📈 Current Real Estate Trends in Kenya (2025)

Here are the most impactful trends defining the current state of real estate in Kenya :

📌 These shifts are making Kenya’s real estate market more transparent, accessible, and inclusive.

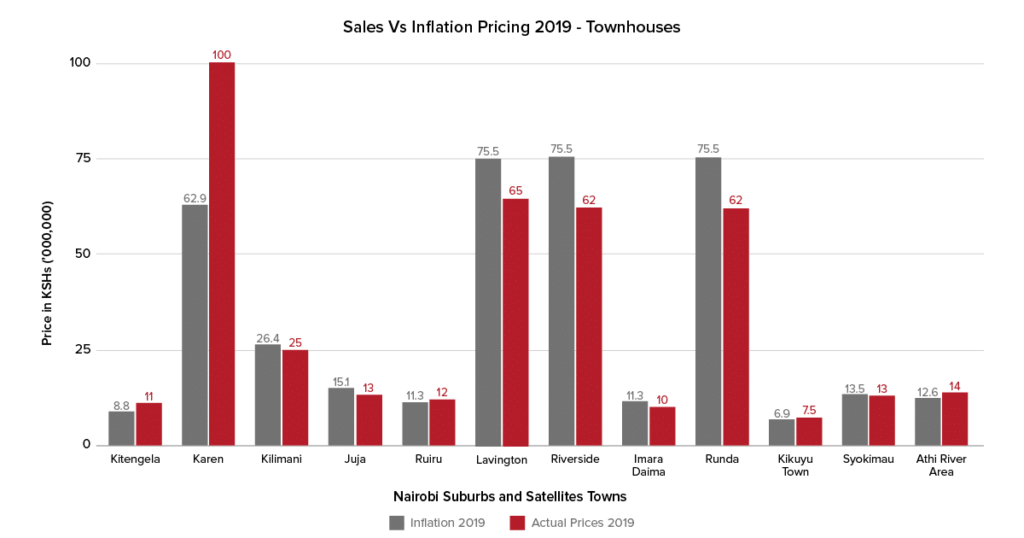

🏢 Property Prices and Investment Returns

Real estate prices vary widely based on location and type:

| Property Type | Nairobi Price Range (KES) | Coastal Region (KES) |

|---|---|---|

| 3-Bedroom Apartment | 4M – 7M | 6M – 10M |

| Affordable House | 2.5M – 4M | 4M – 6M |

| 1 Acre of Land | 1.5M – 3M | 5M – 10M |

| Office Space (per sq.ft.) | 15,000 – 30,000 | 20,000 – 40,000 |

| Retail Shop (per sq.ft.) | 10,000 – 20,000 | 15,000 – 30,000 |

📈 Expected ROI:

- Residential rentals: 5%–8%

- Commercial properties: 7%–12%

- Land banking: 10%–20% appreciation annually

🌆 Urban Growth and Infrastructure Development

Kenya’s cities are expanding fast, especially in Nairobi, Mombasa, and Eldoret.

Major Infrastructure Projects Driving Growth:

- Nairobi Expressway

- Standard Gauge Railway (SGR) expansion

- Thika Superhighway upgrades

- Jomo Kenyatta International Airport improvements

- Konza Technopolis development

📌 These projects are boosting land values and attracting foreign investment.

🏗️ Emerging Real Estate Developments

New and exciting developments are changing how people live and invest:

| Project | Location | Highlights |

|---|---|---|

| Tatu City | Thika | Integrated urban city with residential, industrial, and commercial zones |

| Two Rivers Mall | Kahawa Sukari | Mixed-use retail and residential space |

| Nyumba Yetu Scheme | Ruaka | Affordable housing under Big Four Agenda |

| Umoja Village | Ruiru | High-quality affordable homes with modern amenities |

| Garden City Mall Expansion | Westlands | Upcoming residential towers and office spaces |

📌 These projects reflect growing demand and better planning.

💰 Real Estate Financing and Mortgage Access

Financing remains a challenge but is improving through various channels:

| Financier | Avg. Mortgage Rate (2025) |

|---|---|

| Housing Finance Kenya | 13% – 16% p.a. |

| Co-operative Bank | 12% – 14% p.a. |

| KMRC Partner Banks | ~12% p.a. |

| SACCO-Based Loans | Varies by group |

📌 The government’s Big Four Affordable Housing Program continues to support mortgage lending for low- and mid-income buyers.

🚨 Challenges Still Facing the Sector

Despite its potential, real estate in Kenya faces several hurdles:

| Challenge | Explanation |

|---|---|

| High Construction Costs | Rising material prices affect affordability |

| Lengthy Legal Processes | Title verification can take months |

| Land Fraud | Fake title deeds and unlicensed brokers remain a concern |

| Market Saturation in Nairobi CBD | Oversupply affects rental yields |

| Lack of Standardized Valuation Systems | Inconsistent pricing leads to confusion |

📌 However, digitization and policy reforms are helping reduce these risks.

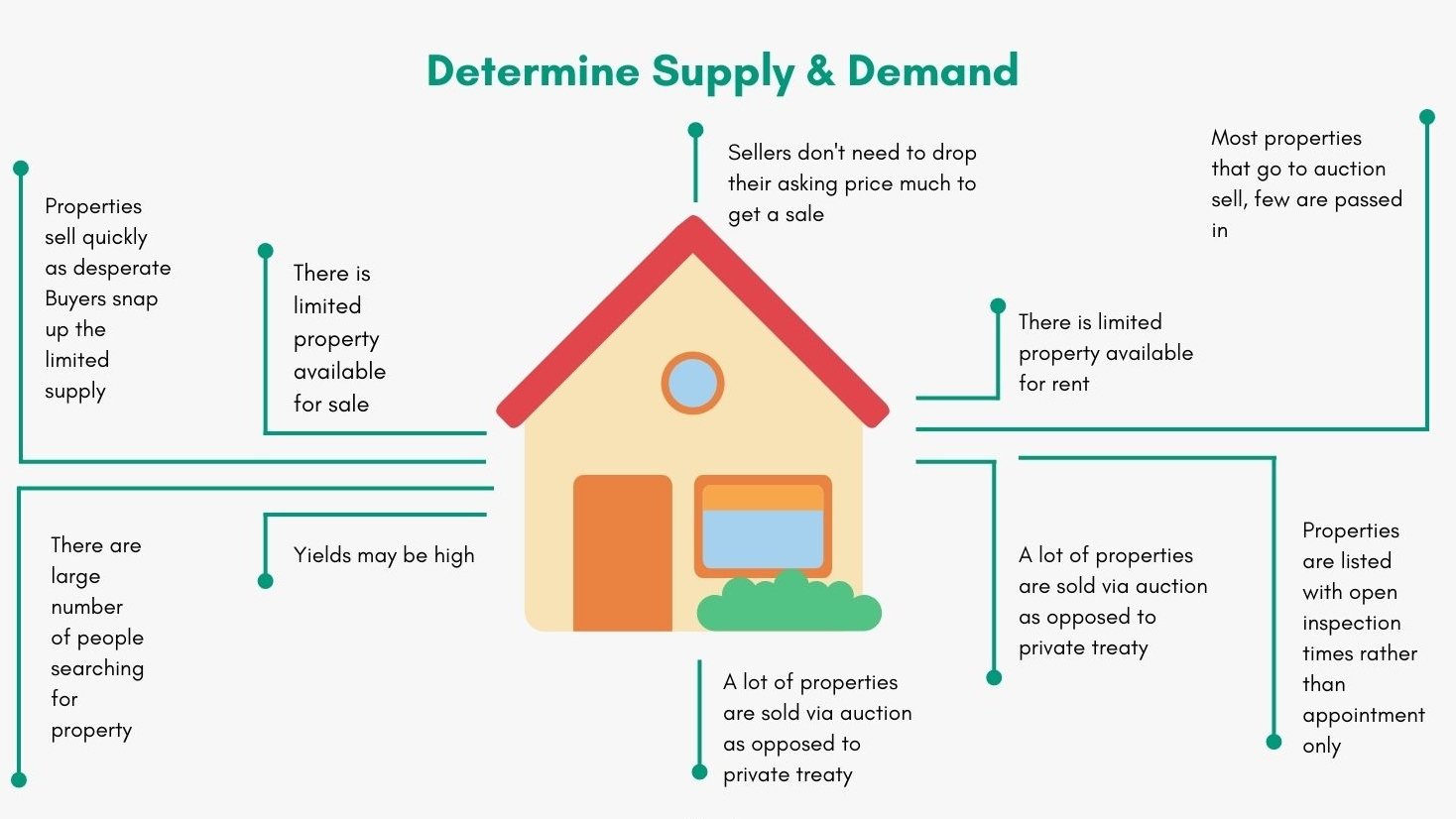

📉 Supply vs. Demand: Kenya’s Housing Gap

Kenya faces a housing deficit of over 2 million units , especially in urban centers.

Key Drivers of Demand:

- Population growth at 2.2% per year

- Migration to cities like Nairobi and Mombasa

- Rise in expatriate and diaspora investment

📌 While supply is increasing through developers and government partnerships, the gap remains significant—offering room for growth.

🧑💼 Careers and Professional Opportunities

As the sector grows, so do job opportunities:

| Role | Skills Required |

|---|---|

| Real Estate Agent | Sales, communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Mortgage Consultant | Financial analysis, customer service |

| Developer | Project management, finance, planning |

| PropTech Developer | Coding, data analysis, real estate knowledge |

| Green Building Consultant | Sustainable design, energy-efficient construction |

🎓 Many students from University of Nairobi , JKUAT , and Technical University of Kenya are entering the field.

🎓 Education and Training in Real Estate

Interest in real estate careers is rising, with more institutions offering relevant courses:

| Institution | Programs Offered |

|---|---|

| University of Nairobi | BSc in Real Estate |

| Jomo Kenyatta University of Agriculture and Technology (JKUAT) | Property Management |

| Technical University of Kenya (TUK) | Real Estate and Property Management |

| Kenya Methodist University (KeMU) | Real Estate Practice |

| Private Training Centers | Short courses via REAK and KIEA |

📌 Graduates often find roles in agencies, banks, and developer firms.

❓ Frequently Asked Questions (FAQs)

Q1: Is the real estate market in Kenya growing?

A1: Yes, Kenya’s real estate sector is growing steadily, supported by urbanization and infrastructure development.

Q2: Can foreigners buy property in Kenya?

A2: Foreigners cannot own freehold land but can lease land for up to 99 years.

Q3: What is the housing deficit in Kenya?

A3: Over 2 million units, especially in urban centers like Nairobi and Mombasa.

Q4: Are there REITs in Kenya?

A4: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial property.

Q5: How do I verify land ownership in Kenya?

A5: Always hire a licensed surveyor and advocate to check title deeds at the Registrar of Titles .