Kenya’s real estate market is one of East Africa’s most promising investment destinations. With urbanization, infrastructure development, and rising demand for housing and commercial spaces, there are many ways to invest—whether you’re a local buyer or an international investor.

In this guide, we’ll explore the top 10 real estate investments in Kenya , their expected returns, and how you can participate in each opportunity.

Let’s dive in!

🔝 The Top 10 Real Estate Investments in Kenya (2025)

Here are the best real estate investment strategies currently gaining traction:

1. Smart Cities Development (Tatu City, Konza Technopolis)

Why It’s Profitable:

These master-planned urban centers offer long-term appreciation as infrastructure expands.

📌 Expected ROI: 7% – 12% annually

📌 Ideal for: Long-term investors and developers

2. Affordable Housing Projects (Big Four Agenda)

Why It’s Profitable:

Government-backed schemes like Umoja Village and Nyumba Yetu offer low-cost entry with high rental demand.

📌 Expected ROI: **6% – 9% via rentals or resale

📌 Ideal for: First-time buyers and small-scale landlords

3. Land Banking in Emerging Areas (Naivasha, Athi River, Konza-linked zones)

Why It’s Profitable:

Buying undeveloped land before infrastructure projects arrive can lead to massive appreciation.

📌 Expected ROI: **10% – 20% appreciation over 5 years

📌 Ideal for: Passive investors and future developers

4. Commercial Property Investment (Malls, Office Towers)

Why It’s Profitable:

📌 Expected ROI: **7% – 12% via dividends or capital gains

📌 Ideal for: Institutional and retail investors

5. Coastal Short-Term Rentals (Diani, Malindi, Watamu)

Why It’s Profitable:

Tourism-driven vacation homes earn strong returns through platforms like Airbnb and local agencies.

📌 Expected ROI: **8% – 15% annually via short-term rentals

📌 Ideal for: Expatriates and lifestyle investors

6. REITs (Real Estate Investment Trusts)

Why It’s Profitable:

Kenya launched its first REIT in 2020—offering small investors access to income-generating properties.

📌 Expected ROI: **6% – 10% in annual dividends

📌 Ideal for: Hands-off investors and retirement portfolios

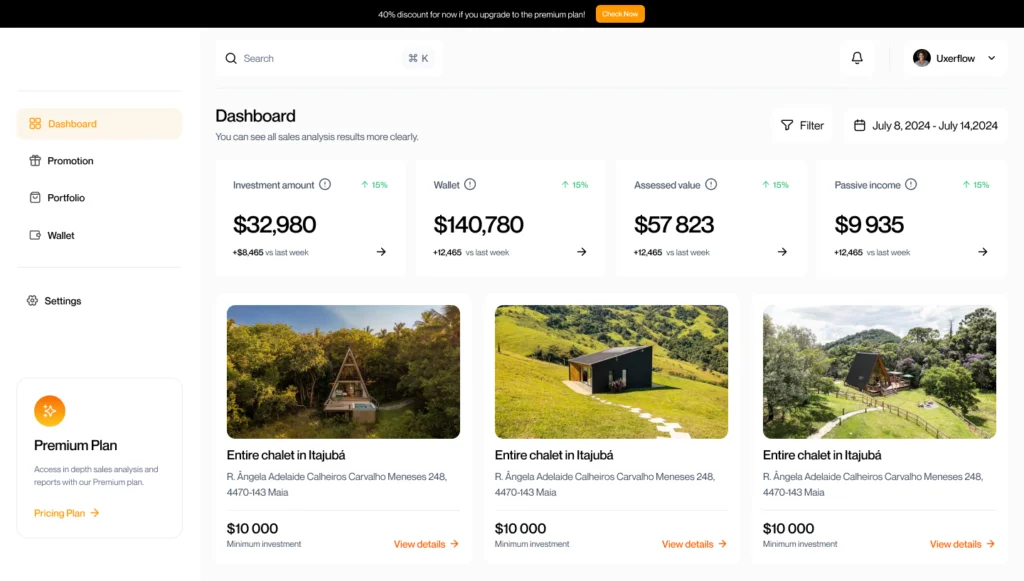

7. Crowdfunding Platforms (Zamara Africa, Eneza Investments)

Why It’s Profitable:

Digital platforms allow small investors to pool funds and buy into large developments.

📌 Expected ROI: **8% – 14% return on project completion

📌 Ideal for: Young professionals and expats with limited capital

8. Mixed-Use Developments (Garden City, ABC Place)

Why It’s Profitable:

Combining residential, retail, and office space increases foot traffic and asset value.

📌 Expected ROI: **8% – 12% annually via rentals

📌 Ideal for: Investors seeking diversified income streams

9. Luxury Residential Villas & Gated Communities (Karen, Lavington, Muthaiga)

Why It’s Profitable:

High-end properties remain in demand among professionals and expatriates.

📌 Expected ROI: **5% – 8% appreciation + rental income

📌 Ideal for: High-net-worth individuals and foreign investors

10. Industrial & Logistics Real Estate (Athi River, Mombasa Port Zone)

Why It’s Profitable:

With transport corridors expanding, warehouses and cold storage units offer strong returns.

📌 Expected ROI: **8% – 12% annually

📌 Ideal for: Institutional investors and logistics companies

🧭 How to Choose the Right Real Estate Investment

Here’s how to select the best option based on your goals:

| Investment | Best For | Minimum Entry |

|---|---|---|

| Smart Cities | Long-term growth | KES 500,000 – KES 2M per plot |

| Affordable Housing | First-time investors | KES 2.5M – KES 4M |

| Land Banking | Future appreciation | KES 500,000 – KES 1.5M per acre |

| Commercial Properties | Steady income | KES 5M+ for shop or office unit |

| Coastal Rentals | Tourism-driven returns | KES 7M+ for villa or cottages |

| REITs | Passive income | KES 100,000+ for shares |

| Crowdfunding | Low-capital entry | KES 50,000+ per stake |

| Mixed-Use Developments | Portfolio diversification | KES 4M+ |

| Luxury Homes | Lifestyle & prestige | KES 10M+ |

| Industrial Real Estate | Business-linked assets | KES 5M+ |

📌 Tip: Always verify title deeds and developer credentials before investing.

🚨 Common Risks to Watch Out For

While real estate offers strong returns, it’s important to be aware of potential risks:

| Risk | Explanation |

|---|---|

| Fraudulent Title Deeds | Fake titles still exist—use ISK-certified brokers |

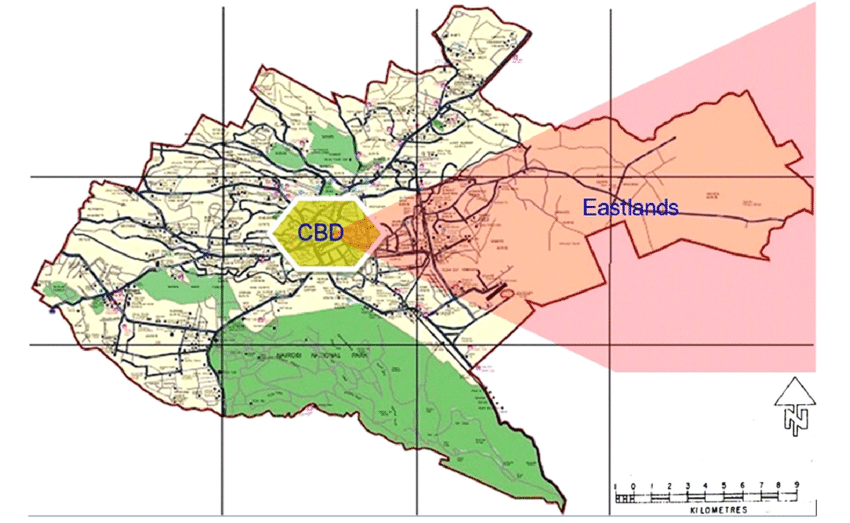

| Market Saturation in Nairobi CBD | Oversupply affects occupancy and yields |

| Construction Cost Inflation | Rising material prices impact new builds |

| Regulatory Delays | Some approvals take months to complete |

| Unregulated Platforms | Crowdfunding sites may lack oversight |

📌 Solution: Conduct due diligence and work with licensed professionals.

📊 Emerging Trends in Kenyan Real Estate Investment

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract institutional investment |

| Green Building Initiatives | Eco-friendly developments command premium pricing |

| REITs Expansion | Retail investors now access commercial assets |

| Remote Property Management | Enables overseas investors to manage Nairobi or coastal assets |

| Crowdfunding Models | Fractional ownership opens up prime property deals |

📈 These innovations are making real estate more inclusive and profitable.

Frequently Asked Questions (FAQs)

Q1: What is the best real estate investment in Kenya today?

A1: Land banking in Konza-linked zones and smart city plots offer some of the highest appreciation rates.

Q2: Can foreigners invest in real estate in Kenya?

A2: Yes—foreigners can lease land for up to 99 years and invest via REITs and crowdfunding platforms.

Q3: Are REITs available in Kenya?

A3: Yes—Kenya launched its first REIT in 2020, offering small investors access to commercial property.

Q4: Is real estate crowdfunding safe in Kenya?

A4: Yes—if you use trusted platforms like Zamara Africa or Eneza Investments .

Q5: How do I verify land ownership in Kenya?

A5: Hire a licensed land surveyor and advocate to check title deeds at the Registrar of Titles .