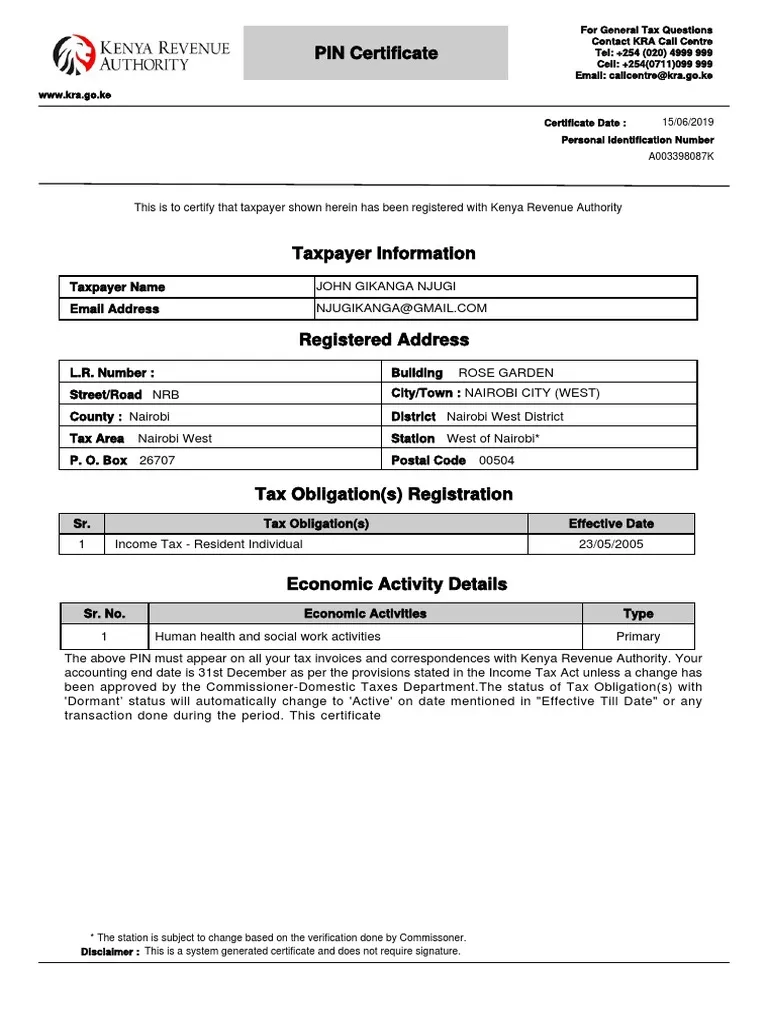

📌 Must be declared under Kenya Revenue Authority (KRA) .

5. Withholding Tax on Rent (for Non-Residents)

What It Is:

Foreign investors collecting rent from Kenyan property are subject to 30% withholding tax .

📌 Applies to expatriates and offshore landlords.

6. Transfer Pricing Rules (for large developers)

What It Is:

Rules ensuring fair valuation during property transfers between related parties.

📌 Enforced by KRA to prevent undervaluation and tax evasion.

7. Value Added Tax (VAT) on New Developments

What It Is:

Developers must charge VAT at 16% on new property sales unless exempt.

📌 Applies to off-plan developments and speculative construction.

🧭 Who Collects Real Estate Taxes?

| Tax Type | Collecting Authority |

|---|---|

| Stamp Duty | Registrar of Titles |

| Land Rates | Nairobi City County, Mombasa County, etc. |

| Rental Income Tax | Kenya Revenue Authority (KRA) |

| VAT on Sales | Kenya Revenue Authority (KRA) |

📌 All taxes should be filed via the iTax platform managed by KRA.

🧾 Step-by-Step Guide to Paying Real Estate Taxes

Here’s how to ensure you’re tax-compliant as a property owner:

Step 1: Register with KRA

Use your National ID and KRA PIN to register for property-related taxes.

Step 2: File Your Returns

Log into iTax and file returns quarterly or annually.

Step 3: Keep Records

Maintain records of rent received, maintenance costs, and agent commissions.

Step 4: Declare Income

Report all rental income and capital gains (where applicable).

Step 5: Renew Tax Compliance

Stay updated with annual land rates and KRA filings to avoid penalties.

📌 Tip: Use a certified accountant or property manager to help track and report your taxes.

📋 Common Deductions Allowed Under Real Estate Tax

You can reduce taxable rental income with these allowable deductions:

| Deduction | Description |

|---|---|

| Mortgage Interest | Only if used for income-generating property |

| Maintenance Costs | Repairs, painting, plumbing, and landscaping |

| Management Fees | Property management and brokerage fees |

| Insurance Premiums | Property insurance paid annually |

| Utilities | Water and electricity bills paid by landlord |

📌 These must be directly linked to income generation.

⚖️ Tax Implications for Different Property Owners

| Owner Type | Key Tax Notes |

|---|---|

| Individual Owner | Subject to 30% tax on net rental income |

| Corporate Entity | Company pays corporate tax on property income |

| Expatriate Investor | Withholding tax applies; leasehold property only |

| SACCO Housing Members | May benefit from lower tax brackets |

| Crowdfunding Investors | Taxed on share of rental income or profit |

| REIT Investors | Dividends taxed at source under PAYE |

📌 Always confirm your status with a licensed tax consultant.

🏢 Taxation Differences by Location

| Area | Additional Local Charges |

|---|---|

| Nairobi | Nairobi City County land rates |

| Mombasa | Mombasa County levies and service charges |

| Ruiru / Ruaka | Lower land rates but rising due to infrastructure growth |

| Coastal Regions (Diani, Malindi) | Tourism-linked taxes and community fees |

📌 Check with the county government for exact land rate amounts.

🚨 Common Tax Mistakes to Avoid

| Mistake | Consequence |

|---|---|

| Not declaring rental income | Fines and back taxes from KRA |

| Skipping land rates payments | Risk of repossession or fines |

| Misclassifying property use | Incorrect tax filing and penalties |

| Failing to update KRA details | Delays in tax clearance certificates |

| Ignoring tax changes | Policy updates can impact liabilities |

📌 Stay informed through the KRA website and tax advisory services.

📈 Emerging Trends in Real Estate Taxation (2025)

| Trend | Impact |

|---|---|

| Digital Tax Reporting | More agents and landlords using iTax for faster compliance |

| County-Level Reforms | Some counties are digitizing land rates collection |

| Green Building Incentives | Eco-friendly homes may receive tax breaks |

| REIT Growth | New rules around dividend taxation expected |

| Tourism Property Tax Adjustments | Short-term rentals may face stricter reporting requirements |

📈 As the market evolves, so do tax policies—especially for digital platforms and foreign investors.

🧾 Conclusion

Understanding the taxation of real estate in Kenya helps you manage your investment responsibly and avoid costly penalties.

From stamp duty and land rates to rental income tax and VAT , each transaction has its own set of rules—depending on property type, location, and ownership structure.

Whether you’re a first-time buyer, seasoned investor, or expatriate landlord, staying compliant ensures long-term profitability and peace of mind.

❓ Frequently Asked Questions (FAQs)

Q1: Do I pay tax on rental income in Kenya?

A: Yes, rental income is taxed at 30% unless deductions apply.

Q2: Is there capital gains tax on property in Kenya?

A: No, Kenya abolished capital gains tax on land and buildings in 2015.

Q3: What is the stamp duty on property transfer?

A: 2% for residential , 4% for commercial property , paid by the buyer.

Q4: Can foreigners pay property tax in Kenya?

A: Yes, expatriate landlords are subject to withholding tax at 30% on rent.

Q5: Are REIT dividends taxable in Kenya?

A: Yes, REIT dividends are taxed at source under PAYE (Pay As You Earn)