Real estate in Kenya refers to land and buildings used for residential, commercial, industrial, or mixed-use purposes. With rapid urbanization, infrastructure development, and increasing demand for housing, Kenya’s real estate sector has become one of the most dynamic in East Africa.

Whether you’re a first-time buyer, investor, or developer, understanding what real estate in Kenya entails is essential for making informed decisions.

In this guide, we’ll explore:

- The different types of real estate

- Key players in the industry

- How real estate works legally

- And investment opportunities across Nairobi, Mombasa, and emerging zones

Let’s dive in!

📌 What Does “Real Estate” Mean in Kenya?

In Kenya, real estate includes:

- Residential homes (apartments, townhouses, villas)

- Commercial buildings (offices, malls, shops)

- Industrial properties (warehouses, logistics hubs)

- Land for sale or lease (residential, agricultural, or commercial use)

📌 It also involves related services like property management, valuations, rentals, and real estate financing.

🧾 Types of Real Estate in Kenya

Here are the main categories of real estate available:

1. Residential Real Estate

- Includes apartments, gated communities, and luxury homes

- Popular areas: Karen, Lavington, Kilimani, Ruiru

📌 Ideal for homeowners and rental income seekers.

2. Land for Sale / Land Banking

- Residential plots, agricultural land, industrial zones

- Emerging hotspots: Naivasha, Athi River, Konza-linked areas

📌 Land banking offers high appreciation—up to 20% annually in growth corridors.

3. Commercial Real Estate

- Office spaces, retail shops, malls, business centers

- High-demand locations: Upper Hill, Westlands, Mombasa Road

📌 Expected ROI: 7%–12% annually from rent and appreciation.

4. Industrial & Logistics Real Estate

- Warehouses, cold storage units, factory buildings

- Growth hubs: Industrial Area (Nairobi), Port Reitz (Mombasa), Athi River

📌 Strategic for investors due to Kenya’s role as an East African logistics gateway.

5. Coastal & Holiday Homes

- Beachfront villas, short-term rentals, vacation cottages

- Top coastal regions: Diani, Malindi, Watamu

📌 Tourism-driven demand leads to strong short-term rental yields.

🏢 Key Players in the Kenyan Real Estate Sector

| Role | Who They Are |

|---|---|

| Developers | Home Afrika, Sameer Africa, Centum Investment Co., Prestige Group |

| Agents & Brokers | Buy Kenya , Knight Frank Kenya, Savills Kenya |

| Government Agencies | Ministry of Transport & Housing, National Land Commission |

| Financial Institutions | Housing Finance Kenya, Co-operative Bank, SACCOs |

| Regulatory Bodies | Institute of Surveyors of Kenya (ISK), Real Estate Association of Kenya (REAK) |

📌 These entities ensure legal compliance, financing access, and professional standards.

🧭 How Real Estate Works in Kenya – Step-by-Step Overview

Here’s how real estate transactions typically unfold:

1. Buyer/Seller Identifies Property

Via online platforms, agents, or direct listings.

2. Title Verification

Surveyor and advocate confirm ownership through the Registrar of Titles .

3. Negotiation & Offer

Price is agreed upon; booking fee may be paid.

4. Sale Agreement Signed

Legal document outlining terms and payment plan.

5. Stamp Duty Paid

2% on residential, 4% on commercial property.

6. Transfer Process

Lawyer prepares documents and completes registration at Land Registry.

📌 Timeline: Usually takes 4–8 weeks after agreement signing.

📊 Real Estate Market Snapshot (2025)

| Metric | Value |

|---|---|

| Urban population growth | 4% annually |

| Housing deficit | Over 2 million units |

| Average property price increase | 5%–10% per year |

| Mortgage penetration | Less than 1% (low but growing) |

| Nairobi property prices | KES 1.5M – KES 50M per plot/apartment |

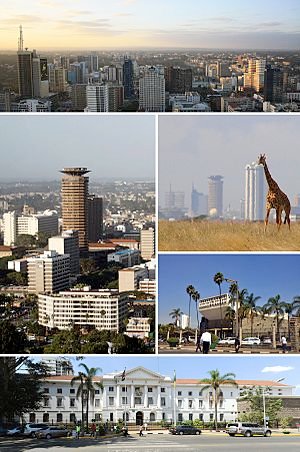

📈 Nairobi remains the epicenter of real estate activity, followed by Mombasa, Eldoret, and emerging zones like Naivasha and Konza .

💰 How People Invest in Real Estate in Kenya

There are several ways to invest:

| Method | Description |

|---|---|

| Direct Ownership | Buy land or property outright |

| REITs | Earn dividends from income-generating commercial assets |

| Crowdfunding Platforms | Pool funds via Zamara Africa or Eneza Investments |

| SACCO-Based Housing | Affordable schemes under Jamii Bora and Stima Housing |

| Off-Plan Property | Purchase before completion for potential resale gains |

📌 Entry point ranges from KES 50,000 (crowdfunding) to KES 2M+ (direct property).

🚨 Common Scams & How to Avoid Them

Here’s how to protect yourself:

| Scam Type | How to Avoid It |

|---|---|

| Fake Title Deeds | Always conduct a land search at the Land Registry |

| Double Selling | Verify that the seller is the sole owner |

| Unlicensed Agents | Use only ISK-certified brokers |

| Phony Developers | Research company background and past projects |

| Fraudulent Listings | Visit the property in person before paying any deposit |

📌 Pro tip: Work with certified professionals and consult with a lawyer before signing any deal.

⚖️ Legal Framework for Real Estate in Kenya

The sector is governed by key laws and institutions:

| Law | Purpose |

|---|---|

| Land Registration Act (2012) | Governs how land is registered and transferred |

| Land Act (2016) | Regulates land administration and use |

| Registration of Titles Act | Ensures authenticity of title deeds |

| National Land Commission Act | Manages public land and advises on policy |

📌 All real estate professionals must follow guidelines set by the Institute of Surveyors of Kenya (ISK) .

📈 Emerging Trends Shaping Real Estate in Kenya

| Trend | Impact |

|---|---|

| Smart Cities Development | Tatu City and Konza attract long-term investment |

| Green Building Initiatives | Sustainable developments gain traction |

| Digital Platforms | Online listing sites improve access and transparency |

| Affordable Housing Expansion | Government-backed programs reaching new buyers |

| REITs and Crowdfunding | Opening up real estate to small investors |

📈 These trends are reshaping how property is bought, sold, and managed in Kenya.

🧑💼 Careers in Real Estate – Opportunities Across Kenya

Real estate offers diverse career paths:

| Role | Skills Required |

|---|---|

| Sales Agent | Strong communication, digital tools |

| Property Valuer | Surveying, economics, ISK certification |

| Property Manager | Tenant relations, maintenance coordination |

| Marketing Executive | Social media, CRM tools, content creation |

| Customer Support | Excellent verbal and written communication |

🎓 Many students enter the field after studying real estate at Technical University of Kenya, JKUAT, or through short courses from KIEA and REAK .

🎓 Education Pathways into Real Estate

If you want to build a career in real estate, here are your options:

| Level | Minimum Requirements |

|---|---|

| Certificate in Real Estate Practice | KCSE with at least C Plain |

| Diploma in Real Estate Management | KCSE C Plain or equivalent |

| BSc in Property Management / Land Economics | KCSE Mean Grade C+ or above |

| Postgraduate Studies | Bachelor’s degree in relevant field |

🎓 Top institutions include University of Nairobi, JKUAT, and Kenyatta University.

🧾 Conclusion

Real estate in Kenya is more than just property—it’s a vital part of economic growth, urban planning, and personal wealth building.

From Nairobi’s luxury apartments to affordable housing schemes, land investments, and coastal villas, there’s something for every budget and goal.

Whether you’re buying your first home, investing in land, or exploring a career, now is an excellent time to get involved.

Start researching today—and unlock your future in Kenya’s booming real estate market.

❓ Frequently Asked Questions (FAQs)

Q1: What does real estate mean in Kenya?

A: Real estate refers to land and buildings used for residential, commercial, or industrial purposes.

Q2: Can foreigners own property in Kenya?

A: Foreigners cannot own freehold land but can lease land for up to 99 years .

Q3: Are real estate agents licensed in Kenya?

A: Yes, all professional agents must be registered with the Institute of Surveyors of Kenya (ISK) .

Q4: Is it safe to invest in land in Kenya?

A: Yes—if you conduct proper title verification and work with certified professionals.

Q5: Are there REITs in Kenya?

A: Yes, Kenya launched its first REIT in 2020—offering small investors access to commercial property.