🏡 Types of Real Estate Investment Opportunities in Kenya

Here are the major categories of real estate opportunities available:

📌 Each offers different returns and entry points based on your budget and goals.

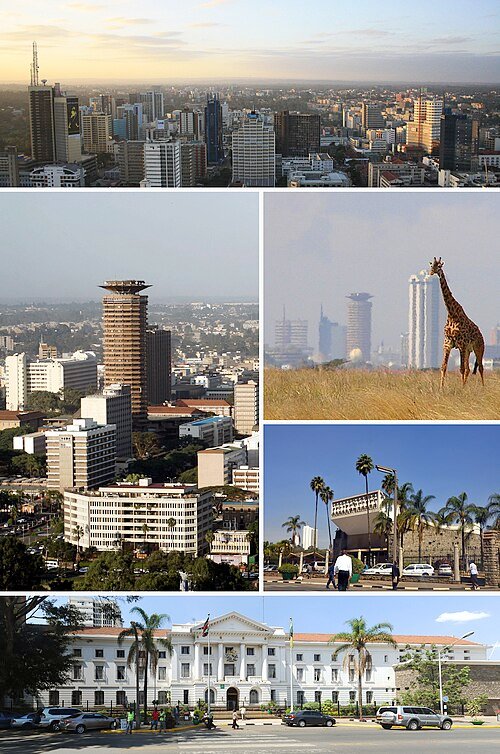

📍 Best Locations for Real Estate Opportunities in Kenya

Some areas offer higher appreciation and demand than others:

| Location | Why It’s Hot in 2025 |

|---|---|

| Karen / Lavington (Nairobi) | Upscale developments and strong resale value |

| Ruiru / Ruaka | Affordable housing boom near Nairobi |

| Konza Technopolis Zone | Tech city development attracting global tenants |

| Naivasha / Athi River | Strategic transport links and land banking |

| Mombasa Road Corridor | Industrial and residential growth |

| Diani / Malindi (Coastal Region) | Tourism-driven short-term rental yields |

💰 Expected Returns on Kenyan Real Estate Investments

Depending on location and property type, returns vary:

| Investment Type | Average Return |

|---|---|

| Residential Rentals (Nairobi) | 5% – 8% annually |

| Commercial Properties | 7% – 12% annually |

| Coastal Villas | 8% – 15% annually |

| Land Banking | 10% – 20% appreciation annually |

| Crowdfunding Projects | 8% – 14% return |

📈 These figures make Kenya one of the most attractive real estate markets in East Africa.

🧭 Step-by-Step Guide to Entering Kenya’s Real Estate Market

Here’s how to get started with real estate investment in Kenya:

Step 1: Define Your Budget & Goals

Are you looking for passive income, capital appreciation, or both?

Step 2: Research Listings Online

Use platforms like:

📌 Tip: Set alerts for keywords like “land for sale Nairobi” or “apartment for sale Karen”.

Step 3: Choose the Right Location

Consider proximity to amenities, transport, and future development plans.

Step 4: Conduct Due Diligence

Hire a licensed surveyor and advocate to verify title deeds and boundaries.

📌 Never skip this step—it protects you from fraud!

Step 5: Select an Investment Model

Choose between:

- Direct ownership

- REITs

- Crowdfunding platforms

- SACCO-based housing

📌 Each model suits different risk appetites and budgets.

Step 6: Make Your Investment

Secure the deal through verified payment methods and legal agreements.

🏢 Top Developers Offering Real Estate Opportunities in Kenya

📊 Comparison Table: Real Estate Investment Options

| Investment Type | Entry Cost | ROI | Risk Level |

|---|---|---|---|

| Residential Rentals | KES 2M+ | 5% – 8% | Low-Medium |

| Commercial Property | KES 5M+ | 7% – 12% | Medium |

| Land Banking | KES 500K – KES 2M per acre | 10% – 20% appreciation | Medium-High |

| Crowdfunding Projects | KES 50K – KES 2M | 8% – 14% | Medium |

| REITs | KES 100K+ | 6% – 10% dividend yield | Low-Medium |

📌 Always assess your financial capacity and risk tolerance before investing.

🚨 Risks and Challenges in Kenya’s Real Estate Sector

While the potential is high, these risks exist:

| Challenge | Explanation |

|---|---|

| Land Fraud | Fake titles and unlicensed agents remain a concern |

| Slow Legal Processes | Title verification can take months |

| Market Saturation in Nairobi CBD | Oversupply affects ROI |

| High Entry Costs | Some premium developments remain out of reach |

| Regulatory Gaps in New Models | Crowdfunding and REITs still evolving |

📌 Solution: Always work with ISK-certified brokers and legal experts.

📉 Emerging Trends in Kenyan Real Estate (2025 Outlook)

These trends are reshaping how property is bought, sold, and managed in Kenya.

🧾 Conclusion

Kenya offers diverse and profitable real estate opportunities for investors at all levels. From Nairobi’s luxury apartments to affordable housing, coastal villas, and land banking in emerging zones like Konza and Naivasha—there’s something for every investor.

With the right research, professional support, and strategic planning, now is an excellent time to enter the Kenyan real estate market.

Start exploring today—and unlock your potential in one of East Africa’s fastest-growing economies.

❓ Frequently Asked Questions (FAQs)

Q1: What are the best real estate opportunities in Kenya today?

A: Land banking, affordable housing, and mixed-use developments are among the top picks.

Q2: Are real estate prices rising in Kenya?

A: Yes, especially in Nairobi and coastal regions, though growth varies by location.

Q3: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q4: Can foreigners invest in real estate in Kenya?

A: Yes—through leasehold arrangements, crowdfunding, or REITs.

Q5: How much do I need to start investing in real estate in Kenya?

A: You can begin with as little as KES 50,000 via crowdfunding or KES 2M+ for direct property.