Are you looking for a reliable and profitable investment opportunity in East Africa?

Kenya’s real estate sector offers one of the most promising avenues for wealth creation — and it’s not hard to see why.

With rapid urbanization, infrastructure development, and growing demand for housing, investing in real estate in Kenya has become an attractive option for both local and international investors.

In this blog post, we’ll explore 10 compelling reasons why real estate in Kenya deserves your attention , including:

- Government-backed affordable housing programs

- High rental yields in major cities

- Steady land appreciation

- And much more

Let’s dive into the reasons why now might be the perfect time to invest in Kenyan real estate.

1. Rapid Urbanization Drives Housing Demand

Kenya is experiencing one of the fastest rates of urbanization in Africa. According to recent data, over 28% of Kenya’s population lives in urban areas , and that number is growing rapidly.

This shift means increased demand for:

- Affordable housing

- Rental apartments

- Commercial office space

- Retail centers

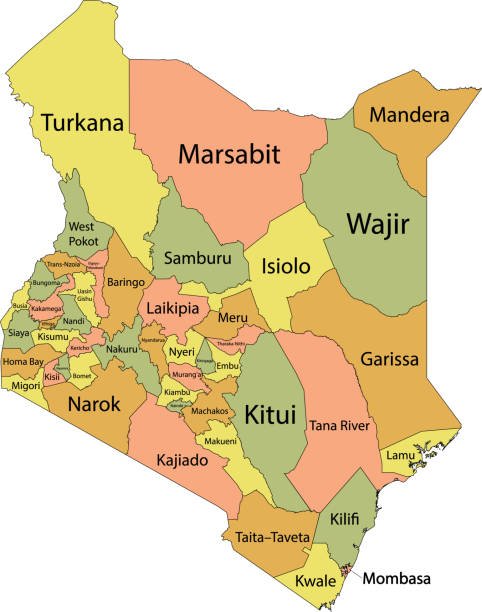

📌 As more people move to cities like Nairobi, Mombasa, Kisumu, and Nakuru, the need for quality housing continues to rise — making real estate a lucrative investment.

2. Government Support Through Affordable Housing Programs

The Kenyan government has made real estate a key focus area under its Big Four Agenda , particularly through the Affordable Housing Program .

Key Highlights:

- Goal to deliver 500,000 housing units by 2027

- Focus on mid-income earners earning between KES 30,000–100,000/month

- Partnerships with developers, banks, and SACCOs to provide financing

📌 This initiative not only improves access to homes but also creates a stable and growing market for real estate investors.

3. Strong Land Appreciation Rates

Land in Kenya has consistently appreciated over the years — especially in peri-urban areas like Ruiru, Thika, Kitengela, and Naivasha.

Average Annual Appreciation:

| Location | Estimated Annual Increase |

|---|---|

| Nairobi Suburbs | 10–15% |

| Mombasa Coastal Areas | 8–12% |

| Satellite Towns | 15–20% |

📌 Investing early in fast-developing areas can lead to significant capital gains within just a few years.

4. High Rental Yields in Major Cities

Kenya’s major cities offer strong returns for landlords due to high demand for rentals.

Average Monthly Rent vs. Property Value:

| City | 2-Bedroom Apartment Rent | Property Price Range |

|---|---|---|

| Nairobi | KES 20,000 – 40,000 | KES 1M – 5M |

| Mombasa | KES 25,000 – 50,000 | KES 1.5M – 6M |

| Kisumu | KES 15,000 – 30,000 | KES 800K – 3M |

📌 In many cases, investors can expect annual rental yields of 10–15% , especially in well-located properties.

5. Infrastructure Development Boosts Property Values

Major infrastructure projects are transforming Kenya’s landscape and boosting property values.

Notable Projects:

- Nairobi Expressway & Eastern Bypass

- Standard Gauge Railway (SGR)

- Jomo Kenyatta International Airport Expansion

- Lake Turkana Wind Power Project

- County-level road upgrades

These developments improve accessibility and attract businesses and residents to surrounding areas — increasing land and property values.

6. Growing Middle Class and Homeownership Culture

Kenya’s middle class is expanding, creating a new wave of potential homeowners and renters.

According to the Kenya National Bureau of Statistics (KNBS), over 3 million households will require decent housing by 2030.

📌 This growing demographic is increasingly seeking ownership of homes, driving up demand and prices across various segments of the market.

7. Favorable Policies for Foreign Investment

While foreigners cannot own freehold land in Kenya, they can still benefit from real estate investments through:

- Leasehold agreements (up to 99 years)

- Investing via a locally registered company

- Participating in joint ventures with Kenyan partners

📌 These options allow international investors to legally and profitably participate in Kenya’s booming real estate market.

8. Technology Is Making Real Estate More Accessible

Technology is revolutionizing how real estate is bought, sold, and managed in Kenya.

Key Innovations:

- Online listing platforms –BuyKenya

- Digital payments and mortgage apps

- Virtual property tours

- Crowdfunding platforms like Makoa Financial

📌 These tools make it easier than ever for small and large investors to enter the market, even with limited funds.

9. Diverse Investment Opportunities

Kenya’s real estate market offers a wide range of investment options to suit different budgets and goals:

- Residential plots and apartments

- Commercial buildings and retail spaces

- Agricultural land

- Off-plan developments

- Co-living and student housing

📌 Whether you’re interested in flipping houses or building a rental portfolio, there’s something for every type of investor.

10. Real Estate Offers Long-Term Wealth Building

Unlike volatile stock markets or fluctuating currencies, real estate provides tangible assets that appreciate over time.

Benefits include:

- Equity buildup through mortgage repayments

- Tax benefits for property owners

- Passive income through rent

- Portfolio diversification

📌 For those looking to build generational wealth, real estate in Kenya offers a solid foundation.

Conclusion: The Time to Invest Is Now

From government initiatives to rising demand and steady appreciation, Kenya presents a golden opportunity for real estate investors.

Whether you’re a first-time buyer, a seasoned investor, or someone looking to diversify your portfolio, investing in real estate in Kenya offers long-term rewards and financial security.

So if you’ve been wondering whether to take the plunge — the answer is yes.

Start researching today, connect with trusted agents or developers, and begin building your future through property.

Frequently Asked Questions (FAQ)

Q: Is real estate a good investment in Kenya?

A: Yes, real estate in Kenya offers high rental yields, strong appreciation, and growing demand driven by urbanization and infrastructure development.

Q: Can foreigners buy land in Kenya?

A: No, but they can lease land for up to 99 years or invest through a locally registered company.

Q: What is the best way to invest in real estate with little money in Kenya?

A: Consider off-plan purchases, micro-investments via crowdfunding, or joint ventures with other investors.